Vodafone Idea loses a quarterly $1.5 billion due to government paymentsVodafone Idea loses a quarterly $1.5 billion due to government payments

Beleaguered Indian telco Vodafone Idea registered the largest ever annual loss by an Indian firm, thanks largely to massive payments to the government.

July 1, 2020

Beleaguered Indian telco Vodafone Idea registered the largest ever annual loss by an Indian firm, thanks largely to massive payments to the government.

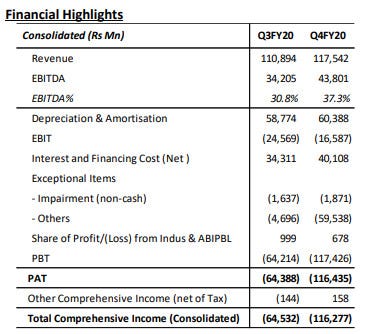

The total fiscal Q4 loss was 116 billion rupees, which is around $1.5 billion and brings the annual total loss to almost 10 billion bucks. As you can see from the financial summary below, the main reason for the sequential deterioration was a jump in exceptional items, which can be attributed to the government shakedown it’s being subjected to. Having said that, the cost of financing its debt seems to be unsustainable too.

Ravinder Takkar, MD & CEO, Vodafone Idea Limited, said “Our focus on rapid network integration, as well as 4G coverage and capacity expansion, has further improved customer experience,” said Ravinder Takkar, CEO of Vodafone Idea. “We thus continue to lead the league tables on 4G data download speeds across several states, metros and large cities.

“We have achieved our full opex merger synergy target. Despite the nationwide lockdown since March due to COVID-19, our teams across all circles continue to work effectively in these difficult times with support of the local authorities, to ensure seamless connectivity for our customers.

“On the AGR matter, the next hearing is scheduled with the Hon’ble SC in the third week of July. Meanwhile, we continue to actively engage with the government seeking a comprehensive relief package for the industry, which faces critical challenges.”

AGR refers to Adjusted Gross Revenue, the definition of which seems to vary wildly. The government wants Vodafone Idea to hand over a far higher figure, as a result, than the operator thinks is right, which is why the Supreme Court is involved. As the following statement from the Vodafone Idea quarterly report shows, the stakes couldn’t be higher.

“It is to be noted that our ability to continue as going concern is essentially dependent on a positive outcome of the application before the Hon’ble Supreme Court for the payment in instalments and successful negotiations with lenders,” said the report.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)