Ericsson celebrates telecoms industry resilience after a solid Q1

Swedish kit vendor Ericsson delivered Q1 2020 numbers broadly in line with expectations and was cautiously positive about how the telecoms industry is handling the coronavirus crisis.

April 22, 2020

Swedish kit vendor Ericsson delivered Q1 2020 numbers broadly in line with expectations and was cautiously positive about how the telecoms industry is handling the coronavirus crisis.

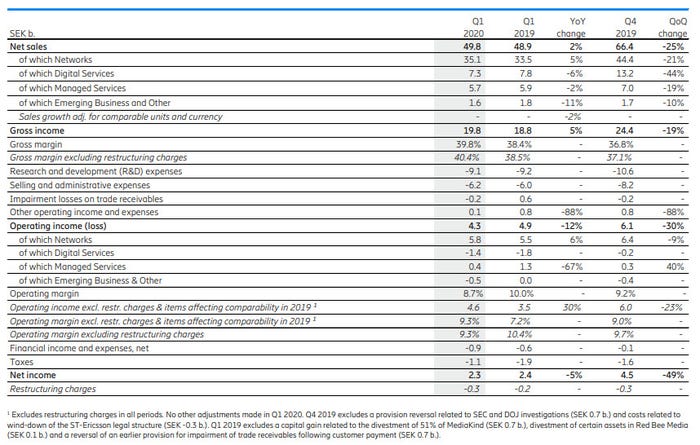

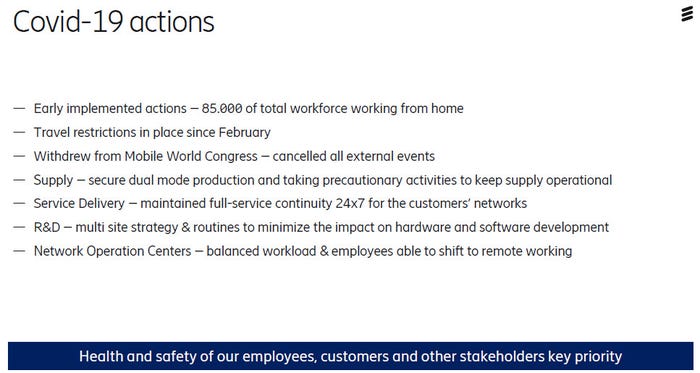

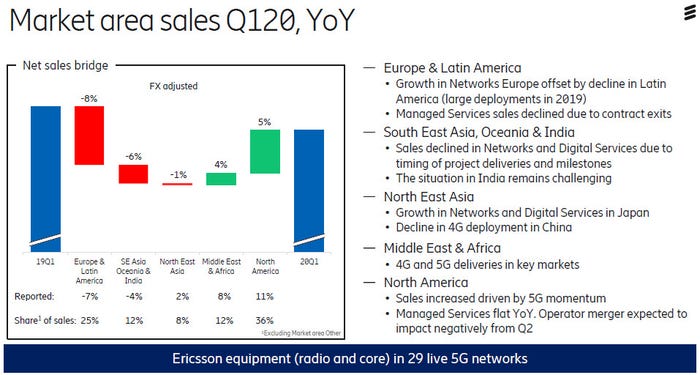

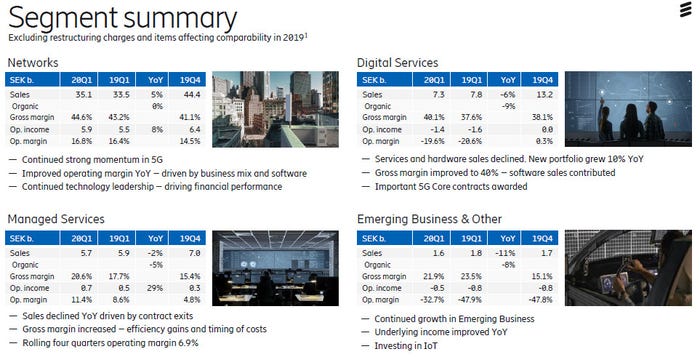

Revenues of SEK 49.8 billion (~$5 billion) represented a 2% decline when adjusted for adjustments, but that seems fine with investors, who had boosted Ericsson shares by 5% at time of writing. Regarding the pandemic, the official line is that it has had ‘limited’ impact on business, but has definitely created greater uncertainty for Q2. Despite that Ericsson is sticking with its previous outlook.

“Ericsson delivered a solid result during the first quarter, with limited impact from the Covid-19 pandemic,” said Ericsson CEO Börje Ekholm. “We expect our industry to show resilience throughout the pandemic and we are well positioned with a competitive 5G product offering and cost structure. There is near-term uncertainty around sales volumes due to Covid-19 and the macroeconomic situation, but with current visibility we have no reason to change our financial targets for 2020 and 2022.

“For 2020 we estimate the RAN market to grow by 4%, however for Q2 we expect somewhat lower than normal sequential sales growth as there are uncertainties impacting short-term growth negatively. Covid-19 and actions taken by governments to slow down the spread are making our service delivery and supply harder due to lockdowns and travel restrictions in many countries. In addition, while we have seen no material effects so far on our demand situation, it is prudent to believe that the slowdown in the general economy may lead some operators to delay investment programs.

“We are determined to come out of the Covid-19 situation in a stronger competitive position and our investments in R&D is a strategic cornerstone which we will not sacrifice. We also continue investments in digital transformation which is expected to generate competitive advantages.

“The current global uncertainty requires a humble attitude towards predicting the near-term future. We remain positive on the longer-term outlook, but the second quarter is likely to be a tad softer than normal due to timing of strategic contracts and uncertainty induced by Covid-19.”

We spoke to Ericsson Head of Networks Fredrik Jejdling and he largely echoed Ekholm’s sentiments. He flagged up the China Mobile wins and the completion of the TMUS/Sprint merger as specific positives, but cautioned that delayed spectrum auctions could have a negative effect in the industry. Jejdling was keen to stress the strategic aim of emerging in a stronger competitive position and the consequent need for Ericsson not to over-react to the crisis.

In that respect Ericsson seems to be adopting a similar strategy to Sweden in general, which has been relatively laissez faire when it comes to shutting itself down. Now that the dust has settled on the first phase of the pandemic, and catastrophe seems to have been averted, it’s sensible for companies and governments alike to start thinking about cautiously opening up once more.

Here are some slides from the earnings presentation.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)