Ericsson CFO says Q1 numbers hit by ongoing North America weakness

Swedish networking vendor Ericsson has reported Q1 2015 earning that revealed a year-on-year revenue declines of -6% when adjusted for currency, but such as the extent of currency factors that unadjusted revenues were actually up 13%.

April 23, 2015

Swedish networking vendor Ericsson has reported Q1 2015 earning that revealed a year-on-year revenue declines of -6% when adjusted for currency, but such as the extent of currency factors that unadjusted revenues were actually up 13%. Around 43% of Ericsson business is in USD and the Krona has declined by around 22% against the dollar in the past year.

Speaking to Telecoms.com, Ericsson CFO Jan Frykhammar pinned the revenue decline pretty much entirely in continued weakness in North America, where operators are currently in a period of consolidation. While Ericsson is doing good business in China, these are mainly 4G coverage projects, which yield lower margin than the less hardware capacity work available in North America.

“This is related to lower activity in North America, to be very precise on the reasons,” said Frykhammar. “We continued to roll out 4G at a fast pace in mainland China and the business around professional services is showing good growth. We had a challenging networks quarter; operating margins have been around 10% for the past five quarters but this quarter they were down to 2%. This is due to the mix shift of lower business volume in North America and a higher share of mobile broadband deployments in China.

“We think the slowness in North America will remain in the short term, but we have to look at this on a quarter by quarter basis. While the underlying market conditions continue to develop favourably, we also have to have a lot of respect for our customers in North America that have acquired a lot of spectrum, or are into consolidation as well, so we have to be patient. We are pragmatic about this because we feel we’re addressing the things we can control, which is the cost base, and we started with that late last year.”

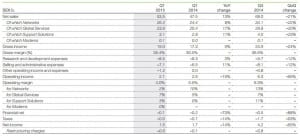

As you can see in the Q1 summary table below, services continue to out-grow networks for Ericsson, and services revenues are on track to overtake networks at some time in the not too distant future. “We continued to have very good traction in OSS/BSS, also good performance in IP and in what we call ‘industry and society’, which is really selling what we have into new customer segments,” said Frykhammar.

Briefings with Ericsson execs tend to be exceptionally frank and to the point, with little of the euphemising and evasion that can be found elsewhere. North America is weak, here’s why; coverage projects are lower margin; we’re focusing on what we can control. Nice and clear.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)