Huawei set to drive Chinese smartphone market recoveryHuawei set to drive Chinese smartphone market recovery

China's smartphone market is still in decline, but recovery is on the cards and will likely be driven by equipment heavyweight Huawei, according to new analyst data.

October 27, 2023

China’s smartphone market is still in decline, but recovery is on the cards and will likely be driven by equipment heavyweight Huawei, according to new analyst data.

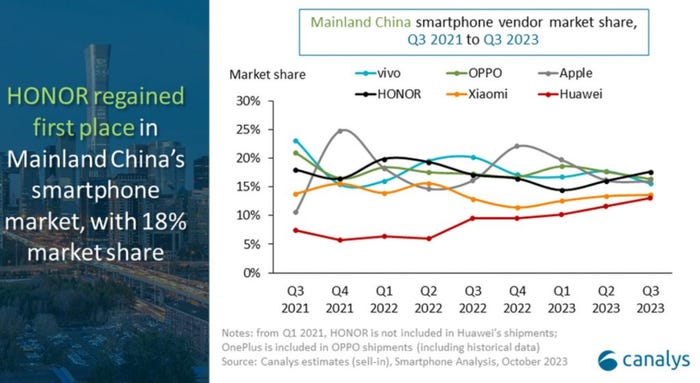

Huawei again boosted its share of the domestic smartphone market in the third quarter of this year, continuing its steady climb towards the market’s top five, estimates from Canalys show. The vendor has had a boost from the launch of devices in its Mate series and the analyst firm expects it not only to continue this momentum, but to provide a shot in the arm to the market as a whole going forward.

Canalys’ figures show that the Chinese smartphone market has recorded year-on-year shipment declines since the end of 2021, but the picture has been improving over the past couple of quarters. In the three months to the end of September shipments fell by 5% to 66.7 million units.

While Canalys is choosing its words carefully, it’s clear it sees the Chinese market picking up in the not-too-distant future.

“The market has bottomed out in 2023 as vendors steadfastly invest and refine channel incentive policies, and there is an expected gradual demand recovery,” said Canalys Senior Analyst Toby Zhu, without expanding on a projected timeframe.

“The market shows that, despite prolonged replacement cycles, consumers are still willing to pay for products within their budget that offer attractive value propositions. In the second half of the year, Huawei will generate a ‘Catfish Effect’ on the competitive landscape,” Zhu predicts. “Vendors will proactively expand their product portfolios and accelerate upgrade frequency, especially in the high-end category, to stimulate consumer upgrades and brand switches.”

Huawei is still categorised as ‘others’ in Canalys’ smartphone vendor shipments table, but its market share chart shows that it has almost caught fifth-placed Xiaomi, which recorded 9.1 million shipments in Q3 to secure a 14% share of the market.

Presumably Huawei’s impact on the broader market will come alongside a continued boost of its own sales, particularly taking into account its recent Mate 60 sales.

Huawei launched its Mate 60 Pro smartphone without any fanfare in late August. And earlier this month, according to Reuters, Counterpoint Research reported that the vendor had sold 1.6 million Mate phones in just six weeks, almost three quarters of which were Mate 60 Pro devices.

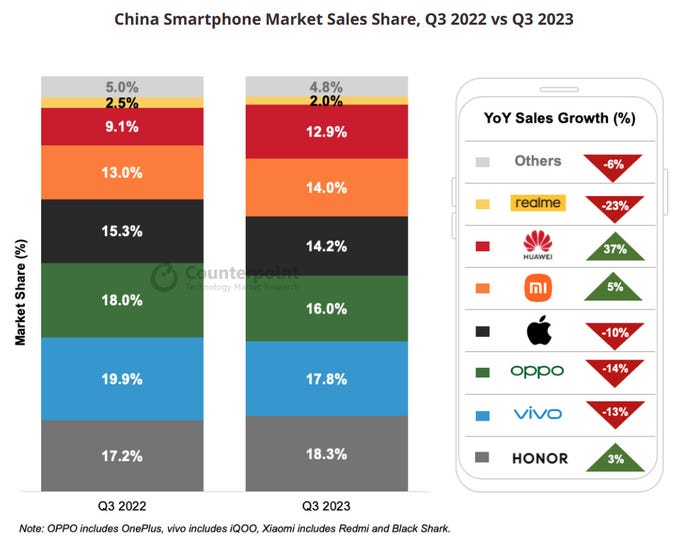

Separately, Counterpoint Research also published some new Chinese smartphone market statistics on Thursday which showed a 3% year-on-year sales decline in Q3. Like Canalys, the analyst firm highlight this as “a sign China’s smartphone market may be closer to bottoming out.”

It too commented in particular on Huawei’s strength in a quarter in which “the performance of most leading OEMs except Huawei was lacklustre.” The Mate 60 Pro “has made a huge splash in the market,” and proved a major contributor to the 37% year-on-year sales growth Huawei recorded in Q3, it said.

“Although the Mate 60’s sales are under the Pioneer Program and mostly carried out through the brand’s offline and online channels, the product has quickly garnered massive attention,” noted Counterpoint Senior Analyst Ivan Lam. “Huawei is striving to ramp up production to catch up with the demand,” he said.

Both analyst firms put former Huawei brand Honor at the top of the market in Q3, Canalys giving it an 18% share of shipments and Counterpoint 18.3% of sales. Both also have Oppo, Apple and Vivo in second to fourth spots, albeit not in the same order; Oppo claimed 16% of smartphone shipments in Q3, Canalys’s numbers show, but the vendor “lost significant ground,” in sales, dropping it to third in Counterpoint’s ranking.

The shape of the market seems to be constantly changing and further jostling for position is on the cards.

Product competitiveness is key for growth, Canalys pointed out. “The Huawei Mate 60 series launch sparked the market,” reiterated Canalys Research Analyst Lucas Zhong. “If Huawei expands the new Kirin chipset into its low-to-mid-range portfolio in the future, it has the potential to disrupt the competitive dynamic among leading vendors.”

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)