Talk of Telefonica fibre sale resurfaces in Peru

Telefonica appears to be gearing up for the sale of fibre assets in Peru, a move that would continue the strategy it has adopted in other Latin American markets.

June 7, 2023

Telefonica appears to be gearing up for the sale of fibre assets in Peru, a move that would continue the strategy it has adopted in other Latin American markets.

The Spanish operator group’s Peruvian unit has hired Deloitte Corporate Finance to help it weigh up its options, according to media outlet El Pais’sCinco Dias.

The main thrust of the story is that Deloitte will help Telefonica with the possible sale of fibre-optic assets it owns in its own right to PangeaCo, a vehicle it set up almost three years ago to manage the rollout of fibre in Peru. The implication of such a move seems to be that it would pave the way for Telefonica to then bring in external investors or new partners.

That is not really news. If anything, the surprise is that it has taken Telefonica so long to get to this point.

The telco has set up fibre vehicles in various South American markets in recent years and brought investors into all of them.

It spun off its Chilean fibre business and sold a 60% stake in the unit to KKR in 2021 in a deal that valued it at US$1 billion. It subsequently created FiBrasil as a Brazilian fibre joint venture with Canada’s CDPQ and later agreed to sell a 60% holding in a new Colombian fibre company, again to KKR.

There has been talk of a similar move in Peru ever since, with KKR – understandably – being one of the most oft-named potential investors. But despite myriad rumours, nothing concrete has emerged.

In its first quarter report, published last month, Telefónica Hispanoamérica, which houses Telefonica’s operations in South and Central America, excluding Brazil, talked up what it described as “successful sharing models,” naming its Chilean and Colombian fibre ventures in particular.

“Telefónica considers that it is essential to continue developing new digital infrastructure deployment models. Cooperation is key to this, as are operators being able to share infrastructure and expand connectivity, as well as developing wholesale neutral networks that allow various companies to use them,” the telco said, in a Spanish language statement.

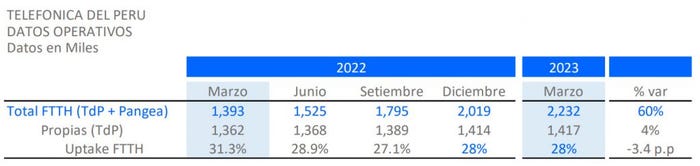

In Peru, Telefonica ended the quarter with 2.23 million homes covered by fibre, an increase of 60% year-on-year. 1.42 million of the total were its own lines, with the remainder contributed by PangeaCo, but the majority of growth over the year came from the latter (see chart below).

Sources from inside Telefonica del Peru told Cinco Dias that the telco is looking for the best way to continue expanding its fibre-optic network, hence the appointment of Deloitte.

The advisor’s role will also see it look at granting usage rights on the Telefonica network and the provision of adjacent services, the paper noted.

Its sources added that Telefonica has reaffirmed its commitment to continue in its endeavours to connect more users to high-speed Internet in Peru, which could either prove to be a platitude, or it could suggest that the telco is not looking to sell out all together.

Given the operator’s track record in Latin America, bringing in an external investor to take a significant stake in a newly bulked-up PangeaCo seems like the most likely outcome here, but it’s anyone’s guess how much longer it will take to broker a deal.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)