Sky and Vodafone NZ merge to create country's largest multiplay operatorSky and Vodafone NZ merge to create country's largest multiplay operator

Sky TV and Vodafone New Zealand have agreed a merge of operations which will create the country’s largest multiplay operator.

June 9, 2016

Sky TV and Vodafone New Zealand have agreed a merge of operations which will create the country’s largest multiplay operator.

The mechanics of the deal see Sky put a valuation of US$2.4 billion on Vodafone’s New Zealand operation. It has offered Vodafone $900 million in cash, as well as shares in the merged entity equivalent to 51%. This, in essence, has created a joint-venture spearheaded by Sky but one of which Vodafone will keep the majority of ownership. According to a statement, despite Sky stumping up nearly a billion dollars as well as shares in the entity, the combined group will technically be a consolidated subsidiary of Vodafone Group.

Sky believes, despite the cash outlay and 49% ownership of the yet-to-be-named entity, the stronger cash flow generation will support an increased return for its shareholders. This optimism stems from the prospect of a combined entity which will lead the NZ mobile market by subs, hold second place for fixed-line subscribers and also be the largest pay TV operator in the country, according to figures cited by Sky.

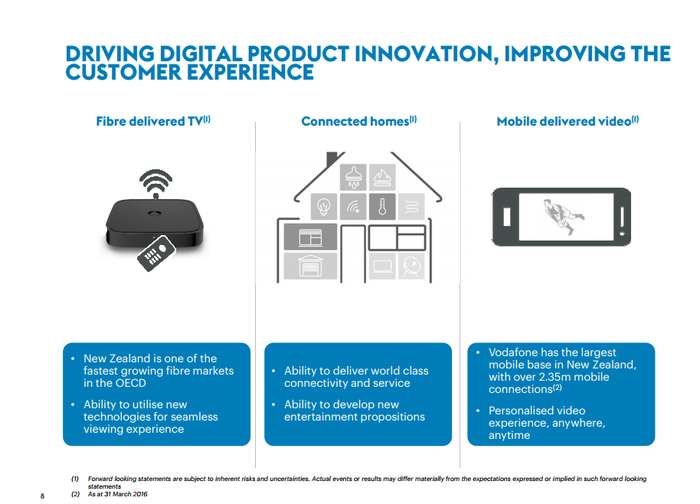

Beyond the sheer numbers, Sky and Vodafone say the combined entity will be able to increase customer stickiness by bundling and offering multiplay services including premium television content, satellite, fixed broadband (both cable and fibre) and mobile packages.

“This is a significant and positive step in SKY’s evolution as a premium entertainment company,” said Chief Executive John Fellet. “We already enjoy an excellent partnership with Vodafone, bringing together our two highly complementary businesses is in the best interests of shareholders and customers. The Combined Group will offer exciting new packages with SKY’s premium entertainment content, Vodafone NZ’s communications and digital services of the future.”

The deal has been approved and agreed between the board members of each operator, and will likely face little in the way of regulatory objections if the precedent set in other markets is anything to go by. As we’ve seen in the UK and US, M&A activity between telecoms and television/ISP operators has generally been given the thumbs up, and the New Zealand market for each will still maintain a significant level of competition.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)