KPN doubles profits in Q4 but still makes a loss for the year

Dutch operator group KPN’s healthy profit increase last quarter looks like a one-off, with revenue growth flat.

January 27, 2021

Dutch operator group KPN’s healthy profit increase last quarter looks like a one-off, with revenue growth flat.

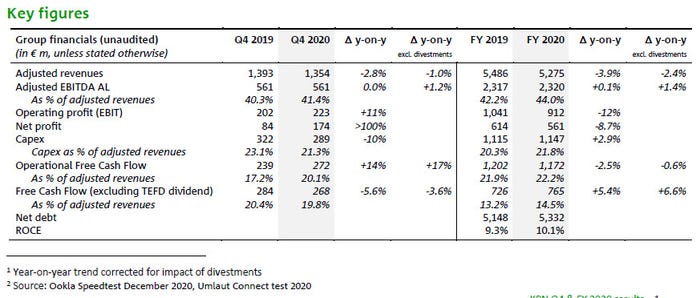

Revenues of €1.35 billion were down a percent on the year-ago quarter when adjusted for adjustments. Operating profit was up 11% but net profit was up 107% thanks to a one-off € 67m positive revaluation of KPN’s deferred tax asset and € 17m release of revenue related provisions in Wholesale. As you can see that accounts for nearly all the growth.

“During the year we saw encouraging base developments in our consumer segment with growth in our postpaid base and a stabilizing broadband base driven by fiber,” said KPN CEO Joost Farwerck. “Encouragingly, this quarter fiber service revenue growth outweighed the loss on copper service revenues for the first time. Although we face COVID-19 related headwinds in the business segment, we are on track to migrate our SME and LCE customers to a future-proof proposition and we see growth on our core products broadband and mobile.

“Supported by our open access policy, the wholesale segment continues to show solid growth. Due to several factors, we have seen adverse customer satisfaction trends in both the consumer and business segment. This has our undivided attention and we have taken additional measures to ensure the service levels customers expect from the quality leader in the Netherlands.”

KPN’s numbers were in line with analyst expectations and its outlook is for more of the same. This is consistent with the annual numbers also shown in the above table, which reveal that despite good Q4 profitability, annual profits were down 9%. Nonetheless KPN shares were up 4% on the numbers, which is about as exciting as it gets for KPN shareholders. Still, there’s always next year’s dividend to look forward to.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)