SoftBank Group flogs 22% of SoftBank Japan coz of coronavirusSoftBank Group flogs 22% of SoftBank Japan coz of coronavirus

Despite raising $41 billion already this year, Softbank reckons it needs a bunch more cash to protect itself from the effects of a COVID-19 resurgence.

August 28, 2020

Despite raising $41 billion already this year, Softbank reckons it needs a bunch more cash to protect itself from the effects of a COVID-19 resurgence.

In a ‘secondary offering of shares in subsidiary SoftBank Corp, SoftBank group is hoping to raise another $12 billion or so to keep down the back of the sofa in case the world goes into full lockdown again. Earlier this year it blamed the pandemic for losing $17 billion on its portfolio of investment.

While Softbank still owns plenty of telecoms and tech companies, the business has increasingly turned towards venture capital activities in its thirst for returns. It picked a bad time to do so, however, with the business world grinding to a halt in the second quarter of this year and the recovery threatened by fears of a second wave.

‘SBG has sold or monetized JPY 4.3 trillion of assets as of August 3, 2020, as part of the program announced on March 23, 2020,’ said the SoftBank Group announcement. ‘In light of the ongoing uncertainty in the market environment due to concerns about a potential second or even third wave of COVID-19, SBG believes it is necessary to expand cash reserves beyond the JPY 4.5 Trillion Program to ensure flexible options to respond to changes in the market environment. In order to do this, SBG will offer a portion of its holding of common stock of subsidiary SB, held through its wholly owned subsidiary SBGJ, via the Secondary Offering.’

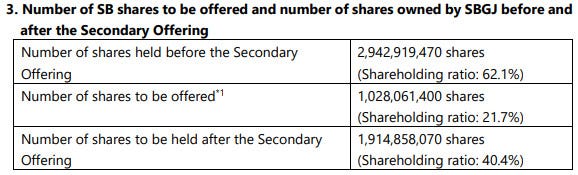

As you can see in the table below, Softbank Group is offering up 21.7% of the total shareholding in SoftBank Japan, which would result in it no longer being the majority owner of it. Since it could have offered half as much and still retain undisputed control of its Japanese operator, this implies SoftBank Group is seriously worried about cashflow and anticipates further heavy losses on its investments.

If they all get sold that should raise another $12 billion, give or take, at today’s prices. Softbank’s shares were down a few percent, at time of writing, on the news, implying that investors were a bit spooked by the move, but not too much. Most countries around the world are still erring on the side of caution with respect to coronavirus and it seems reasonable to expect some kind of second wave this winter. Maybe we’ll deal with it better next time.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)