Middle East telco credit health in the wake of the Arab Spring

Analysis suggests that the Middle Eastern telecoms industry is actually stronger in terms of credit health, than its European equivalent, despite the impact of the Arab Spring, says Pavle Sabic, Solutions Architect at S&P Capital IQ.

December 21, 2011

The political unrest in the Middle East has had a wide range of economic ramifications, not least to the financial performance of companies in the Gulf Cooperation Council (GCC) area, particularly those in the telecommunications sector which have come under scrutiny from investors and companies’ counterparties.

By tracking the fundamental credit health of three major Middle East telecom firms – Qtel, Du and Saudi Telecom – for the relevant period, and comparing the results to various peer groups inside and outside the region, a clearer picture of the impact of the Arab Spring develops. It seems that the impact of political uncertainty has not had the negative effect one might expect.

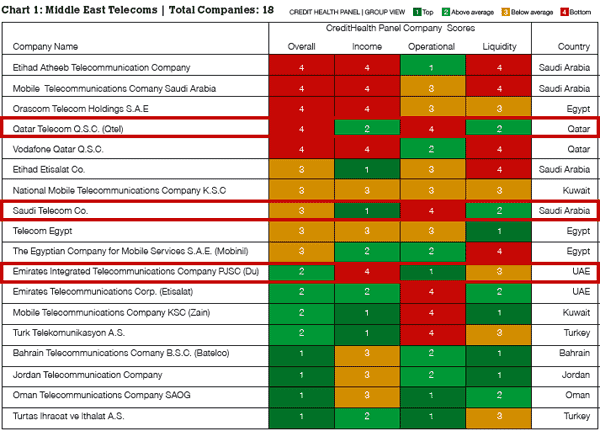

From A Regional Perspective Using S&P’s Credit Health Panel (CHP) scoring system, the three companies were ranked against their Arab nations peer group using 33 fundamental metrics categorized by three main panels: Income (ability to generate income), Operational (ability to manage its balance sheet), and Liquidity (ability to repay its debt obligations on time).

Table 1 shows the relative rank for 18 regional peers to provide a snap shot of the region’s telecommunication industry post- Arab Spring. Out of the three companies selected, Qtel rests at “Bottom” overall and Saudi Telecom is classed “Below Average”. Du has an “Above Average” score. However, in terms of Income, Qtel and Saudi Telecom have an “Above Average” and “Top” score, respectively, while Du is scored as “Bottom”. In terms of liquidity, Qtel and Saudi Telecom have “Above Average” scores, while Du has a “Below Average” score.

However, while Table 1 provides a useful snapshot of the relative credit health of key ME telecom businesses, it does not indicate how the entire regional sector was affected by the Arab Spring. For this, a wider perspective is required.

SP-fig1

SP-fig2

Is The Signal Strong In EMEA?

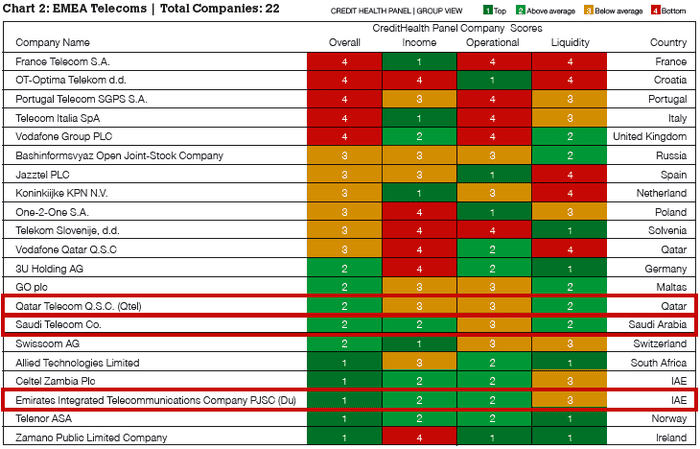

With this in mind, the research was extended to encompass a peer group of 22 companies in the integrated telecommunication services and wireless telecommunication services sub-industries across Europe and Africa.

Table 2 shows that all three companies are performing relatively well against their European and African peers. Indeed, this broader analysis suggests that the Middle Eastern telecom industry is actually stronger in some instances – in terms of credit health – than its European equivalent, despite the negative economic impact of the Arab Spring.

To find an answer to why GCC telecoms have performed so well, it is worth a deeper examination of the credit profile and market perception of Qtel – the biggest mover under the previous two peer groups.

Qtel – How Has The Credit Health Changed?

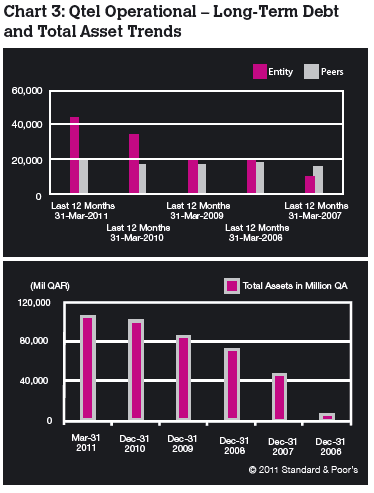

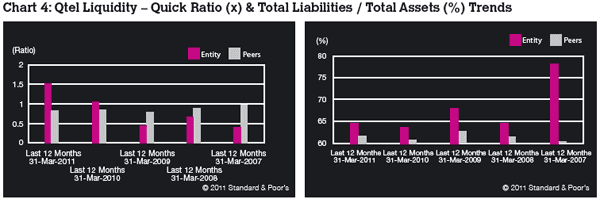

Qtel has improved its credit health in the past four years. One important indicator is Qtel’s liquidity ratio in Chart 1 – that is, its ability to immediately extinguish its current liabilities.

Plotted against the company’s standard peer group of 40 firms, it is clear that since March 31, 2007, Qtel has been increasing its shortterm assets to cover its immediate liabilities. And after March 31, 2011, this ratio peeked above the group average.

In addition, Chart 2 shows that the company’s leverage (total liabilities-tototal- assets) dropped significantly from nearly 80 per cent on March 21, 2007, to around 65 per cent on March 31, 2011.

However, Qtel’s long-term debt (chart 3) grew significantly from $5,411m in 2009 to $12,013m in 2010. A conflicting performance is appearing as the total liabilitiesto- total-assets are falling but the long-term debt is rising (comparing charts 2 and 3). One likely explanation is that Qtel has increased its assets at a faster rate than its debt.

Indeed, Qtel’s total assets have been increasing rapidly since 2006; Chart 4 shows a 1,252 per cent increase since December 31, 2006. This was mainly driven by Qtel’s acquisition of a 38.2 per cent stake of NavLink for $28 million on November 20, 2006. Despite these very positive flashes, a growing debt burden could change Qtel’s perception in the market and thus its equity value.

Consequently, as an entity’s credit profile is often linked to share price in this manner, it is helpful to take a closer look at Qtel’s equity profile to examine it for any adverse behavior during the Arab Spring.

SP-fig3

Qtel – How Has The Market View Changed?

Qtel’s share price dropped immediately after the beginning of the Arab Spring, with a significant fall (around 20 per cent) in the beginning of March 2011. Since that date, the price has slowly been increasing, mainly outperforming the S&P GCC Composite Index since April 2011. Interestingly, the S&P GCC Composite Index has rebounded since the drop in March 2011. However, the S&P GCC Composite Telecommunication Services Index only rebounded for a transient period. From April 11, 2011, it has been dropping, posing questions about the sector’s overall performance. However, Qtel is outperforming this index as well, showing signs of weathering the storm well. This could be a market response to Qtel’s initiatives to improve its leverage ratios.

SP-fig4

Concluding Thoughts

In light of this fundamental credit health analysis, it seems that the key Middle Eastern telecom companies have been fairly resilient during the tumultuous political period in the region. Saudi Telecom, Du, and Qtel have actually improved their CHP scores despite strains from the Arab Spring.

From an equity perspective, the GCC Telecoms Index is showing decreasing performance, but Qtel so far appears to be relatively unaffected as it has continued to see increases in its share price. Qtel is clearly taking actions to improve the company’s credit health, and the market is rewarding this initiative.

Pavle Sabic is a Solutions Architect at S&P Capital IQ

Read more about:

DiscussionAbout the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)