Analysts: Apple Pay revolutionary, Apple Watch promising, iPhones adequateAnalysts: Apple Pay revolutionary, Apple Watch promising, iPhones adequate

As you would expect, the analyst community has been quick to pass comment on yesterday’s Apple mega-launch. Here are just a few of their views.

September 10, 2014

As you would expect, the analyst community has been quick to pass comment on yesterday’s Apple mega-launch. Here are just a few of their views.

Apple Pay

Nitesh Patel, wireless media analyst, Strategy Analytics

Apple NFC support provides a boost to the currently anaemic NFC payments ecosystem

Apple pay will be accepted in a limited 220,000 US locations supporting NFC payments today; a single digit fraction of the millions of payment locations in the US. Apple will hope Apple Pay can grow this low base, despite support from some large retailers. Apple Pay will face the same challenge of low installed base of NFC terminals outside US. Poland, UK, France, Turkey and Japan are leading markets for contactless payment infrastructure deployments.

Operators are unlikely to block Apple Pay in same way as Google Wallet

Operator ambitions for mobile wallet have waned to some extent over last 12 months and they have limited power to stop Apple. Not offering the new iPhone is not an option for operators! ISIS (Softcard) is working with Apple to devise an “integrated SIM-based hardware solution”.

Apple Pay focuses on “Security and Privacy” to win hearts and minds of consumers

Tokenized credentials, delivered in real-time keeps users payment details secure. TouchID to provide added layer of security to authenticate transaction – how does this work with Apple Pay on the phone?

Retailer data integrity combined with possible lower fees may tip balance for Apple Pay and drive retail support, which is essential to make it useful beyond a fraction of retail locations

Rumours that Apple has negotiated favourable rates with banks for transactions improves appeal for retailers, but does it make sense for retailers to support Apple Pay and not other NFC services? Strong message to keep customer transaction data private for retailers and customers

Android NFC devices (Google Wallet) and Softcard will benefit from Apple’s support of NFC

Unlikely to be a blow for Google Wallet given Apple Pay doesn’t impact Android devices.

Eden Zoller, consumer analyst, Ovum

Apple reckons its new Apple Pay service will be the one that makes traditional wallets a thing of the past. Rhetoric to this effect is nothing new in the m-payments space but so far it has left consumers cold. But if anyone can help make this happen then it is probably Apple, although it will need strong partnerships. NFC, as we expected, is the key enabling technology for mobile proximity payments but TouchID biometrics are also in the equation for authentication and Apple Pay looks set to be integrated with Passbook, which is a natural fit. But it’s not all about proximity payments – Apple is also set to enable online checkouts without having to enter card details. This should get PayPal and other online payment providers a little worried, particularly as Apple already has 800 million iTunes accounts on file.

Ovum believes Apple will prove effective at marketing mobile payments to consumers, not as a technology but as something that will make paying for goods and services with your phone fast, easy and even fun. When Apple introduces cool features on the iPhone people tend to use them, which is critical for the future of NFC as an enabling technology. If consumers start using NFC for proximity payments then merchants will be more prepared to invest in it, a key factor that has held NFC back. Apple was at pains to stress the security of its new m-payment services, although we would have liked to have seen more concrete details on this front. But the fact that Apple is underscoring security from the start is important as concerns on this front are still the biggest show stoppers for consumers when it comes to m-payments.

It looks like many in the ecosystem think Apple can make mobile payments fly as it has launched with the backing of major card schemes, a clutch of banks and big name retailers. This is a promising start although not everyone will be happy as the strengths of Apple Pay will make it highly disruptive for many existing digital wallet providers such as Google Wallet and those run by mobile operators, which in many markets are making slow progress.

Enrique Velasco-Castillo, digital economy analyst, Analysis Mason

Apple has an advantage in the race for mobile commerce and payments dominance thanks to a combination of security features in the iPhone 6 and the Apple Watch, detailed customer data, key partnerships with card networks and merchants, and sheer good timing.

Convenient for users, secure for merchants: security features on the iPhone (Touch ID, Secure Enclave, tokenisation and encryption between the handset and the payments terminal) mean convenience for users, and lower fraud rates for merchants.

The time is right: US banks and merchants will be required to switch from magnetic stripe cards to the chip-and-PIN standard (EMV) in use worldwide. This switch will require an overhaul of payment terminals in stores, which will likely support contactless payments. Recent security breaches at large retailers in the US have served to accelerate this transition.

Over 1 billion iTunes accounts by Q4 2015: Apple also holds detailed customer data through its more than 800 million iTunes accounts—of which the majority have credit cards associated to them. Analysys Mason expects Apple to have over 1 billion iTunes accounts by Q4 2015—just in time for the switch to chip-and-PIN in the US.

Attractive for merchants: Apple may have been able to negotiate lower transaction fees with its card network partners, and will likely pass on the savings to merchants in the form of lower transaction fees. This will help persuade them to accept Apple Pay at their stores. In addition, Apple’s iBeacon technology will allow merchants to personalise in-store experiences and prevent fraud by using their customers’ location.

Geoff Blaber, devices analyst, CCS Insight

The launch of Apple Pay using NFC is of huge significance. Although initially only rolling out in the US, the involvement of 83 percent of leading US credit cards by volume, a host of leading retailers and compatibility with existing contactless payment infrastructure confirms our long standing prediction that it will be Apple that finally makes the promise of mobile payments a reality.

Apple Pay will offer a huge demand reinforcement benefit for Apple devices, further strengthening the Apple ecosystem. The extent of this benefit will depend on how quickly it can roll out beyond the US. This will be a complex task due to the fragmented nature of markets in regions like Europe and is likely to take some considerable time and investment. Nonetheless, this will be an area of considerable focus for Apple over the coming years given the significant long-term ecosystem benefits.

Apple Watch

Paul Jackson, media analyst, Ovum

The good:

As expected the Apple Watch has a lovely design, and I like that they’ve thought of the screen obscuring issues that touch presents on such a small screen – hence the ‘crown’ controls. Features like sapphire screen, built-in heart-rate monitor and haptic feedback show an unusual level of technology leadership from Apple – who usually let others try and fail first. The charging solution is elegant and that crystal on the back is reminiscent of quality traditional pocket watches.

The interchangeable straps options and multiple cases and sizes also show they have thought more about the fashion and jewellery elements compared to their competitors. This watch, along with the Moto 360 and LG G Watch R finally offer something non-techies might consider wearing.

Digital Touch is reminiscent of Nintendo Pictochat with added heartbeat monitor – and is just as likely to be used once and then never again. The health and fitness apps look nice, but don’t improve significantly on other existing (and cheaper) solutions for those with more than a passing interest – it will thrive though if the various major players (Nike, Fitbit, Garmin) get behind the apps ecosystem

The bad:

Well, obviously the price (and remember that is ‘starting from’ and you’re also going to need an iPhone) and that vague, distant release date. Expect to see the top end Watches top $500.

Also, aside from an ‘all-day’ quip by Tim Cook there was no word on battery life – given similar watches with fewer capabilities are tapping out at 12hrs, it’s unlikely the Apple Watch will do much better. The form factor and nature of today’s chipsets (many still designed with Smartphones in mind) simply can’t accommodate larger capacity batteries and more measured performance. This is still the major deal breaker for mass adoption – sure tech firms have trained us to charge our phones every day, but devices like watches, fit bands, glasses etc need multi-day capacities.

Disappointing after all the talk of personal devices, freedom and flexibility than an iPhone is needed to make it work. Wasn’t expecting full phone functionality (a la Samsung Galaxy Gear S), but something that would work as a stand-alone at least some of the time would have been a nice option (this may still be the case of course when we get more details).

Overall:

Aside from nice looking devices (which we’re finally getting after 18 months of false starts), smartwatches will really make their mark when they prove to be genuinely useful. Siri and Google are now the current embodiments of this; adding functionality that would be just too tiresome to use the smartphone for (especially if typing in queries).

Even mapping and directions make more sense on a watch than all those annoying people who walk along the street looking at directions on their phone. WatchKit (the Apple developer tool) is a key element here too – who knows what useful applications 3rd party developers will come up with (when enough people have bought the device to make it worthwhile). If you can also replace your FitBit or Jawbone Up that’s another step towards justifying the cost.

The four smart watches we’re seen announced over the past few weeks (Samsung Galaxy S, Apple Watch, Moto 360, LG G Watch R) real represent an optimistic second wave of devices that, while still flawed (battery life, size, need for paired phones), point to a genuinely useful category of devices emerging over the next 18 months.

Neil Mawston, wireless devices analyst, Strategy Analytics

Overall, there is little revolutionary in the Apple Watch. Most features and designs in it are already available in other smartwatches from Samsung and others. But what Apple has done is to package its various parts into a single package that many global consumers will find compelling. We expect Apple’s Watch to instantly become the world’s best-selling smartwatch.

Geoff Blaber, devices analyst, CCS Insight

Apple has succeeded where others have failed in creating a device that stands up to comparison to highly personal pieces of jewellery. More details are needed to ascertain the degree to which the device will be considered a “must have” when it launches in early 2015 starting at $349, but there can be little doubt Apple will quickly sell millions of devices.

In a stroke Apple has become a leader in smartwatches and massively raised consumer awareness of the wearables segment. For rivals the delayed launch will dampen demand for their products in the near-term as consumers wait for commercial availability of the Apple Watch before making a final purchasing decision. For Apple’s competitors this launch will force them to rethink many aspects of their product plans.

Enrique Velasco-Castillo, digital economy analyst, Analysis Mason

The Apple Watch will at first have a chilling effect on competitors, followed by a spike in sales upon launch.Apple’s new wearable will significantly slow down sales of competing devices in the final quarter of 2014 as consumers wait for the Apple Watch to reach stores in Q1 2015. Analysys Mason expects just under 1 million smartwatches to have sold by the end of 2014; this will leap to 13.6 million sales in 2015 following the Apple Watch launch.

It will become the centre(time)piece of interaction with other Apple devices. Siri voice recognition, along with HomeKit (smart home control) and third-party apps will enable new use cases for health and fitness (through HealthKit), shopping (thanks to Apple Pay), and communication.

iPhones and general commentary

Geoff Blaber, devices analyst, CCS Insight

Tim Cook has been consistently promising new product categories and now he’s delivered. Yesterday’s event has definitively set the tone and direction of a post Steve Jobs Apple. The company has finally broken its long term resistance to a large screen iPhone and in doing so stands to tighten the screw on the competition and its biggest competitor in Samsung. Apple’s launch of a 5.5-inch iPhone a year after the iPhone 5C is a clear acknowledgement that it can no longer survive with a “one size fits all” approach to an increasingly segmented smartphone market. The question is whether Apple’s scale and pricing can avoid a margin impact.

Neil Mawston, wireless devices analyst, Strategy Analytics

As expected, the iPhone6 range contains LTE Cat 4. This will enable faster data access for advanced apps, such as real-time gaming. There will also be VoLTE for crisper voice calls (but it may hit battery life), quicker 802.11ac WiFi data access, and the ability to make voice calls over the WiFi network (many mobile carriers will dislike that feature).

There are now 1.3 million apps available in the Apple App Store, so the ecosystem for Apple iPhone remains strong. Apple is partnering with developers, like Gameloft and Disney, to deliver console-quality mobile games. Apple deserves credit for pushing ahead with its mobile gaming strategy, because our research indicates games are the world’s most popular mobile app.

Health apps now play a key role in iOS 8. For example, the iPhone6 portfolio will measure physical activity, like your number of steps. There is also a barometer for height sensoring. None of these are new features, and plenty of other vendors, like Samsung, already have similar features in their smartphone portfolios. In the bigger scheme of things, Apple today is no doubt optimizing its iPhone portfolio for the upcoming wearables industry that is emerging tomorrow.

Overall, the iPhone6 Plus is “as expected” and there are few surprises (most of the features and apps were already leaked). The iPhone6 Plus is a solid phablet that will quickly sell tens of millions units worldwide during the rest of this year. Rivals, like Samsung, LG, Motorola and others, will be getting a few restless nights of sleep in the coming months.

Paul Lambert, operator strategy analyst, Ovum

Today’s Apple announcement is great news for network operators as it raises to new heights public interest in the latest mobile technology, which now includes Apple’s connected watch that will create more buzz around this to-date niche part of the market. Viewed together, the devices represent a step-change in how mobile consumers’ will be connected to the Internet.

Apple’s new devices offer operators a great opportunity to increase data usage and data revenues. Each of the new devices will lead to more cellular data use, which is also great news for operators – especially if they can price data services in ways that capture consumers’ imaginations. The iPhones support more 4G frequencies and also VoLTE, both of which are welcome additions for 4G operators and will boost global 4G uptake.

Operators have seen that with each new iPhone consumers are willing to pay a premium to own the latest Apple device. With the new iPhones operators have fresh impetus to help them increase the amount their subscribers spend with them, and how long they stay with them. At the same time, operators can offer iPhone inventory at lower prices to increase ownership of premium smartphones among a broader range of prepaid and postpaid users.

Crucially, with the new iPhone 6 devices, operators will need to continue to invest in their networks to ensure they offer robust Internet access that can cope with the increase in mobile data traffic the new devices will bring about.

Equity

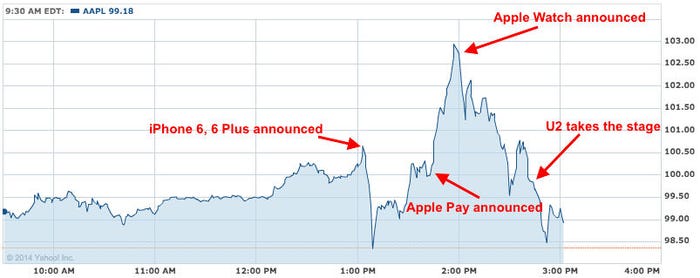

And just to round things off, a measure of what equity analysts thought of the announcements can be gauged by the behaviour of Apple’s share price during the event. The chart below was published by Business Insider and appears to show support for Apple Pay but disappointment towards the phones, the watch and U2.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)