Telcos: utility or futility?

Whilst landline services have had a utilities aspect for many years it is now clear that in just about every aspect of data and communications services, the whole sector is now firmly established as a regulated utility.

July 10, 2018

Telecoms.com periodically invites third parties to share their views on the industry’s most pressing issues. In this piece Professor Chris Bones, Co-Founder and Chairman of Good Growth, looks at what telcos can do about the growing spectre of commoditisation.

It’s tough when your sector becomes a commodity market, it gives less room for price and pushes you into a significantly greater investment in promotion to drive growth more from increases in market share as opposed to growing the market; when it becomes a utility, however, the dynamics change again as alongside price, a different set of social issues arise such as access, equality of provision, support to vulnerable customers and service continuity during periods of financial difficulty.

Whilst landline services have had a utilities aspect for many years it is now clear that in just about every aspect of data and communications services, the whole sector is now firmly established as a regulated utility reflecting the reality that broadband and mobile connectivity have shifted from a discretionary purchase into being seen as essential services to support modern life. Up until now there has been a high level of customer retention, but the coming introduction of things like customer-led porting and eSim plus new entrants are making the retention-led model much more challenging. One of the responses from Telcos has been to work hard to develop products and services that make the customer ‘more sticky’. These have had a particular focus on bundling where the argument goes that the more services a customer buys, the more churn will reduce.

The commercial priorities for any utility in these circumstances are clear:

Retain as many customers as you can – it is far less costly to re-sell and extend services to those you know, than attract and convert those you don’t know

Reduce the ‘cost to serve’ for the ‘average’ customer

Increase the willingness of current customers to recommend your service to friends and family – reducing the cost to acquire

Attract customers who are more likely to stay with you for the medium to longer-term and who may be willing to pay for additional services or a higher than average level of service

Create new product and service lines in faster growing sectors that can deliver better margins

Like other utilities, one of the biggest barriers is the power of the indirect channel: aggregators like U Switch and especially for Telcos, players such as Dixons Carphone. The challenge is to work out how to attract and engage customer in the market such that they build the relationship directly and can increasingly build lifetime value. To do this requires effort to understand the customer in the market and what it takes to attract and engage them such that they will buy direct.

But in a market where price is now the lead engagement with the customer, where do leaders invest to create a competitive advantage? We would back customer experience over additional technology any day. Whether you are selling landline or 5G services, contract or SIM-only, a bundle or a single product, the connecting thread through all interactions is the quality of the customer experience. It is the quality of the experience both in acquiring and retaining customers that build the willingness to continue as a customer and to recommend services to friends and family. In our work for O2, we proved that a focus on building insight as to why customers chose not to buy direct and then testing alternative customer experiences to drive performance improvement could make a real difference. Former Chief Digital Officer for O2, David Plumb, states that ‘this approach made a real difference in a number of product areas with some very significant uplifts in customer engagement’.

What should be concerning all suppliers in the market is the degree to which current customers are engaged in promoting their services to others in their circle. Last May, a survey of Which? Members suggested that only 20% of EE customers would recommend their services to a friend and the number wasn’t much better (25%) for Vodafone. Between them, these two operators have around half of the market. This May, Ofcom’s consumer satisfaction report suggested that it was the customers of Vodafone and Virgin Mobile who were least likely to recommend their services to a friend. It also highlighted the poor levels of satisfaction across all providers of both broadband and mobile services in how they handle complaints with no provider able to reach a satisfaction rating of higher than 67% in mobile, 59% in broadband and 58% in landline.

Customer service quality is an increasing focus for the regulator. Next year ‘one-text switching’ will arrive and this along with a focus on ensuring people receive automatic compensation when things go wrong and get better information on broadband speeds before entering a contract will put increasing pressure on suppliers to ensure that their customer experience is outstanding and the ability for a customer to switch in response to poor service is much easier than it is today.

Push-me-Pull-You Marketing

From outside the sector, the response to this focus on customer service seems rather difficult to understand in that major players seem to be investing even more in attracting new customers, than they are in enabling current customers to manage their relationships with the least possible friction.

Price competition and promotions such as free flights and extra data sit alongside improved features and benefits such as roll-over or sharing of data allowances. There is no doubt that data usage is increasing as smartphones become ubiquitous and more sophisticated, but differentiation can be quickly neutralised in digital markets and, unless suppliers want to join in a race to the bottom there needs to be a focus on delighting the customer. This is particularly true of any supplier looking to offer a premium priced service.

This approach implies an acceptance of the current levels of customer churn and a willingness to pay to attract dissatisfied customers from competitors. We call this push-me-pull-you marketing: capturing the interest of active users in a market who have been pushed away from their current supplier – more often than not due to poor service, a failure to deliver to a promised standard, or a belief that the ‘perks’ of the package are not worth the additional feed – to pull them into their sales funnel, through offering to meet a particular need: lower costs or greater (data) benefits.

This mindset carries with it the risk that the new customer gets a far greater focus than those already contracted, and the customer experience post sale gets pushed so far down the agenda it becomes lost from sight.

It’s the organisation, stupid

Customer acquisition and much of customer service is executed online and the focus here should be on optimisation to deliver the best outcome for the customer. Yet there still exists a firm belief in many e-commerce and digital marketing teams that the solution to finding growth in core and shoulder markets is to invest even more money in new platforms, new websites, re-skinned pages; or pet projects such as new functionality, personalisation, an app, voice and visual search and broad spectrum social media marketing activity.

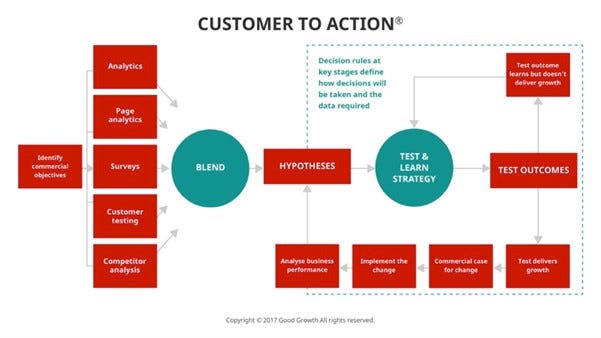

There are times when these investments are the right thing to do but, having yet to advise a client that we couldn’t get their current site to perform better without them investing heavily in nearly seven years of working in e-commerce improvement, we think that doing this before trying to get more out of what you already have is a sure-fire way of pouring good money after bad: particularly when customer satisfaction is a significant issue. A key first question for all leaders in the sector is to check what is driving your resource allocation online: if it isn’t deep, well-informed customer insight from both new and current customers, worry. Organisations have a terrible habit in getting in the way of customers. If yours doesn’t understand the customer’s perception of their online experience, then what it does may well be making things worse, not better. We think about this in terms of building hypotheses to describe customer failure and then testing in a highly disciplined fashion to find the most effective customer experience that can transform performance:

Telecoms products are basically subscriptions. In our work for subscription-based propositions in media, insurance, health and fitness and utilities (including Telecoms) we believe there is significant value to come from:

Understanding why customers (current and potential new ones) are on your site

Knowing why these customers fail to transact their intended action on your site

Having qualitative and quantitative data that supports a clear set of hypotheses about what might be changed to improve the chances of customer success

Running a highly disciplined testing programme that is focused on performance improvement in retention and acquisition

Learning from every test and adjusting your understanding of the customer accordingly

Subscribers stay with you if they value the total experience, not just the product and regardless of the product, if they have a bad experience when they engage, then they are much more likely to find fault and look to leave. From next year, departure in mobile will get much easier. You’ve been warned!

Chris Bones is the Chairman of Good Growth and the lead for its strategy work. Chris developed the Customer to Action® model and, as an organisation and change strategist with a global commercial brand background, he advises clients on strategic implementation, change and organisation alignment. After working in energy, brewing and retail, Chris had a global career in FMCG with senior HR roles in Diageo and Cadbury Schweppes.

Chris Bones is the Chairman of Good Growth and the lead for its strategy work. Chris developed the Customer to Action® model and, as an organisation and change strategist with a global commercial brand background, he advises clients on strategic implementation, change and organisation alignment. After working in energy, brewing and retail, Chris had a global career in FMCG with senior HR roles in Diageo and Cadbury Schweppes.

He became the first non-academic Dean of Henley Business School – one of the world’s major business schools – which, under his leadership, boasted a ‘world top 20’ ranked MBA. A noted columnist and broadcaster, his book ‘The Cult of the Leader’ won the CMI/British Library ‘Management Book of the Year’ prize in 2012. Chris graduated with an MA and was also awarded an honorary doctorate from the University of Aberdeen. On a part-time basis, he is the Professor of Creativity and Leadership at Alliance Manchester Business School.

Read more about:

DiscussionAbout the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)