Vodafone reveals bright Idea for tackling Jio in IndiaVodafone reveals bright Idea for tackling Jio in India

The second and third largest Indian operators have formally announced a merger that seems designed almost entirely to counter the threat from Reliance Jio.

March 20, 2017

The second and third largest Indian operators have formally announced a merger that seems designed almost entirely to counter the threat from Reliance Jio.

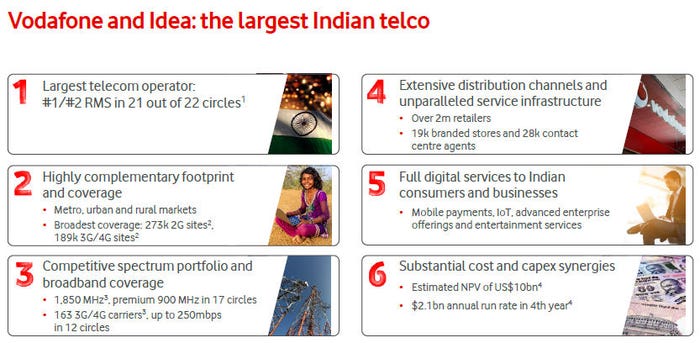

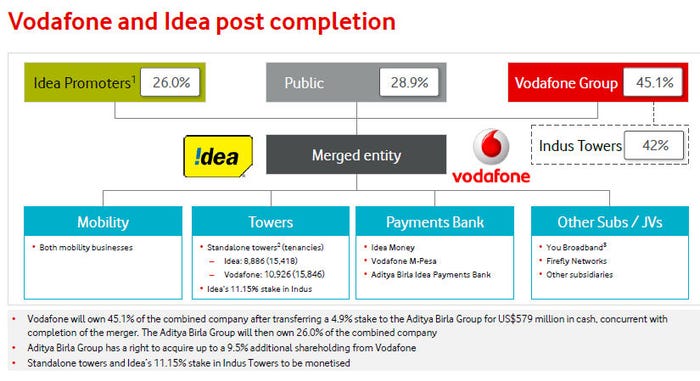

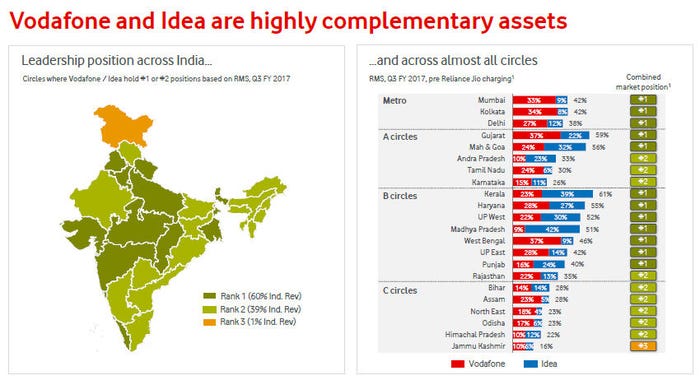

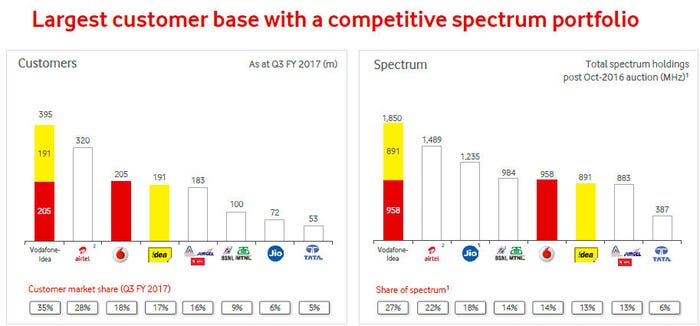

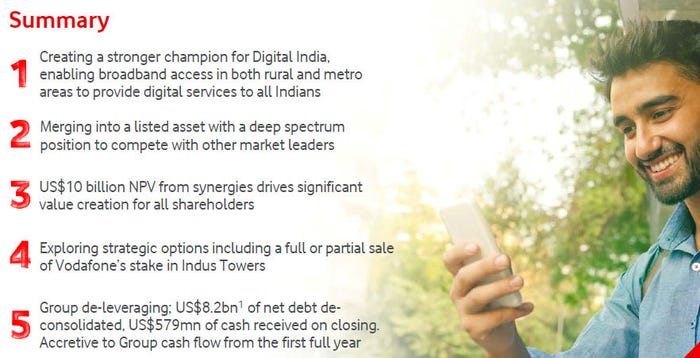

Vodafone India and Idea Cellular admitted they were in talks at the end of January and have taken a couple of months to dot the Is and cross the Ts. It is being positioned as a 50/50 merger although Vodafone’s stake is slightly larger, both in terms of revenues and subscribers. The combined entity will have almost 400 million subscribers, dwarfing current leader Bharti Airtel’s approximately 270 million. Jio is thought to be closing on 100 million already.

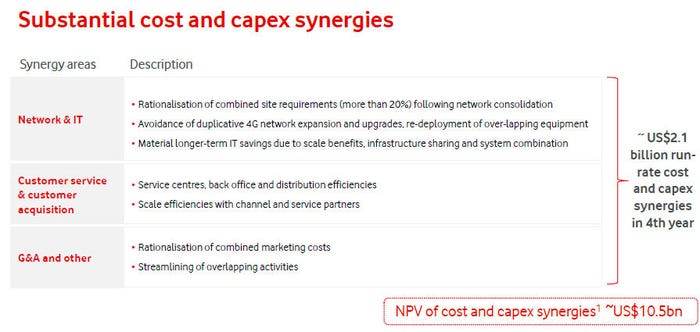

In their canned quotes both companies were keen to appeal to the Digital India national initiative, much as Bharti Airtel was when it launched its Payments Bank earlier this year. Other than that there’s the usual M&A stuff lauding all the lovely synergies, economies of scale and general corporate shininess that seems to be obligatory at times like this.

“The combination of Vodafone India and Idea will create a new champion of Digital India founded with a long-term commitment and vision to bring world-class 4G networks to villages, towns and cities across India,” said Vittorio Colao, Chief Exec of Vodafone Group.

“The combined company will have the scale required to ensure sustainable consumer choice in a competitive market and to expand new technologies – such as mobile money services – that have the potential to transform daily life for every Indian. We look forward to working with the Aditya Birla Group to create value for all stakeholders.”

“This landmark combination will enable the Aditya Birla Group to create a high quality digital infrastructure that will transition the Indian population towards a digital lifestyle and make the Government’s Digital India vision a reality,” said Kumar Mangalam Birla, Chairman of Aditya Birla Group, the conglomerate that owns Idea.

“For Idea shareholders and lenders who have supported us thus far, this transaction is highly accretive, and Idea and Vodafone will together create a very valuable company given our complementary strengths.”

All these complementary strengths will take a while to realise, however. On a subsequent media call Collao confirmed they will be maintaining the two brands for the foreseeable future on the grounds that they’re both strong. He dismissed one comparison with the creation of Verizon Wireless out of hand as being a completely different set of circumstances and pointed to scale and combined spectrum ownership as the two key factors that will enable this deal to better counteract the Jio threat.

The combined company will hold 1,850 MHz of spectrum, including circa 1,645 MHz of liberalised spectrum acquired through auctions. This, it is claimed, will allow the building of substantial mobile data capacity, utilising the largest broadband spectrum portfolio with 34 3G carriers and 129 4G carriers across the country.

While Collao was careful not to say as much on the call, this deal was clearly brought about by the massive new competitive threat posed by Jio. M&A like this usually takes a while to get regulatory approval and it’s not expected to complete for another year. Even then the process of realising all these synergies will be protracted and expensive.

The biggest challenge will be maintaining continuity throughout this process. Bharti is currently only dipping its toe in M&A, while Jio is about to embark on the process of trying to extract some cash out of the millions of Indians seduced by its great give-away. Any loss of focus from Vodafone/Idea could result in significant subscriber churn, so this move is still a long way from being the solution to a problem like Jio.

Here’s a selection of slides from the Vodafone investor presentation.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)