Verizon wanted much bigger discount for Yahoo boo-boos

It looks like Yahoo got the better of negotiations with Verizon following the revelation of a number of major data breaches after the initial take-over bid.

March 14, 2017

It looks like Yahoo got the better of negotiations with Verizon following the revelation of a number of major data breaches after the initial take-over bid.

A few weeks ago it was announced that Verizon had managed to shave $350 million off the price of acquiring the core internet business of Yahoo in the light of the beaches. At the time that seemed quite a small proportion of the nearly $5 billion acquisition cost of the company, considering the severity of the incidents, and a recent Yahoo filing reveals Verizon wanted almost three times as much off.

Reflecting on conversations between the top brass of each company in the light of the security revelations, the filing reviewed the options proposed at the time. “Verizon could complete its evaluation of the impact of the Security Incidents on the Business over the next several months, after which Verizon would decide how to proceed and whether to assert any legal rights against Yahoo.

“Yahoo could agree to, among other things, a purchase price reduction in return for Verizon’s release of potential rights and claims in respect of the data security incidents; or the parties could mutually agree to terminate the Sale Transaction.

“Mr. McInerney asked Mr. McAdam the magnitude of the purchase price reduction being requested and Mr. McAdam noted that Verizon was still formulating a view but that a purchase price reduction as high as $925 million could be appropriate.

“On February 9, 2017, Mr. McInerney and Mr. McAdam met at Verizon’s offices in New York City. At such meeting, Mr. McInerney informed Mr. McAdam that the Board was unwilling to agree to a purchase price reduction at the high end of the range previously discussed. After further discussion, Mr. McAdam and Mr. McInerney each agreed to review with their respective boards of directors a proposal that included a purchase price reduction in the amount of $350 million.”

It’s hard not to conclude Mr. McInerney got by far the better of those negotiations, which in turn implies Verizon was both too invested in the acquisition to stand its ground and too impatient to complete its own investigations. Precisely what value owning most of Yahoo will provide to Verizon is yet to be seen but Verizon shareholders are entitled to be unimpressed by how those negotiations played out.

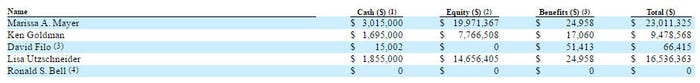

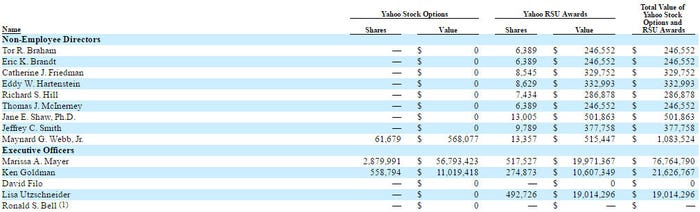

Their mood is unlikely to be improved by the golden parachutes being given to some Yahoo senior execs, who will move on to new challenges after the acquisition is complete. As you can see from the table taken from the filing below Yahoo CEO Marissa is being given 23 million bucks to keep the wolf from the door while she looks for another job. On top of that the stock options (second table) she has accrued over her tenure as CEO come to around $77 million, meaning she’s walking off with a cool $100 million for her troubles.

While this is yet another example of how efficiently the business world moves money to the top of the pyramid at everyone else’s expense, a look at Yahoo’s share price (third table) since Mayer took over five years ago indicates, by that measure alone, that she’s worth it. But at least $40 billion of its current $45 billion market cap is accounted for by stuff Verizon isn’t acquiring, including Yahoo’s stakes in Alibaba and Yahoo Japan, so that argument doesn’t hold water.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)