NB-IoT gathers momentumNB-IoT gathers momentum

Trials in Australia and the UK involving Ericsson and Vodafone indicate the NB-IoT standard is starting to become a reality.

September 27, 2018

Trials in Australia and the UK involving Ericsson and Vodafone indicate the NB-IoT standard is starting to become a reality.

Ericsson and Telstra are claiming the longest connection for the narrowband wireless standard that is set to be the default for IoT. The trial used a Telstra base station to communicate with an NB-IoT temperature sensor 94 km away on Mount Cenn Cruaich in New South Wales, Australia. They say the previous range limit was more like 40 km.

“We’re partnering with Telstra to deliver its customers a world-leading capability in NB-IoT extended range cells and demonstrating the huge opportunity that IoT represents in rural and regional areas for both Australia and globally, particularly for logistics and agriculture,” said Emilio Romeo, Ericsson’s MD for Australia and New Zealand.

“Telstra already had Australia’s largest IoT coverage with Cat M1 across our 4G metro, regional and rural coverage footprint,” said Channa Seneviratne, Telstra’s Executive Director of Network and Infrastructure Engineering. “With this NB-IoT extended range feature, we have now extended our coverage to more than three and a half million square kilometers, delivering our customers the best IoT coverage and capability in the country.”

Meanwhile Vodafone has started trialling NB-IoT in the UK, as reported by Light Reading. Energy company Scottish Power is Vodafone’s first UK NB-IoT customer and is using IoT temperature sensors to detect when some of its remote kit might be overheating. They’re apparently powered by standard AA batteries and each one costs a couple of quid.

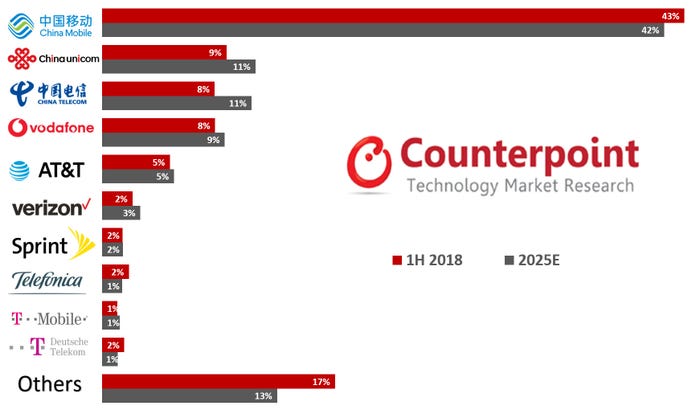

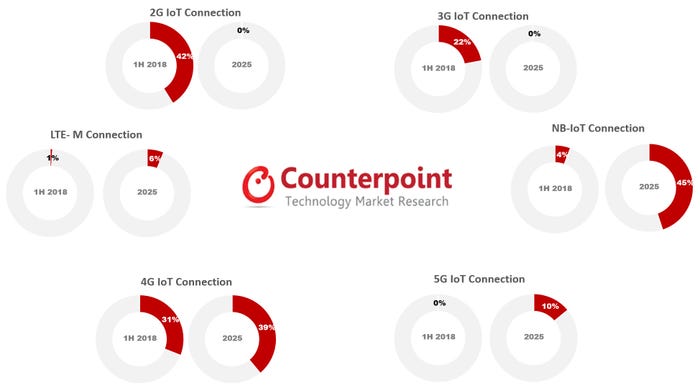

Lastly Counterpoint Research has found that global cellular IoT connections grew by 72% in the first half of this year and forecasted NB-IoT will account for around half of all IoT connections in the long term. As you can see from the charts below most of the action seems to be happening in China, but Vodafone is leading the international effort.

“Emerging markets like India, Brazil and in Africa while can offer tremendous scale but will likely be late followers compared to China in this path to connected everything,” said Satyajit Sinha of Counterpoint. “However, the massive growth opportunity remains in terms of cellular-IoT connections in emerging markets which will be possibly catalysed by operators such as Jio in India but more specifically from multi-market players such as Telefónica, MTN or Vodafone with plans to deploy LPWAN networks such as NB-IoT leveraging scale across their coverage markets.”

“Revenue generation from the IoT ecosystem is not siloed to any one specific segment of the value chain, rather it is distributed among all segments,” said Neil Shah of Counterpoint. “On an average for a cellular IoT solution deployment, connectivity represents around 12%, whereas hardware components, modules and devices represent 22%.

“The rest of the bulk of the value in an IoT solution is captured by system integrators, middleware, software platforms, and cloud analytics vendors. Hence, if operators are looking to capture maximum value, the strategies need to provide an end-to-end IoT solutions by bundling IoT devices, secure connectivity, platform, and data management to capitalize on the overall opportunity.”

The big variable with IoT, of course, is revenue. It doesn’t look too tough to scatter billions of sensors all over the place and connect them to the cloud via NB-IoT or whatever, but getting companies to pay for services on the back of them is another matter. It looks like a lot of the commercial precedent will be set in China, so the rest of the world might wait to see how that plays out before committing.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)