Shared data tariffs key to pricing strategy

Over half of operators (55 per cent) that responded to the Telecoms.com Intelligence Industry Survey 2014 believe shared data tariffs will be important in future pricing strategies.

February 13, 2014

Over half of operators (55 per cent) that responded to the Telecoms.com Intelligence Industry Survey 2014 believe shared data tariffs will be important in future pricing strategies.

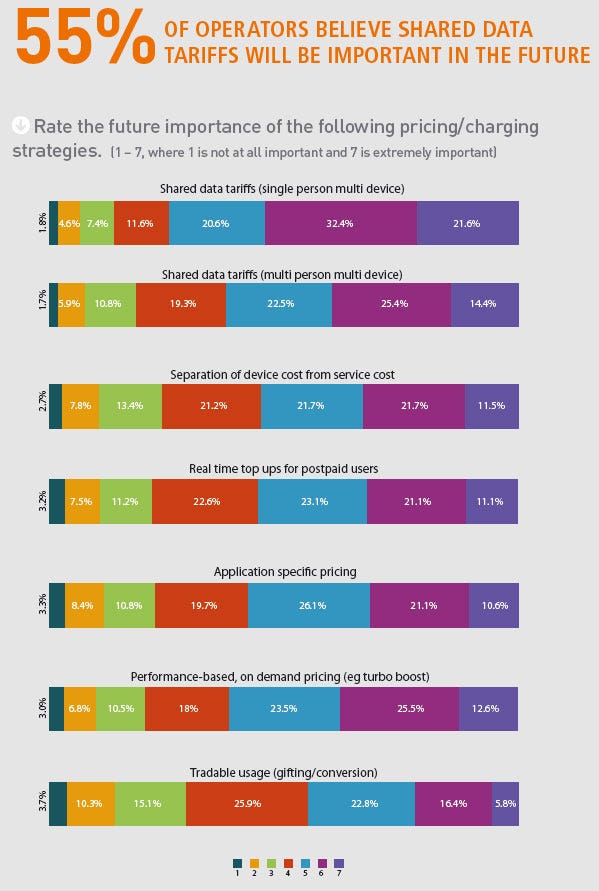

Pricing innovation and charging strategies have continued to gain in importance for operators, particularly in the mobile sector. In this year’s survey we asked respondents to rate a number of charging models for their future importance and analysed the proportion of operator respondents that ranked these models six or seven out of seven for future importance.

As we might have expected given their current popularity, shared data tariffs were viewed as the most important by both operator respondents and the industry at large. But tariffs that allow single users to split allowance over a range of devices were deemed as most important by a larger proportion of operator respondents—55.1 per cent—than tariffs that allow data to be shared between people (such as family plans)—44 per cent.

Performance-based, on demand pricing, like a turbo boost, got a fairly high showing with 38 per cent of respondents rating it as the next most important strategy. This was followed up by three models which received similar ratings: Separation of device from service cost 33 per cent; real time top ups for postpaid users 32 per cent; and application specific pricing 32 per cent.

The least important option, according to our respondents, was tradable usage or gifting, although it was still given a high importance rating by more than one quarter of operator respondents.

Another question demonstrated the importance of pricing and tariffing, with pricing innovation and simplicity/transparency of offerings selected by 30 and 31.2 per cent of respondents respectively as the fourth and fifth more dominant means of competitive differentiation.

The 2014 Telecoms.com Intelligence Global Industry Survey drew responses from more than 2,000 industry professionals, including more than 700 operator representatives. The full report from the survey will be made available in mid-February. You can register to receive the report here.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)