Chinese vendors continue to gain share in the global telecoms equipment marketChinese vendors continue to gain share in the global telecoms equipment market

Preliminary numbers from research firm Dell’Oro reveal that, while the kit market grew in 2019, it was driven almost entirely by Chinese vendors.

March 2, 2020

Preliminary numbers from research firm Dell’Oro reveal that, while the kit market grew in 2019, it was driven almost entirely by Chinese vendors.

Dell’Oro’s total telecoms market numbers include the following product types: broadband access, microwave & optical transport, mobile core & radio access network, SP router & CE switch. Its preliminary numbers have the overall market growing by 2% in 2019, which marks its second consecutive year of growth.

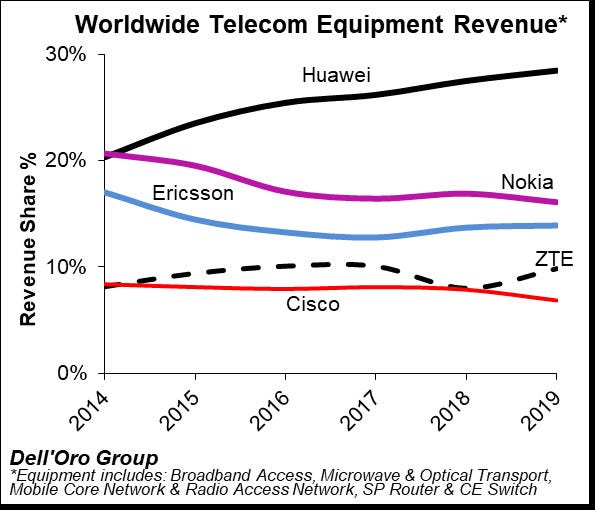

The relative revenue shares over the past six years are shown in the table below. The rounded percentages are as follows, with 2018 share in brackets. Huawei 28% (28%); Nokia 16% (17%); Ericsson 14% (14%); ZTE 10% (8%); and Cisco 7% (8%). So in the past year ZTE’s rebound has been the big story, with Nokia and Cisco losing out. Over the longer term, however, you can see how much share Huawei has taken from Nokia and Ericsson.

The two largest equipment markets in the year were Mobile RAN and Optical Transport, together accounting for about 55% of the overall telecom equipment market. They were also the growth drivers, apparently. 5G RAN seemed to be an especially pleasant surprise, as previously anticipated by Dell’Oro and confirmed by the firm’s recent Q4 2019 RAN numbers.

“While the overall RAN results in the quarter were in line with expectations, 5G wireless RAN activity surprised on the upside, underpinning projections that the rollout of 5G wireless networks is accelerating,” said Stefan Pongratz, VP at Dell’Oro. “This migration from LTE to 5G NR continued to accelerate at a torrid pace throughout 2019. We remain optimistic these trends will extend into 2020, propelling the overall RAN market to advance for a third consecutive year.”

So a crude interpretation of those numbers is that Huawei and ZTE are out-competing Nokia and Ericsson in the RAN market, which is slightly counterintuitive given the restrictions the US has put them under. One possible answer to that riddle could be that the Chinese government obliged its operators to favour domestic suppliers in response.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)