Alcatel-Lucent resists calls to renegotiate Nokia deal after earnings

French networking vendor Alcatel-Lucent has reported solid Q1 2015 earnings, prompting questions about the value its shareholders are getting from the proposed Nokia acquisition.

May 7, 2015

French networking vendor Alcatel-Lucent has reported solid Q1 2015 earnings, prompting questions about the value its shareholders are getting from the proposed Nokia acquisition.

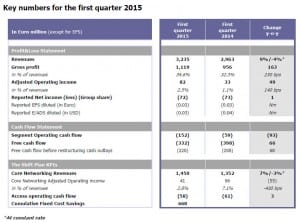

While ALU managed to increase revenues by 9% year-on-year (with a fair bit of exchange rate help) and kept losses constant, Nokia’s profits declined dramatically this quarter. These contrasting fortunes inevitably led to speculation that the terms of the deal should be amended, which ALU CEO Michel Combes resisted.

“Our agreement with Nokia doesn’t depend on a single quarter, it’s based on long-term industrial trends,” said Combes on a subsequent media call. “There’s no reason for any change to the deal.”

“Our first quarter 2015 results reflect not only strong growth in our next-generation products, but also the diligent efforts we have made to turn Alcatel-Lucent around and build a more resilient organization,” said Combes when announcing the results.

“Evidence of our progress is shown through the continued improvement in margins and cash flow. Execution of the Shift Plan is and will continue to be our top priority, underlined by our commitment to reach our positive free cash flow target in 2015. These results help pave the way for successful execution of our goals as we prepare for our combination with Nokia.”

Among the highlights identified in the earnings report were 25% growth from ‘next-generation products’, over double the operating margin of the year-ago quarter and solid progress towards the targeted €950 million in fixed cost savings in 2015. ALU’s shares were up a couple of a percent on the news, as were Nokia’s.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)