April 26, 2024

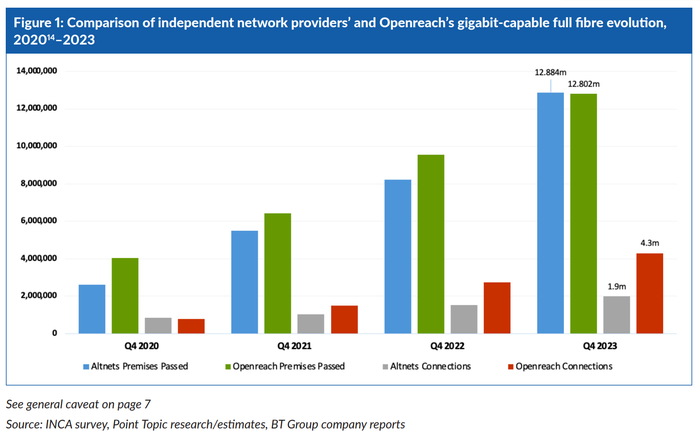

UK altnets had passed 12.9 million premises with fibre as of the end of 2023, compared with Openreach's 12.8 million, according to the latest annual State of the Altnets report published by INCA – or the Independent Networks Cooperative Association – and analyst firm Point Topic.

That's certainly an interesting headline finding. But given the size and growth ambitions of some of the UK's altnets – CityFibre immediately springs to mind – with networks that underpin some big retail ISPs, it is perhaps not surprising that they have caught up with the establishment. The finer details of the report are arguably more noteworthy, including the altnets' rate of growth, the fact that close to 7 million premises in the UK only have altnet-supplied fibre, and the alternative players' willingness to invest in areas where no one expected competition.

At the end of last year the altnets' footprint covered 35% of UK premises, up from 25% at end-2022, when they lagged the incumbent by some way. Back then they had deployed network to 8.2 million premises to Openreach's approximately 10 million (see chart). INCA defines an altnet as a company rolling out broadband infrastructure for retail or wholesale use that is not part of BT nor Virgin Media O2, the country's cable incumbent.

Altnets now have just shy of 2 million customers connected to their networks, which is fewer than half those claimed by Openreach, Although the gap between them does appear to be widening, INCA is – naturally – focusing on the positive, pointing out that the figure represents 33% on-year growth and that almost half a million customers decided to switch to an altnet last year. That 15% take-up rate demonstrates a receptive customer base, INCA insists, predicting that the altnets' live customers will grow to 3 million by the end of this year, while their overall footprint will expand to 16.7 million premises. That would take their uptake rate to almost 18%.

Nonetheless, the altnets still need to increase uptake, and that means we could start to see a change in the shape of the market in the coming years.

"The 'build it and they will come; approach won't necessarily work long-term and to truly compete with legacy ISPs, altnets must be able to deliver the same national reach and unified approach as their competitors," said Lee Myall, CEO of fibre builder and business services provider Neos Networks, commenting on the INCA report.

"As a result, over the next few years, we are likely to see more convergence and collaboration across the altnet landscape as they look to expand their capabilities and interconnect their networks," Myall said.

To an extent it is already happening. CityFibre, having been pretty vocal about the need for consolidation in the UK fibre market, bought smaller player Lit Fibre last month, having already made various acquisitions previously. CityFibre is on a push to become the third scale platform in the UK and is certainly making progress in that direction. Its growth is arguably starting to blur the lines between incumbent and altnet – it has bought network from KCOM in the past – but for now it sits in the latter camp.

Smaller operators have also turned to M&A, with Freedom Fibre and VX UK announcing their intention to combine their businesses at the back end of last year, to give one example. And there will be more deals to come.

However many they number going forward, the altnets have played a vital role in the development of UK fibre infrastructure to date and will doubtless continue to do so.

INCA and Point Topic's data shows that 6.9 million UK premises only have access to fibre infrastructure deployed by an altnet; that's a sizeable number of homes and businesses ignored or deprioritised by Openreach and Virgin Media O2.

Further, altnets have rolled out fibre in many areas in which Ofcom predicted they would fear to tread. The UK regulator designated rural and small town properties as Area 3 and made the assumption that there would be no real competition to the incumbent in these markets, predicting that Openreach would require incentives to connect them with fibre. However, the report shows that altnets have provided full fibre to 3 million Area 3 premises, or 32% of the total, up from 2.3 million a year ago. Openreach, meanwhile has covered only slightly more at 3.7 million, or 39%.

In many ways, those Area 3 numbers are reflective of the development of the UK fibre market as a whole. What better incentive for the incumbents to invest than the competitive threat presented by alternative players keen to get fibre into the ground all over the country?

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)