E-Health Case Study: Vodafone

Towards the end of 2009, Vodafone consolidated its health-specific resources—developed historically across its national subsidiaries as part of delivering general enterprise services to the healthcare sector—into a single business unit, Vodafone Health Solutions. Sitting within Vodafone Global Enterprise, the operator’s multinational-corporations division, its task is to develop a global portfolio of healthcare-specific services.

July 4, 2011

By joanne lowe

Towards the end of 2009, Vodafone consolidated its health-specific resources—developed historically across its national subsidiaries as part of delivering general enterprise services to the healthcare sector—into a single business unit, Vodafone Health Solutions. Sitting within Vodafone Global Enterprise, the operator’s multinational-corporations division, its task is to develop a global portfolio of healthcare-specific services.

Vodafone Health Solutions has identified a timely opportunity: According to its own research into the healthcare sector, there has been a fundamental shift over the past few years in the industry away from legacy resistance and toward the use of new technology to deploy new healthcare-delivery models.

As in many industries affected by economic constraints, healthcare companies are under pressure to reassess and improve their core business. Pharmaceutical company Pharma World, for example, is investing in product and marketing development that will enhance the vendor’s direct relationship with those patients who use its drugs, whom it sees as being increasingly informed about and engaged in their own personal care.

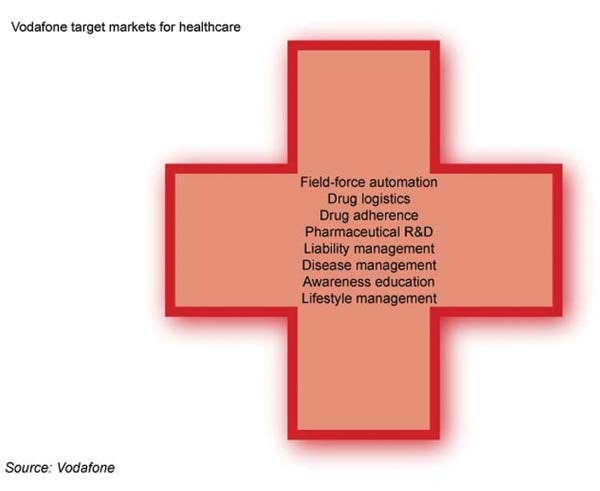

The “realm of personal care”—healthy living, long-term-condition management, community clinics and general-practitioner offices—is another area where Vodafone sees an opportunity for delivering services. Using mobile communications and network technologies to improve the dissemination of medical information and internal data management drives better cost efficiencies, productivity and better overall provisioning of healthcare services.

For pharmaceutical companies and healthcare-insurance providers, Vodafone is aiming to help specialist direct-to-patient communications, particularly helping pharmaceutical companies recruit and manage patients in late-phase clinical trials. It is a service strategy that, in theory, taps into new revenue streams and builds significant customer loyalty.

In February 2010, Vodafone completed SMS for Life, a six-month pilot program for drug-logistics management in Tanzania, in partnership with the Roll Back Malaria Partnership, pharmaceutical giant Novartis, software vendor IBM and the Tanzanian Ministry of Health and Social Welfare. The pilot was launched in response to a challenge faced by Novartis to meet urgent drug requests during epidemics and used messaging software to track the stock levels of antimalarial drugs in 129 rural health centres in Tanzania.

Automated text messages requesting stock information were sent each week to health workers’ existing mobile numbers, and the workers were given mobile phone credits as an incentive to respond. The responses were collected by a centralized web-based program, which district medical officers in charge of drug redistribution could access via SMS or on any internet-enabled device.

For Novartis, the results of the SMS for Life pilot were impressive: The proportion of health centres with available antimalarial drugs increased from 76 per cent to 99 per cent, increasing the number of people with access to treatment from 264,000 to 888,000.

As the operator expands its activities to areas such as pharmaceutical R&D using M2M and disease management, it expects the estimated market value of mobile healthcare to more than double by 2012. Pilots are under way in the UK, Germany and Spain to analyze the way in which paper forms used in clinical trials can be replaced by remotely accessible electronic forms connected to remote medical peripheral devices.

For services relating to disease management, lifestyle management and health-awareness education, the operator is at an earlier stage of development, working on joint initiatives with pharmaceutical companies and healthcare providers to define the scope of trials that need to take place. For disease and lifestyle management, more groundwork must be done to convince healthcare customers of the value of new technology and improve software and devices to achieve sufficiently good usability straight “out of the box.” The operator expects to launch these services commercially by 2012.

Vodafone purports to have a relationship with more than 50 of the world’s biggest pharmaceutical companies and averages 50 per cent share of public-sector enterprise contracts in the countries in which it operates. It therefore considers itself in good stead to compete in the market for new healthcare-specific services. It sees both its global footprint and track record in launching initiatives and deploying services in the healthcare sector in the past decade as key differentiators—the former especially, given the operator’s reach in both mature and emerging markets.

Vodafone’s key operator competitors include Orange and Telefónica. However, Vodafone anticipates that its biggest challenge will come from traditional IT suppliers to the pharmaceutical and health sectors, which are increasingly engaging in the software-as-a-service business model.

Vodafone Health Solutions sits at the group level and therefore might avoid the rivalries allegedly present between national subsidiaries. It has its own research, business-development, sales, customer-support, customer-management, marketing and strategy teams, located within and supported by the wider Vodafone Global Enterprise business. Courtesy of Vodafone’s Global Enterprise operation and its role in coordinating the deployment of enterprise services within the company’s national subsidiaries, Vodafone is anticipated to have equally strong integrated control when it comes to the enterprise sector.

Vodafone’s focus on the pharmaceutical industry might be a key differentiator for the operator in its approach to the healthcare sector. Exploiting existing private-sector customer relationships and coming up with innovative services in partnership with global pharmaceutical companies—services that can be deployed in multiple markets—might generate faster returns on investment than local public-sector initiatives, establishing Vodafone as a “mobile healthcare” player more quickly than its competitors, since most of the brand-building groundwork will have already been done.

Vodafone market_healthcare

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)