Vodafone’s Indian issues overshadow domestic drama

With the chaos caused by the emergence of Jio in India Vodafone has faced its fair share of drama, and the saga does seem to have disguised problems the operator is facing in the UK.

February 2, 2017

With the chaos caused by the emergence of Jio in India Vodafone has faced its fair share of drama, and the saga does seem to have disguised problems the operator is facing in the UK.

India represents a notable presence for the operator in the international arena, though the European region still accounts for the majority of revenues presenting a largely overlooked problem. Yes, India is a significant growth opportunity for the company, but losing out in the cash-cow markets of Europe could present a larger problem; if the team’s steady European foundation is wobbling, it doesn’t bode well for other ventures.

Revenues across the group for the quarter ending December 31 declined 3.9%, with the European market dropping 4.6%, compared to the same period in 2015. Jio has sucked up headlines, stolen customers and caused a redistribution of battle funds, but a 19% year-on-year decline is a hefty amount of business to lose, in what would generally be considered a safe market for the operator.

Alongside the 19% decline in the UK for the quarter, Germany also dropped 0.6%, while revenues across other European nations, including Ireland, Netherlands and Czech Republic, decreased by a total of 2.8%. Italy was one of the bright spots for the team, with revenues rising 2.8% year-on-year.

Although the team was relatively coy in reporting the decline, increased competition in Enterprise, lower MVNO revenues and the continued impact of roaming regulation, were pinned down as the reasons. In terms of the specifics, revenues from in-bundle mobile contracts dropped 17%, while out-of-bundle fell 33%. Fixed line dropped 18% and revenues from ‘other’ services also fell 23%. Jio maybe causing all sorts of problems in the Indian market, but a wobbly cash-cow could present a bigger worry.

The UK is a slightly different beast than the rest of the world. Convergence is a business model which has worked elsewhere, but is a smaller aspect in the UK. The enterprise channel has been much more significant in the UK, and this is unlikely to change in the immediate future. CEO Vittorio Colao highlighted that they are facing pressure from other competitors in the market, but the model in the UK has been a success in the past, and the enterprise channel will continue to be at the front of the business.

Another area which has been discussed in recent months in the Vodafone entry into the TV market, which now doesn’t look like it’s going to happen in the near future. Colao was relatively standoffish regarding TV, though did highlight the platform is ready to launch, following the success of the initiative in other markets. The offering is currently available in Ireland, Italy and Spain, amongst others, though Colao has stated the UK will remain a broadband first market, with the potential to launch a TV proposition in a matter of weeks.

On the topic of India, total revenues across the group dropped 5.5%, with the more fluid, out-of-bundle customers proving to be the largest pain-point here. Revenues here dropped roughly 12%, seemingly lured by the generous promotions offered by Jio. The most recent development in the Indian saga has been a potential merger with Idea Cellular to combat the disruption; Vodafone doesn’t have any updates on this front, but it does seem to have caught the attention of our readers.

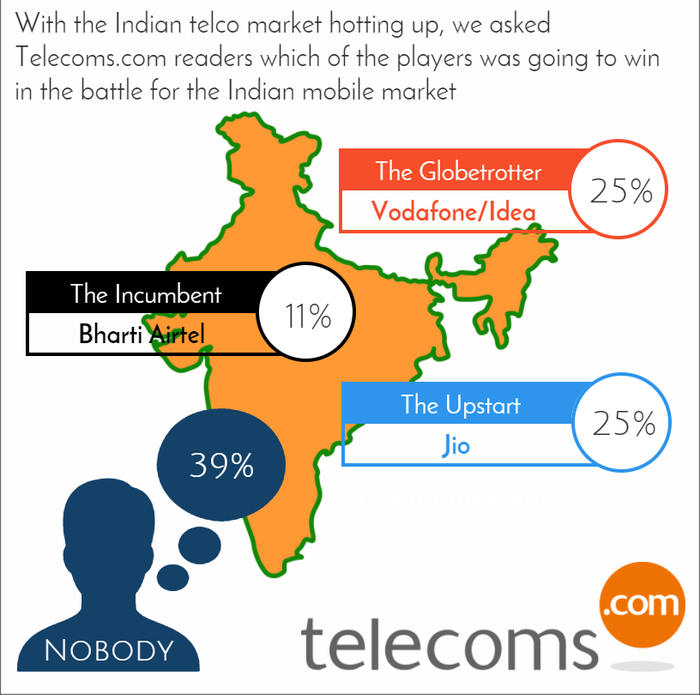

Following the announcement, we asked Telecoms.com readers who they thought the winner of the Indian battle would be. The Vodafone/Idea merger has brought some confidence, as 25% of respondents believed a new, hardened brand would have enough ammo to combat Jio, but the big losing here was current market leader Bharti Airtel, which only account for 11% of the vote. You can see the full infographic at the bottom of the article.

Overall, it has been a tough quarter for the Vodafone team, with forecasts for 2017 being lowered as a result. Troubles in the Indian market may grab the headlines, but the poor performance in the UK could be seen as a more significant worry.

Yes, international expansion will drive growth in a time where the mature European markets are becoming increasingly stagnant, however unless Vodafone holds onto a strong position in these cash-cow markets, there is no foundation to fuel the international expansion. Is the Jenga tower beginning to wobble?

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)