2021 will be the beginning of the end of mobile data commoditisation2021 will be the beginning of the end of mobile data commoditisation

The biggest driver of this transformation was the need to stay relevant in the minds of the digital consumer – to react to impulse and meet expectations every time.

November 23, 2020

Telecoms.com periodically invites expert third parties to share their views on the industry’s most pressing issues. In this piece Martin Morgan, VP Marketing of Openet, an Amdocs company, reflects on the findings of the 2020 Telecoms.com annual industry survey (AIS) and looks forward to lucrative new network-centric services for operators arriving in 2021.

Most global operators were undergoing fundamental transformation programs before the COVID-19 pandemic hit. The ultimate goal was to complete the journey from being a traditional telco, to a digital services provider as quickly as possible. The arrival of 5G was not the catalyst for change, but it was a significant accelerator and helped operators focus minds in building new digital identities. The biggest driver of this transformation was the need to stay relevant in the minds of the digital consumer – to react to impulse and meet expectations every time.

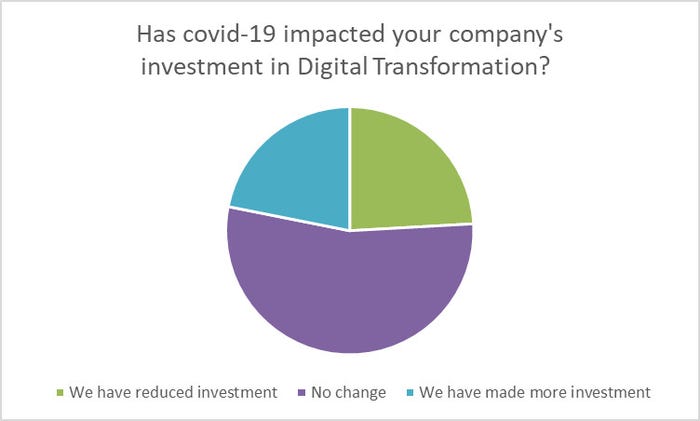

For most operators, digital transformation is no small ask. It requires fundamental change – technologically, structurally, and culturally. It permeates every employee, at every level, across all departments. Therefore, most people could reasonably expect that when the COVID-19 pandemic first struck, progress against digital transformation objectives would be halted in its tracks, with budgets being diverted to cover numerous amounts of firefighting. Interestingly, this has not been the case.

We asked a few questions of operators in the Telecoms.com 2020 AIS. The impact of COVD-19 on the continuity of digital transformation programs was something we tried to uncover. More than half (54%) of operator respondents said the pandemic had no impact whatsoever and that investment had remained consistent – in fact 22% increased their budget. This is despite 44% of global operators admitting having been negatively impacted by the pandemic overall. This commitment to transformation reflects its overall importance to the global operator community. Digital transformation, as well as being a fight for relevance, is also a fight for ongoing visibility, despite a dwindling physical retail presence, through greater focus on ecommerce for sales and customer care.

Has covid-19 impacted your company’s investment in Digital Transformation?

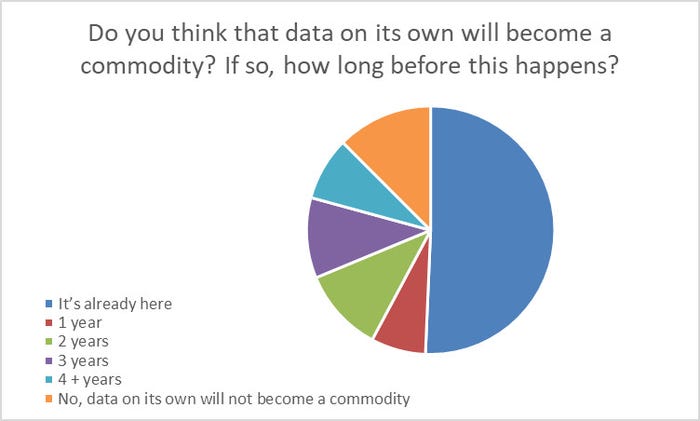

The operator plight is not helped by their historical reliance on an increasingly commoditised utility – mobile data. In fact, most operator respondents (88%) in the AIS believed mobile data was either already a commodity or is well on its way to being commoditised. This realisation is forcing new thinking across the operator community to find ways to better monetise the capabilities of 5G networks beyond offering faster network speeds.

Do you think that data on its own will become a commodity? If so, how long before this happens?

The good news here is that 5G provides opportunity for the creation of new services that enables operators to charge a premium for robust, reliable and secure connectivity and the best possible service QoS. We’re talking about network embedded services – the ability to charge for the inherent technological benefits of 5G SA. The introduction of network slicing offers new possibilities in terms of ultra-low latency connectivity powering new consumer and enterprise use cases.

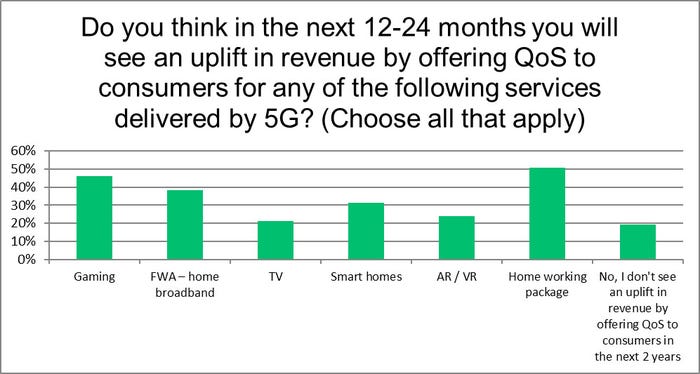

From a consumer perspective, network embedded services guaranteeing premium QoS will be targeted mainly at the home. We asked operators what their expectations were from these consumer services. Most survey respondents were confident that in the next 1 to 2 years, consumers would start embracing 5G network embedded services and that they would help grow revenues. Operators expect home working packages to be most sought after, followed by gaming, fixed wireless access-based home broadband, and smart home packages.

Do you think in the next 12-24 months you will see an uplift in revenue by offering QoS to consumers for any of the following services delivered by 5G? (Choose all that apply)

While operators remain optimistic about the uptake for these consumer services, most appreciate that they represent relatively small gains from a revenue perspective. However, most also accept that enterprise 5G SA network embedded services have highly lucrative revenue generating potential. Dedicating network slices to enterprises will guarantee premium connectivity (high speeds, low latency, guaranteed availability etc.) for a host of innovative business and security applications. More than half of operator survey respondents (56%) believe their customers would pay a premium for them.

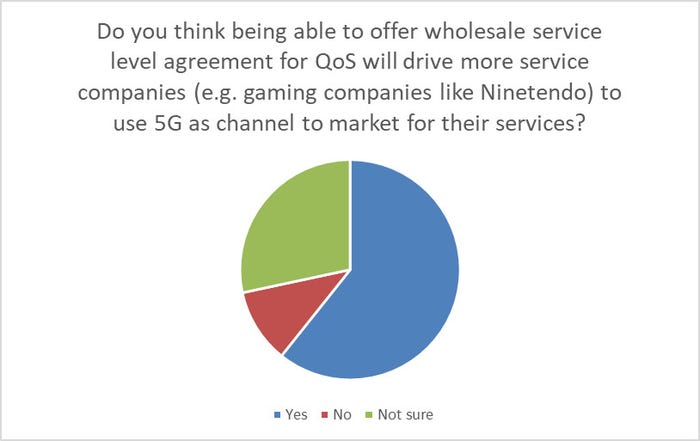

A significant proportion of this new expected revenue could come via partnership with content providers looking to leverage the capabilities of 5G as a marketing and sales channel. Wholesale QoS-based service level agreements (SLAs) can be offered by operators, to specialist third parties, to help generate, and offer, compelling new services. For example, an operator could team up with a gaming content provider, like Nintendo, to build a compelling 5G mobile cloud gaming service. Most operators surveyed (61%) believe that demand from content providers for these types of agreements will be strong.

Do you think being able to offer wholesale service level agreement for QoS will drive more service companies (e.g. gaming companies like Nintendo) to use 5G as channel to market for their services?

Cloud gaming is one of many possibilities. Other examples could include allocating a network slice with accompanying QoS SLA to television companies looking to leverage 5G networks for broadcast purposes, creating deals with hospitals looking to leverage 5G for remote surgery techniques, or agreements with industrial companies wanting to use 5G to power smart manufacturing. 5G operators need a range of partners across the ecosystem for network embedded services to succeed. Operators are very much aware of this, with some set to be more selective than others. Most (68%) operators surveyed believe they won’t need more than 50 partners, 29% believe they’ll not need for than 10. This suggests a great deal of thinking has gone into uncovering the use cases with the most potential.

Despite the negative impact of the COVID-19 pandemic, operator optimism for digital transformation programs and the arrival of 5G SA embedded services remains strong. The global operator community appears well aligned on its thinking and is targeting both consumer and enterprise use cases. Most agree that the enterprise holds the key in terms of accelerating ROI for 5G SA investment and carefully selected partnerships would make the difference in making potential a lucrative reality. The network capabilities are there, operators just need to sell them. 2021 is set to be an exciting year.

Martin Morgan is the VP Marketing at Openet. With 30 years’ experience in mobile communications software, Martin has worked in mobile since the early days of the industry. He’s ran the marketing teams for several BSS companies and served on trade association and company boards. In that time, he’s spoken at over 50 telecoms conferences worldwide and had a similar number of articles published in the telecoms trade press and served on trade association and company boards. At Openet Martin is responsible for marketing thought leadership and market interaction.

Martin Morgan is the VP Marketing at Openet. With 30 years’ experience in mobile communications software, Martin has worked in mobile since the early days of the industry. He’s ran the marketing teams for several BSS companies and served on trade association and company boards. In that time, he’s spoken at over 50 telecoms conferences worldwide and had a similar number of articles published in the telecoms trade press and served on trade association and company boards. At Openet Martin is responsible for marketing thought leadership and market interaction.

Read more about:

DiscussionAbout the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)