BT reports solid numbers but potentially damaging strikes loomBT reports solid numbers but potentially damaging strikes loom

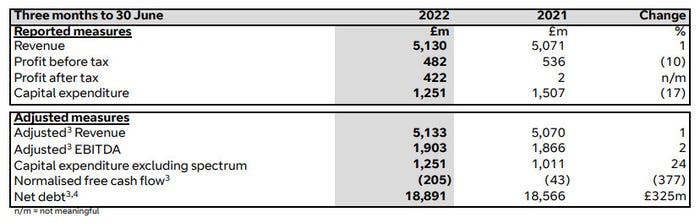

UK operator group BT managed to grow revenues by 1% in Q2 2022 but compensating for industrial action by almost 40,000 workers won’t be cheap.

July 28, 2022

UK operator group BT managed to grow revenues by 1% in Q2 2022 but compensating for industrial action by almost 40,000 workers won’t be cheap.

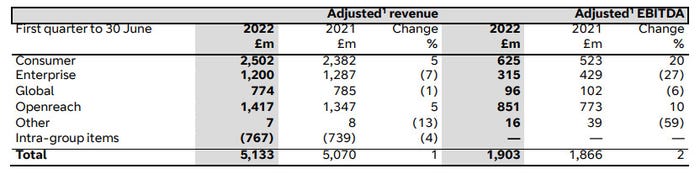

BT’s consumer facing operations grew their revenues by 5% year-on-year, thanks to price hikes implemented earlier this year. This compensated for a 7% revenue decline in the enterprise group and allowed BT to meet market expectations. Despite that, BT’s shares initially fell by as much as 6% after the earnings announcement, although they were staging a bit of a recovery at time of writing.

“BT Group has made a good start to the year; we’re accelerating our network investments and performing well operationally,” said BT Chief Exec Philip Jansen. “Despite ongoing challenges in our enterprise businesses, we returned to revenue and EBITDA growth in the quarter.

“We’re building our full fibre broadband network faster than ever and we’re seeing record customer connections – both ahead of our own expectations. Openreach’s full fibre network now reaches over 8 million homes and businesses across the UK and we anticipate increasing our annual build from 2.6 million premises last year to around 3.5 million this year.

“EE’s 5G network covers more than 55% of the country’s population. We’re achieving continued high customer satisfaction scores thanks to our much improved customer service and the value for money that our products and services represent. The modernisation of BT Group remains on track. We are delivering and notwithstanding the current economic uncertainty we remain confident in our outlook for this financial year.”

Additional uncertainty comes in the form of industrial action, of which BT is one of the most prominent victims, at least in the UK. Many British unions have seized on soaring inflation as a pretext to strike over perceived reluctance by employers to adequately compensate their staff for it, thus effectively giving them pay cuts. The Communications Workers Union (CWU) is one of these and its 30,000+ BT engineers and 9,000 BT call centre worker members will strike tomorrow and the following Monday.

This is part of a broader trend as ‘the cost of living crisis’, especially concerning energy bills this winter, has fuelled labour discontent across many industries (as opposed to Labour). The CWU has done a good job of stoking this discontent, pointing to the apparent fact that BT can find money to give Jansen a fat pay rise (let alone yet another corporate rebrand), but not its foot soldiers.

“The union-busting techniques deployed against loyal key workers have been pathetic and desperate,” said CWU General Secretary Dave Ward in a recent press release. “BT have assured the media repeatedly that contingency plans are in place to undermine strikes, but their panic shows otherwise.

“Our members don’t want to take strike action, but neither are they going to accept the imposition of a real-terms pay cut while the company made £1.3 billion in profit, shareholders gained £750 million, and the CEO pocketed a 32% pay rise – taking him to £3.5 million. They’re using Swiss banks while our members use food banks.

“Some BT Group workers earn just £21,000 a year, but they have self-respect and aren’t afraid to stick up for themselves. They are taking action against corporate hypocrisy, and no boss will crack their confidence any time soon.”

This could get messy. As ever with industrial action, on top the eternal desire of employers to purchase labour as cheaply as possible there is the concern that if they cave in to these demands that will set a precedent. But if BT/EE/Openreach service delivery starts to suffer as a consequence, Jansen will come under increasing pressure to find a solution. This is a battle of wills that the CWU and its members seem determined not to lose.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)