Vodafone set to sell out of Italy for €8 billionVodafone set to sell out of Italy for €8 billion

Vodafone is working on a deal that should see it sell its Italian operations to Swisscom for €8 billion in cash.

February 28, 2024

The telecoms group issued a statement to that effect on Wednesday following relentless media speculation over such a deal. The two companies are in exclusive talks on Vodafone Italy, but have yet to reach a binding agreement, it said.

When and if that binding deal comes it will value Vodafone's Italian operations at an enterprise value of €8 billion on a cash and debt free basis, the operator said. That figure represents a multiple of around 26X Vodafone Italy's predicted operating free cash flow for the current financial year and 7.6X adjusted EBITDAaL.

There could yet be price adjustments though. Further, it is still possible that no deal will materialise, Vodafone said, pledging to update as and when appropriate. That said, given the extent of the detail Vodafone has shared about this proposed transaction, the smart money is on it going ahead.

The telco, which has been the subject of M&A speculation in Italy for some time, was much more tight-lipped when other deals were rumoured. Even when it had a concrete offer on the table from Iliad late last year, it had very little to say on the matter. Iliad sweetened the terms of that proposal, but last month Vodafone turned it down.

Iliad's offer – which was for the creation of a 50:50 joint venture, at least initially – valued Vodafone Italy at €10.45 billion and would have seen Vodafone receive €6.5 billion in cash plus a €2 billion shareholder loan, as well as affording it the opportunity to bring in yet more cash – up to €1.95 billion in total – by allowing Iliad to buy it out through a call option at a rate of 10% per year.

Vodafone gets more cash from the Swisscom deal, which may have swung it. Perhaps coupled with the fact that it is not keen to retain a presence in Italy, where competition has been fierce for some years, and a greater likelihood of successfully jumping through the regulatory hoops.

"Vodafone has engaged extensively with several parties to explore market consolidation in Italy and believes this potential transaction delivers the best combination of value creation, upfront cash proceeds and transaction certainty for Vodafone shareholders," the telco said.

That transaction certainty, as Vodafone puts it, is likely related to the fact that the deal raises fewer competition concerns than a tie-up with Iliad would have done. That proposed JV would have taken a mobile network operator out of the market and we all know how the European Commission feels about that, despite protestations to the contrary. The regulatory process would have been lengthy.

A Swisscom takeover will see Vodafone Italy merged with Italian fixed broadband operator Fastweb.

Just in case there was any doubt: "Swisscom confirms that it is in advanced exclusive negotiations with Vodafone Group Plc with respect to an acquisition of 100% of Vodafone Italia S.p.A. for cash. Swisscom plans to merge Vodafone Italia S.p.A. with Fastweb, Swisscom's subsidiary in Italy," the Swiss incumbent said, in a brief statement.

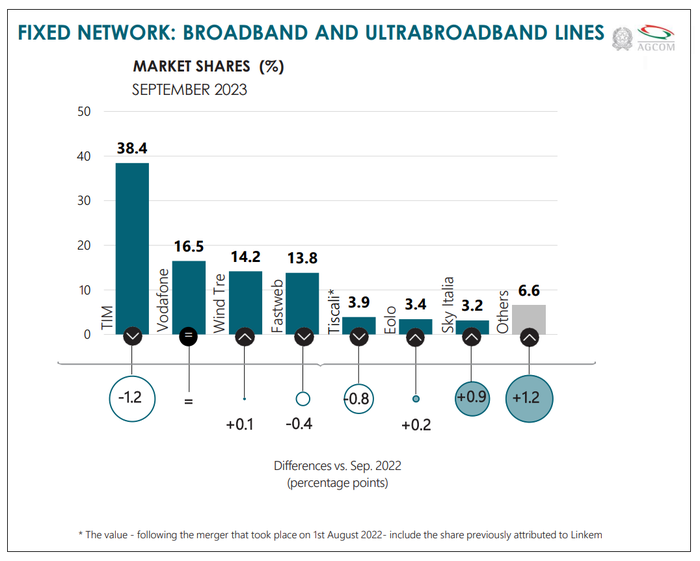

Fastweb's presence in the Italian mobile market is limited and as such the merger will raise few regulatory eyebrows. On the fixed side, the two telcos have roughly similar market shares. While Vodafone is the second largest player in Italy's fixed broadband market after TIM, but regulator Agcom's latest figures show that it would remain in second place even after adding in Fastweb's market share (see chart). Further, there are other, smaller players in the fixed broadband market, so while the loss of retail competitor here will draw the attention of competition regulators, it shouldn't be an insurmountable hurdle.

While both Vodafone and Swisscom are playing it pretty cool at this point, it seems likely we can expect a final deal announcement before long.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)