NFT hype gets a reality check

Non-fungible tokens have been heavily hyped over the past year or so but new data suggests an inevitable correction may have already started.

May 4, 2022

Non-fungible tokens have been heavily hyped over the past year or so but new data suggests an inevitable correction may have already started.

“NFT Sales Are Flatlining” declares a recent WSJ headline, before asking “Is this the beginning of the end of NFTs?” As if concerned that the opening statements were too nuanced, the body copy opens with “The NFT market is collapsing.” NFT’s are a way of rendering a digital file unique, and thus collectible, for people who are into that sort of thing.

The WSJ assertions were based on data provided by specialist website NonFungible, comparing the trade in NFTs last week with selected moments in the past year. It seems daily average sales volume was down 92% from its peak last September, while the number of active digital wallets (presumably where acquired NFTs are kept) fell 88% from its November peak.

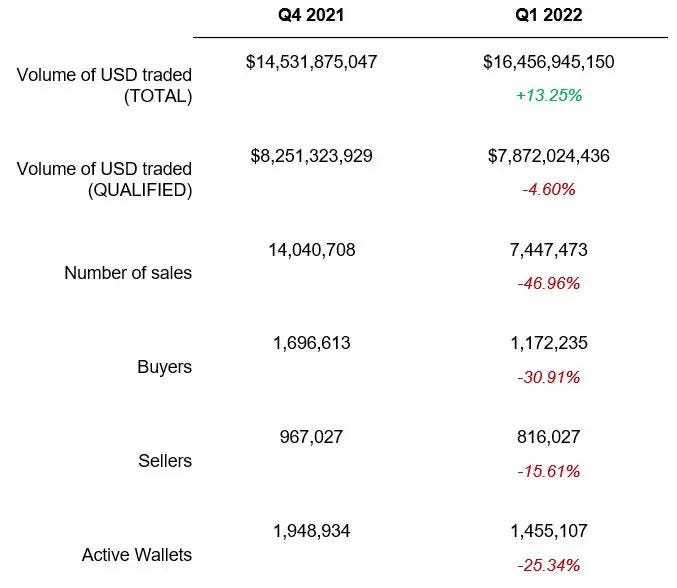

NonFungible doesn’t seem to have published the data used by the WSJ, but it did recently release its Q1 2022 report, the summary of which contains the table below. “The NFT market experienced strong euphoria in 2021, mainly driven by the Collectibles segment,” it opens. “But at the end of the year, the various volumes began to decline and this trend continued in the first quarter of 2022.”

The subsequent analysis is rather more nuanced than the WSJ opted for. Essentially, NonFungible views the 2022 data trends as an inevitable correction from the previous fervour. That NFTs experienced a speculative bubble last year seems clear and high profile secondary market flops have anecdotally pointed towards that bubble bursting. But, having said that, the year-on-year quarterly comparisons above are nowhere near as dramatic as the data points chosen by the WSJ.

“Overall, the indicators are bearish,” says the NonFungible release. “As we announced in our 2021 annual report, a decrease in NFT sales volume due to the saturation of the collectible market was to be expected… However, this drop in sales volume is accompanied by a much smaller drop in the volume of dollars traded (only 5% drop)… With nearly $8 billion traded in the first quarter of 2022, the market cannot really be considered to have collapsed. We are observing a stabilization of the NFT market, in line with the last quarter of 2021.”

Crypto news site Cointelegraph apparently prefers to rely on data from Dune Analytics, which it reckons contradicts the WSJ angle. The piece also embeds the following tweets from investor Tom Schmidt, which encapsulate the more bullish view of the NFT market.

It’s hard to know who to believe when it comes to such a new and speculative investment market, since many commentators will have some degree of vested interest affecting their analysis. It does seem likely that the initial wave of people buying NFTs mainly because they assume they will mirror the economics of the physical art market has run out of steam, at least for now. But that could just herald a more sophisticated phase involving gaming micropayments and the metaverse. Let’s see.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)