Ericsson shares drop on disappointing North America numbers

Sales at kit vendor Ericsson barely grew in Q4 2019, with most of the blame being pinned on the protracted merger of T-Mobile US and Sprint.

January 24, 2020

Sales at kit vendor Ericsson barely grew in Q4 2019, with most of the blame being pinned on the protracted merger of T-Mobile US and Sprint.

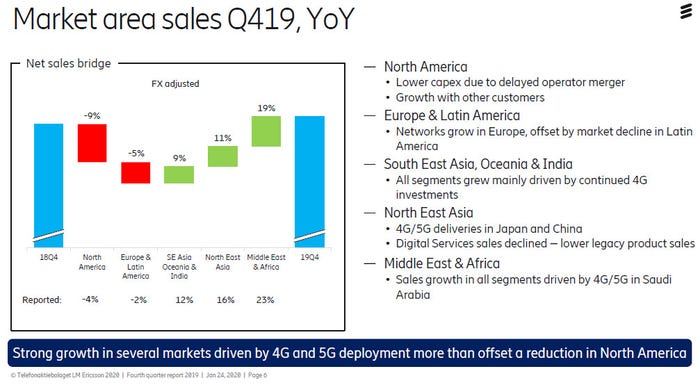

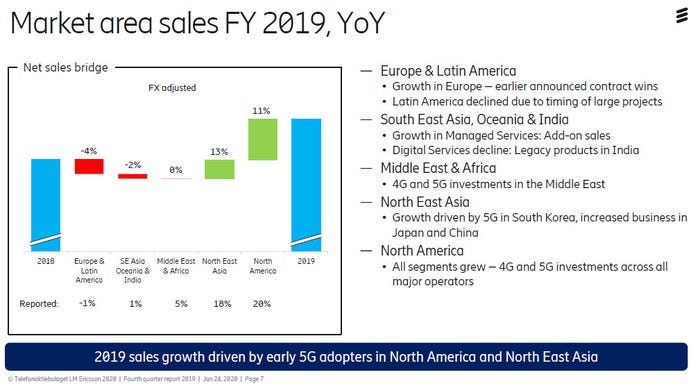

When adjusted for adjustments total sales increased just 1% year-on-year, thanks to a 9% decline in North America. As you can see from the tables below, Ericsson had plenty of growth earlier in the year in North America, so this is a fairly significant reversal of fortunes. Ericsson would like us to believe it was an aberration brought about by the uncertainty surrounding the TMUS/Sprint merger, but that’s been going for a while so it’s not obvious why it would suddenly have such a profound effect.

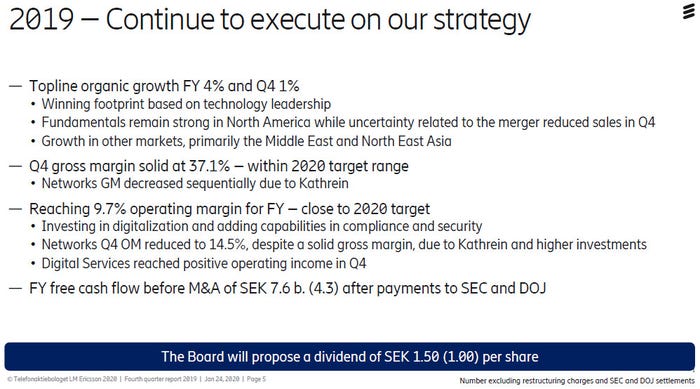

“Due to the uncertainty related to an announced operator merger, we saw a slowdown in our North American business in Q4, resulting in North America having the lowest share of total sales for some time,” said Ericsson CEO Börje Ekholm. “However, the underlying business fundamentals in North America remain strong.

“Operating income was impacted by increased operating expenses. The increase is related to the Kathrein business acquisition, increased investments in digitalization and added resources to strengthen security as well as our Ethics and Compliance program. For 2020 we expect somewhat higher operating expenses, which will not jeopardize our financial targets.”

It looks like investors didn’t totally buy the North America narrative either, with Ericsson’s shares down around 8% at time of writing. Ekholm spoke at length about how important it is to continue to build for the long term and not sacrifice that for short-term gains. That’s fine, but many more quarters like this and even that strategy will be called into question.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)