Ericsson shares tank on the back of shrinking marginsEricsson shares tank on the back of shrinking margins

Swedish kit vendor disappointed investors with its Q3 2022 earnings as margins were hit from multiple directions.

October 20, 2022

Swedish kit vendor disappointed investors with its Q3 2022 earnings as margins were hit from multiple directions.

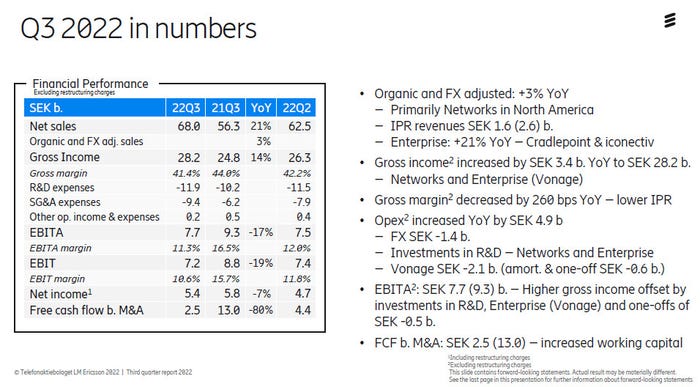

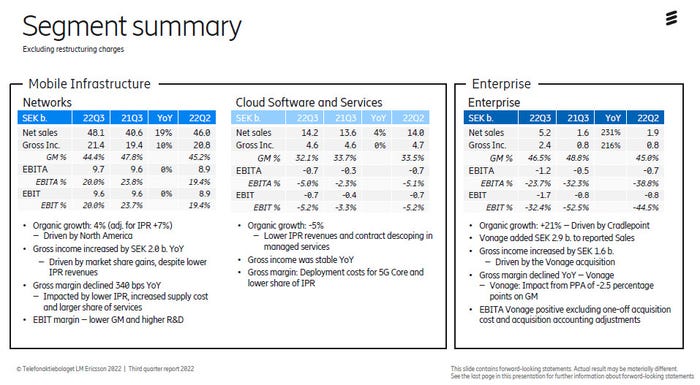

Sales were still up a little bit after adjusting for the completion of the Vonage acquisition but significantly increased expenses associated with R&D, lower IPR revenues, continued weakness in its software and services division, and global inflation shave off around five percentage points of margin. As a result Ericsson’s shares were down around 16% at time of writing.

“We see robust underlying performance and strong momentum in the business as we continue to execute on our strategy,” said Ericsson CEO Börje Ekholm. “This includes leadership in mobile networks by growing market share. Since 2017 we have increased RAN market share, excluding Mainland China, from 33% to 39% and we have had multiple contract wins across geographies in this quarter.

“We continue to solidify our strong position in 5G to capture the considerable opportunities presented by the fastest scaling mobile generation. Our expansion into the exciting high-growth Enterprise space is gaining momentum with the acquisition of Vonage, providing us with access to a powerful range of cloud communication services.

“In the new Cloud Software & Services segment, revenues were impacted by lower managed services sales and IPR revenues. Gross income was stable after offsetting ongoing 5G Core deployment costs. We have an ambition to unleash the great potential that we believe is present in this business. Our new management team is taking further actions to turn around the business and establish a satisfactory profitability. This includes strong focus on driving down costs, including realizing synergies from combining two business areas, while solidifying our technology and market leadership position. Improvements in performance will be gradual.

“In the current inflationary environment, we are making pricing adjustments as well as leveraging product substitution to manage margins. We are also simplifying operations across the company and will continue to be proactive in reviewing options to reduce costs, whilst continuing to develop best-in-class products and services. We are fundamentally strengthening cost competitiveness through an intense focus on internal end-to-end efficiency gains and structural costs. We are dedicated to our long-term target of EBITA margin of 15-18% no later than 2024 and we will take out costs to secure delivery of this target.”

It seems Ekholm’s words failed to reassure least one major Ericsson investor. Bloomberg reports that Cevian Capital, which owns around 5% of its stock, publicly expressed its disappointment with the performance, especially of the non-networks business units, and demanded the swamp of losses they represent be drained ASAP.

Inflation is bound to hit a lot of margins so long as it remains so high, and it seems there were one or two other exceptional drags on Ericsson’s profitability this quarter. But the continued struggles of some business units are testing investor patience and probably making them less likely to give Ekholm the benefit of the doubt. That’s especially awkward for him at a time when he’s integrating the company’s largest ever acquisition and attempting a strategic pivot towards enterprise markets.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)