AT&T delivers bullish 3-year outlook after a mixed Q3 (Updated)

US telecom and media giant AT&T has reported a steady Q3, with revenues slightly down coupled with improved operation. A bullish 3-year outlook to further de-leverage is welcome news to the capital market.

October 29, 2019

US telecom and media giant AT&T has reported a steady Q3, with revenues slightly down coupled with improved operation. A bullish 3-year outlook to further de-leverage is welcome news to the capital market.

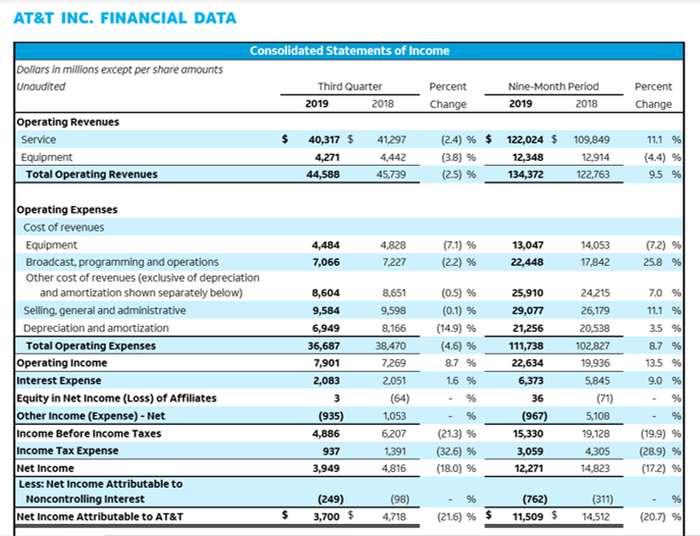

The company lost 1.2 million premium pay-TV subs, but the HBO business registered growth. The corporate level revenue of $44.588 billion is a 2.5% decline from a year ago (2% decline on constant currency). Operating income grew by 8.7% to reach $7.901 billion, up from $7.269 billion a year ago. EPS was dropped by 23% to $0.50.

When it comes down to business group level, the Communications group delivered a largely steady result. Wireless service revenues edged up, helped to a large extend by the increase in postpaid subscriber base (including 173,000 postpaid smartphone subs) and the upward move of postpaid ARPU ($55.89, up from $55.58 a year ago). The entertainment part of the Communications business was less steady. The company lost 1.16 million “Premium” pay-TV subs (DirecTV satellite and U-verse IPTV) and 195,000 OTT-TV (AT&T TV Now) customers. The total number of AT&T pay-TV subs stood at 21.56 million by the end of Q3, down from 25.15 million a year ago.

Numbers from WarnerMedia, the second largest business group of AT&T, epitomised the “mixed” nature of the results. The total group level income went down by 4.4% to $7.8 billion, but HBO reported an impressive 10.6% year-on-year increase in revenue to reach $1.8 billion, and the $714 million operating income represented a 13.7% growth.

The strong performance of HBO came at a time when AT&T is about to launch HBO Max later today. Priced at $14.99, the current HBO package is the most expensive offer among the major video streaming services (Netflix and Amazon at $12.99, Disney+ at $6.99, Apple TV+ at $4.99). It remains to be seen how AT&T will choose between maxing the user base by pricing HBO Max more aggressively and defending profitability by retaining it at the premium tier.

Guidelines to 2022

The company delayed its Q3 results reporting by a week to finalise its discussion with activist investor Elliott Management Corporation. Presumably as a result of that discussion, AT&T published a rather detailed 3-year financial guidance (to 2022). The key items include growing revenues by 1-2% CAGR, EBITDA target set at 35%, free cash flow to reach $30-32 billion, and no major M&A planned.

The items that made most headlines are related to debt reduction. Specifically, AT&T promised to “Pay off 100% of acquisition debt from Time Warner deal; net-debt-to-adjusted-EBITDA5 of 2.0x to 2.25x in 2022”. Its current net debt to adjusted EBITDA ratio is 2.5, down from 2.66 at the beginning of the year.

According to the analysis by the Washington Post, the Time Warner deal could have cost AT&T over $108 billion including the debt it assumed from Time Warner at the acquisition. AT&T would not be able to pay off its debts, which stood at $153 billion by the end of September (coming down from $166 billion at the end of 2018) with the income generated from its business operations. This means more non-critical assets will be divested. The company is on way to generate $14 billion through asset monetisation in 2019 and plans to recoup $5-10 billion of non-strategic asset sales in 2020.

“The strategic investments we’ve made over the last several years have given us the essential elements to meet growing demand for content and connectivity,” said Randall Stephenson, AT&T chairman and CEO. “Our 3-year plan delivers both substantial and consistent financial improvements over the next 3 years. We grow revenues, EBITDA and EPS every single year, and free cash flow is stable next year, but then grows in both of the next two years, as well. And all of this is inclusive of our investment in HBO Max.”

When it comes to what qualifies as strategic or non-strategic, Stephenson told investors “we have no sacred cows. We’re always open to making portfolio moves.” However, DirecTV, albeit being highlighted by Elliott as one of the failed acquisitions, is not viewed as a target to liquidate in the near future. The business “will be an important piece of our strategy over the next 3 years”, said Stephenson.

The guideline largely reflected what Elliott’s letter to AT&T has demanded. In addition to the defence of DirecTV, probably the only other exception AT&T has made in its guideline was Elliott’s call for management change – AT&T stated “CEO transition not expected in 2020”.

Update (30 October 7:00am GMT):

AT&T announced at the event at Warner Brothers Studio in California that HBO Max, to be launched in May, will be priced at $14.99, the same level as the current HBO offer.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)