An actual usecase for Big Data? Maybe, but let’s not get carried away

Data has been promised as the new oil in the digital era, but there has been little substance to the idea thus far. That said, WeDo Technologies think they have cracked it.

May 12, 2017

Data has been promised as the new oil in the digital era, but there has been little substance to the idea thus far. That said, WeDo Technologies think they have cracked it.

If Big Data was someone you fancied, the telcos have firmly been locked in the friendzone for years. Whether it be regulation, the constraints of technologies or user acceptance, there has been little to shout about. With the fortunes promised, you can understand why the telcos have been getting excited.

The mountains of data which have been collected from users over the years could result in a gold rush, but using it has been an uphill struggle. That said, WeDo Technologies’ Carlos Martins thinks he’s got a couple of ideas.

“There are more than 2.5 billion people around the world who don’t have a bank account,” said Martins. “Yet numerous industries still base decisions on whether to offer customers credit or new products on credit ratings. In countries like Turkey or India, which are economies traditionally based on cash, this could lead to customers being misrepresented, or even opportunities to upsell being missed.

“There have been a lot of promises about the potential of Big Data, but to be completely honest, the environment wasn’t right. With the fact the cost of compute power and data storage is dropping all the time, there is a genuine opportunity to develop new ideas and business models.”

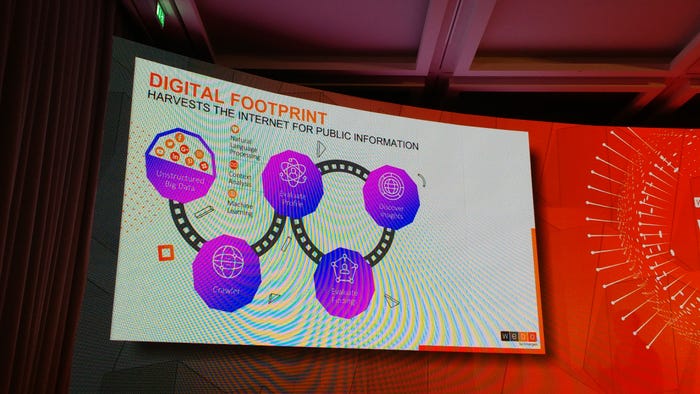

Martins is currently overseeing the development of a new product called Digital Footprint. It’s a relatively simple idea, but the best ones mostly are. Using an internet crawler, WeDo can collect all the data on the public internet and dark web on a certain individual, before using various artificial intelligence technologies to build a character profile. It does sound a bit like profiling, but considering the (sometimes) limited nature of credit profiling, it could open up new avenues to understand and engage customers.

Right now the team are just focusing on text, but it shouldn’t be too long before image recognition plays a role. It could potentially tell you a lot about a person’s interests, personality, habits and general state of mind.

For revenue assurance, collecting all this information can help create a ‘most likely’ profile for fraudsters or from a marketing perspective you can begin to understand when, how or why to engage customers. The crawler will collect data from various sources including the dark web for leaked information, social media accounts for personality traits and also generic websites for additional colour.

Once all this unstructured data has been collected, it can be rationalised through natural language processing or sentiment analysis to understand who that individual is, and what kind of person they are. Marketing and fraud detection are just two of the areas, but you can imagine there will be other opportunities once the technology is more widely available.

Currently, the team are still in the beta stage, working with a select number of customers to refine the proposition before bringing to the market later this year, but the team has given themselves a self-imposed glass ceiling as sort; it’s going to be a B2B2C product.

This is where the opportunity lies for the telcos. Revenue assurance teams might be happy to directly license the technology from WeDo, and will most likely find some good usecases, however there is also the opportunity for telcos to white label Digital Footprint, before selling onto potential enterprise customers as marketing engagement tool. The software can be integrated with current CRM systems, allowing marketer to build a useful profile of customers.

“One of the main challenges we will be facing over the next couple of years is data protection regulation however,” said Martins. “EU GDPR means that you would have to gather consent of each individual customer to use the data, however in North America, once something is on the internet its fair game.

“We’ve been testing out the idea in North America due to a more relaxed approach to data privacy, but once our lawyers have worked out how we can operate safely and within regulations, Europe will be the next frontier.”

It’s a complicated process, one which is laden with challenges (both technical and legal), but a strong case for Big Data… finally.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)