Who's got the stones to buy Netflix?

Apple, Disney, Microsoft or even Alibaba; one of the biggest questions which has circled the technology industry over the last couple of years is who could possibly acquire Netflix?

January 29, 2019

Apple, Disney, Microsoft or even Alibaba; one of the biggest questions which has circled the technology industry over the last couple of years is who could possibly acquire Netflix?

The streaming giant, Wall Street’s darling, has almost constantly been talked up as an acquisition target. However, another year has passed and it’s another year where no-one managed to capture the content beast. You have to start to wonder whether it will ever happen, but here we’re going to have a look at who might be in the running.

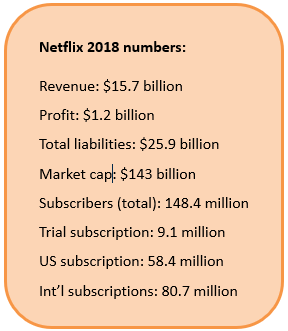

With subscriptions totalling more than 148 million, 2018 revenues exceeding $15.7 billion and operating income up to $1.6 billion, Netflix would certainly be a useful addition to any company. However, with market capitalisation now roughly $143 billion and debt which would make your eyes water, an acquisition would be a scary prospect for almost everyone.

With subscriptions totalling more than 148 million, 2018 revenues exceeding $15.7 billion and operating income up to $1.6 billion, Netflix would certainly be a useful addition to any company. However, with market capitalisation now roughly $143 billion and debt which would make your eyes water, an acquisition would be a scary prospect for almost everyone.

First and foremost, let’s have a look at some of the players who might have been in the equation, but alas, no more.

Disney has been a rumoured acquirer for almost as long as Netflix existed. This is an incredibly successful company, but no-one is immune to the shift tides of the global economy and consumer behaviour. Getting in on the internet craze is something which should be considered critical to Disney, and Netflix would have given them a direct-to-consumer channel. However, there was always a feeling Disney would develop its own proposition organically and this turned out to be the case.

AT&T is another company which might have been in the fray, but its Time Warner acquisition satisfied the content needs of the business. All telcos are searching to get in on the content cash, developing converged offerings, and AT&T is a company which certainly has a big bank account. As mentioned above, the acquisition of Time Warner completes rules this business out.

There are of course others who might have been interested in acquiring the streaming giant, but for various reasons they would not be considered today. Either it would be way too expensive, wouldn’t fit into the company’s objectives or there is already a streaming service present. But now onto the interesting stuff, who could be in the running.

Microsoft

From doom to gloom, CEO Satya Nadella has certainly turned fortunes around at Microsoft. Only a few years ago, Microsoft was a shadow of its former self as the declining PC industry hit home hard. A disastrous venture into the world of smartphones was a slight detour but under the cloud-orientated leadership of Nadella, Microsoft is back as a lean, mean tech heavyweight.

Alongside the cloud computing business, Microsoft has also successfully lead the Xbox brand into the digital era. Not only is the platform increasingly evolving into an online gaming landscape, but it also lends itself well to sit alongside the Netflix business. If Microsoft wants to compete with Amazon across the entire digital ecosystem, both consumer and enterprise, it will need to expand the business into more consumer channels.

For Netflix, this might be an interesting tie up as well. Netflix is a business which operates through a single revenue stream at the moment, entertainment, and might be keen to look at new avenues. Gaming and eSports are two segments which align well with Netflix, opening up some interesting synergies with Microsoft’s consumer business.

“Microsoft is at a crossroads,” said independent telco, media and tech analyst Paolo Pescatore. “Its rivals have made big moves in video and it needs to follow suit. The acquisition addresses this and complements its efforts with Xbox. The move also strengthens its growing aspirations in the cloud with Azure, firmly positioning itself against Amazon with AWS and Prime video.”

However, while this is a company which could potentially afford to buy Netflix, you have to wonder whether it actually will. The Netflix culture does not necessarily align with Microsoft, and while diversification into new channels is always attractive, it might be considered too much of a distraction from the cloud computing mission. Nadella has already stated he is targeting the edge computing and AI segments, and considering the bounties on offer there, why bother entertaining an expensive distraction.

Apple

Apple is another company which has billions floating in free cash and assets which could be used to leverage any transaction. It is also a company which has struggled to make any effective mark on the content world, excluding iTunes success. With Netflix, Apple could purchase a very successful brand, broadening the horizons of the business.

The last couple of months have shown Apple is not immune to the dampened smartphone trends. Sales are not roaring the same way they were during yesteryear, perhaps because there has been so little innovation in the segment for years. The last genuine disruption for devices probably came from Apple a decade ago when it ditched the keyboard. Arguably everything else has just been incremental change, while prices are sky-rocketing; the consumer feels abused.

To compensate for the slowdown, CEO Tim Cook has been talking up the software and services business unit. While this has been successful, it seems not enough for investors. Netflix would offer a perfect opportunity for Apple to diversify and tap into the recurring revenues pot which everyone wants to grab.

However, Netflix is a service for anyone and everyone. Apple has traditionally tied services into Apple devices. At CES, we saw the firm expand into openness with new partnerships, but this might be a step too far. Another condemning argument is Apple generally likes to build business organically, or at least acquire to bolster existing products. This would stomp all over this concept.

Alibaba

A Chinese company which has been tearing up trees in the domestic market but struggled to impose itself on the international space, Alibaba has been hoping to replicate the Huawei playbook to dominate the world, but no-where near as successfully.

Perhaps an internationally renowned business is exactly what Alibaba needs to establish itself on the international space. But what is worth noting is this relationship could head the other direction as well; Netflix wouldn’t mind capitalising on the Chinese market.

As with any international business a local business partner is needed to trade in China. Alibaba, with its broad reach across the vast country, could prove to be a very interesting playmate. With Netflix’s Eastern ambitions and Alibaba’s Western dreams, there certainly is dovetail potential.

However, it is very difficult to believe the current US political administration would entertain this idea. Aside from aggression and antagonistic actions, the White House has form in blocking acquisitions which would benefit China, see Broadcom’s attempted acquisition of Qualcomm. This is a completely different argument and segment but considering the escalating trade war between the US and China, it is hard to see any tie up between these two internet giants.

If you’re going to talk about a monstrous acquisition in Silicon Valley, it’s difficult not to mention Google. This is one of the most influential and successful businesses on the planet with cash to burn. And there might just be interest in acquiring Netflix.

Time and time again, Google has shown it is not scared of spending money, a prime example of this is the acquisition of YouTube for $1.65 billion. This might seem like pocket change today, but back in 2006 this was big cash. It seemed like a ridiculous bet for years, but who is laughing now?

The issue with YouTube is the business model. Its advertiser led, open to all and recently there have been some PR blunders with the advert/content alignment. Some content companies have actively avoided the platform, while attempts to create a subscription business have been unsuccessful. This is where Netflix could fit in.

“Google has made numerous failed attempts to crack the paid online video landscape,” said Pescatore. “Content and media owners no longer want to devalue their prized assets by giving it away on YouTube. Acquiring Netflix gives Google a sizeable subscriber base and greater credibility with content and media owners.”

Where there is an opportunity to make money, Google is not scared about big cash outlays. Yes, Netflix is a massive purchase, and there is a lot of debt to consider, but Google is an adventurous and bold enough company to make this work.

However, you have to question whether the US competition authorities would allow two of the largest content platforms to be owned by the same company. There might not necessarily be any direct overlap, but this is a lot of influence to have in one place. Authorities don’t generally like this idea.

Verizon

Could Verizon borrow a page from the AT&T playbook and go big on a content acquisition? Perhaps it will struggle to justify the expense to investors, but this one might make sense.

Verizon has been attempting to force its way into the diversification game and so far, it has been a disaster. While AT&T bought Game of Thrones, Verizon went after Yahoo to challenge the likes of Google and Facebook for advertising dollars. A couple of data breaches later, the content and media vision looks like a shambles. Hindsight is always 20/20 but this was a terrible decision.

However, with a 5G rollout to consider, fixed broadband ambitions and burnt fingers from the last content acquisition, you have to wonder whether the team has the stomach to take on such a massive task. Verizon as a business is nothing like Netflix and despite the attractive recurring revenues and value-add opportunities, the integration would be a nightmare. The headache might not be worth the reward.

You also have to wonder whether the telco would be scared off by some of the bold decisions made from a content perspective. Telcos on the whole are quite risk-adverse organizations, something which Netflix certainly isn’t. How many people would have taken a risk and funded content like Stranger Things? And with the release of Bandersnatch, Netflix is entering the new domain of interactive content. You have to be brave and accept considerable risk to make such bets work; we can’t see Verizon adopting this mentality.

Softbank Vision Fund

Another with telco heritage, but this is a completely different story.

A couple of years back, Softbank CEO Masayoshi Son had a ridiculous idea which was mocked by many. The creation of a $100 billion investment fund which he would manage seemed unimaginable, but he found the backers, made it profitable and then started up a second-one.

Son is a man to knows how to make money and has the right connections to raise funds for future wonderful ideas. Buying Netflix might sound like an absurd idea, but this is one place we could really see it working.

However, the issue here is the business itself. While Son might be interested in digital ventures which are capable of making profits, the aim of the funds have mainly been directed towards artificial intelligence. Even if Son and his team have bought into other business segments, they are more enterprise orientated. There are smaller bets which have been directed towards the consumer market, but would require an investment on another level.

Tencent

Another Chinese company which has big ambitions on the global stage.

This is a business which has been incredibly successful in the Chinese market and used assets effectively in the international markets as well. The purchase of both Epic Games and Supercell have spread the influence of the business further across the world and numerous quarterly results have shown just how strong Tencent’s credentials are in the digital economy.

Tencent would most likely be able to raise the funds to purchase the monster Netflix, while the gaming and entertainment portfolio would work well alongside the streaming brand. Cross selling would be an option, as would embedding more varied content on different platforms. It could be a match made in heaven.

However, you have to bear in mind this is a Chinese company and the political climate is not necessarily in the frame to consider such as transaction. Like Alibaba, Tencent might be viewed as too close to the Chinese government.

No-one

This is an option which is looking increasingly likely. Not only will the business cost a huge amount of money, perhaps a 30-40% premium on market capitalisation, the acquirer will also have to swallow all the debt built-up over the years. There will also have to be enough cash to fuel the content ambitions of Netflix, it reportedly spend $7.5 billion on content last year.

Finally, the acquirer would also have to convince Netflix CEO Reed Hastings, as well as the shareholders, that selling up is the best option.

“If I was a shareholder or Reed Hastings, I’d be wondering whether it is better to be owned by someone else or just carry on what we’re doing now,” said Ed Barton, Practise Lead at Ovum.

“These guys are going down in business school history for what they have done with Netflix already, do they need to sell out to someone else?”

Netflix is growing very quickly and now bringing in some notable profits. The most interesting thing about this business is the potential as well. The US market might be highly saturated, but the international potential is massive. Many countries around the world, most notably in Asia, are just beginning to experience the Netflix euphoria meaning the growth ceiling is still years away.

What this international potential offers Netflix is time, time to explore new opportunities, convergence and diversification. Any business with a single revenue stream, Netflix is solely reliant on subscriptions, sits in a precarious position, but with international growth filling the coffers the team have time to organically create new business streams.

Ultimately, Hastings and his management team have to ask themselves a simple question; is it better to control our own fate or answer to someone else for a bumper payday? We suspect Hastings’ bank account is already bursting and this is a man who is driven by ambition, the need to be the biggest and best, breaking boundaries and creating the unthinkable.

Most of these suitors will probably be thinking they should have acquired Netflix years ago, when the price was a bit more palatable, but would they have been able to drive the same success as Hastings has done flying solo? We suspect not.

Read more about:

DiscussionAbout the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)