Resurgent Vodafone upgrades outlook on solid European performanceResurgent Vodafone upgrades outlook on solid European performance

UK operator group Vodafone is having a good few months, culminating in the first upward revision of its organic EBITDA growth for ages.

November 14, 2017

UK operator group Vodafone is having a good few months, culminating in the first upward revision of its organic EBITDA growth for ages.

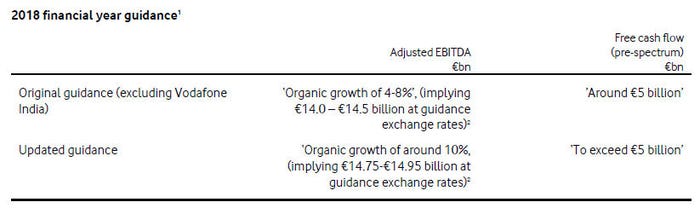

It’s all down to strong growth in Europe, apparently, with mobile, fixed and enterprise all heading in the right direction. India is still a bit of a struggle but even there Vodafone reckons the worst of the Jio-induced carnage may be over. The result is anticipated organic growth of around 10% for the 2018 financial year, up from the previous guidance of around 6%.

“In the first half of the year we have maintained good commercial momentum,” said Vittorio Colao, Vodafone Group Chief Executive. “Revenue grew organically in the majority of our markets driven by mobile data and our continued success as Europe’s fastest growing broadband provider.

“Enterprise revenues continue to grow, led by our Internet of Things (‘IoT’), Cloud and Fixed services, and for the second year running we achieved an absolute reduction in our operating costs. As a result, we are able to report a strong financial performance, with substantial EBITDA margin expansion and profit growth, and we are raising our financial outlook for the year.

“In India competition remains intense. There are however signs of positive developments in the Indian market, with consolidation of smaller operators and recent price increases from the new entrant. We are making good progress in securing regulatory approvals for our merger with Idea Cellular and in monetising our tower assets.

“In the second half of the year we will continue to implement our strategic initiatives, including fibre infrastructure expansion in Germany, Portugal and the UK; our entry into the consumer IoT market with the launch of “V by Vodafone”; and the ‘Digital Vodafone’ programme designed to enhance our customers’ experience, increasing revenues and cost efficiency.”

Other factors contributing to the upward adjustment, which is apparently the first one for a while, include the delayed entry into the Italian market by Iliad, better than expected return from the introduction of handset financing in the UK and a one-off payment from Openreach after it was found to have delayed compensation for installation delays. Those three factors will contribute an extra €300 million to the 2018 EBITDA total.

Investors seem pleased with this upgrade, with Vodafone shares up 5% at time of writing. In the further CEO comments there was a lot of emphasis put on Vodafone’s fibre efforts in Germany and the UK, as well as some of its recent UK consumer-facing initiatives. Vodafone also reckons its NPS has finally recovered from the billing system cock-up that blighted its UK operations for the last couple of years.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)