The only way isn't up when it comes to tomorrow's broadband

At Informa Telecoms & Media, we don't often use charts, graphs or diagrams to illustrate our thought pieces, but sometimes a picture can paint a thousand words, as the old saying goes.

June 29, 2009

By Rob Gallagher

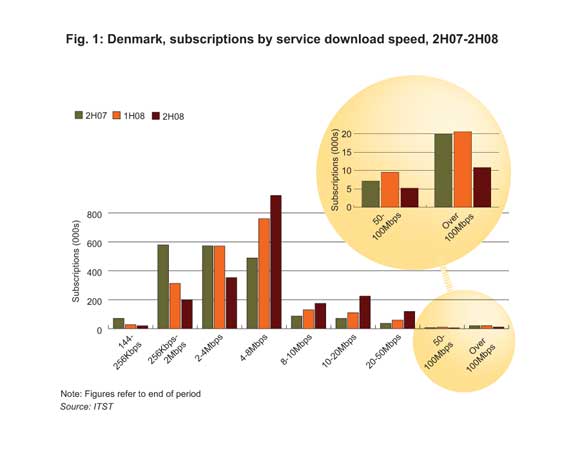

At Informa Telecoms & Media, we don’t often use charts, graphs or diagrams to illustrate our thought pieces, but sometimes a picture can paint a thousand words, as the old saying goes. Take this chart, based on data published this month by Denmark’s regulator, ITST.

fig1

It’s first worth explaining why this small window onto the world matters. After all, why should the global telecoms industry care about what’s happening in Denmark? It’s certainly not one of Western Europe’s largest markets. With just 5.5 million people living in 2.53 million homes, Denmark is only a fraction of the size of the region’s “big five”: Germany, France, the UK, Spain and Italy.

But the country is leading the way in other respects. After the Netherlands and the “microstates” of the Faroe Islands and Gibraltar, Denmark has the highest level of broadband take-up in Western Europe. At the end of 2008, eight out of 10 Danish households were subscribed to broadband, compared with about six out of 10 in France, the UK, Germany and Spain, and just over four out of 10 in Italy.

And although next-generation broadband is only just beginning to arrive in many Western European countries, fiber-to-the-home/building services have been available in Denmark since about 2004. So you could say Denmark offers a glimpse of how other, larger broadband markets might behave once they become as advanced.

Now back to the chart. It shows how the number of subscriptions to different types of broadband services in Denmark changed over 2008. The first thing you’ll notice is that 4-8Mbps speeds are the most popular, despite the widespread availability of “superfast” fiber-based broadband services. This will come as no surprise to regular readers of Informa’s research, as we have long been skeptical about people’s willingness to pay for tens of megabits of extra bandwidth they will find little use for.

But read from left to right, the bars seem to bear out a belief common among many broadband providers: “Speed sells.” The number of subscriptions to services slower than 256Kbps appears to have been in decline long before 2008, while those services offering between 2Mbps and 4Mbps began to suffer heavy losses in the latter part of that year. The next few bars show the market for 4-10Mbps speeds growing steadily throughout 2008, and demand picking up for 10-20Mbps speeds in the second half. It’s not hard to imagine this “wave” of demand for ever faster services making its way across to the right of similar charts for 2009, 2010 and beyond.

But something interesting is happening in the far right-hand corner of this latest version. The number of subscriptions to both 50Mbps and 100Mbps-plus services began to decline in the last six months of 2008. Why? FTTH operators throughout the fiber-rich Nordics have told us that few consumers see the need for such extreme speeds. Now it seems that even some of those few have had their doubts and have downgraded to lower speeds, in Denmark at least. So much for the allure of speed.

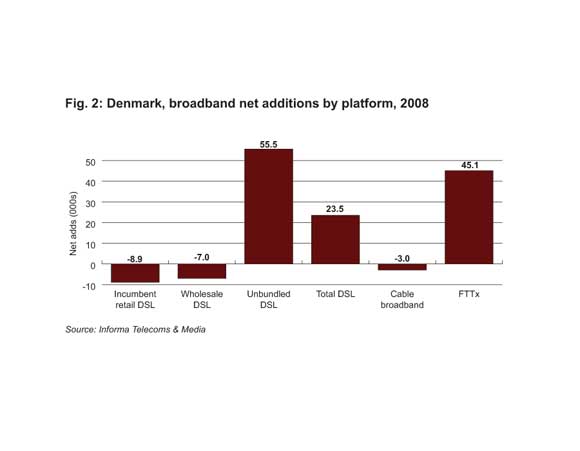

The picture gets even more interesting when you examine which types of providers have benefited the most from the changing tastes of the Danes. The FTTx providers did relatively well in 2008, increasing their broadband market share nearly 2.2 percentage points as both the Danish incumbent, TDC, and the country’s cable operators shed subscribers.

fig2

But unbundled DSL made the most gains by far. This was partly because established operators migrated their subscribers from services based on TDC’s wholesale platform to more-profitable ones based on their own unbundled lines. The biggest contributor, however, was a relative new entrant. Fullrate entered Denmark’s broadband market toward the end of 2006 and consistently attracted more new subscribers than any of its competitors throughout 2008. Fullrate’s pitch? Low-priced, no-frills broadband at a range of DSL speeds.

To be fair, there have also been some signs that Danish customers aren’t interested only in paying less. Some would like to see broadband services move “sideways” to include new features, such as mobility, voice and TV. Mobile broadband services based on USB dongles and laptop data-cards attracted three times as many new customers as fixed-line broadband services in 2008. TDC also claimed to have signed up more than 50,000 subscribers to its Home dual- and triple-play bundles of broadband, fixed-line telephony and IPTV in the first few months of this year.

But I suspect TDC knows its bundling strategy is more of about the power of discounts than the convergence of telecoms and media. And to use another old saying, the incumbent’s actions speak louder than words. In March, it acquired Fullrate. TDC seems to know that whatever direction broadband services head off in, many customers will always be happy to see prices go down.

Read more about:

DiscussionYou May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)