Apple iPhone sales plunged by 20% in November - Counterpoint

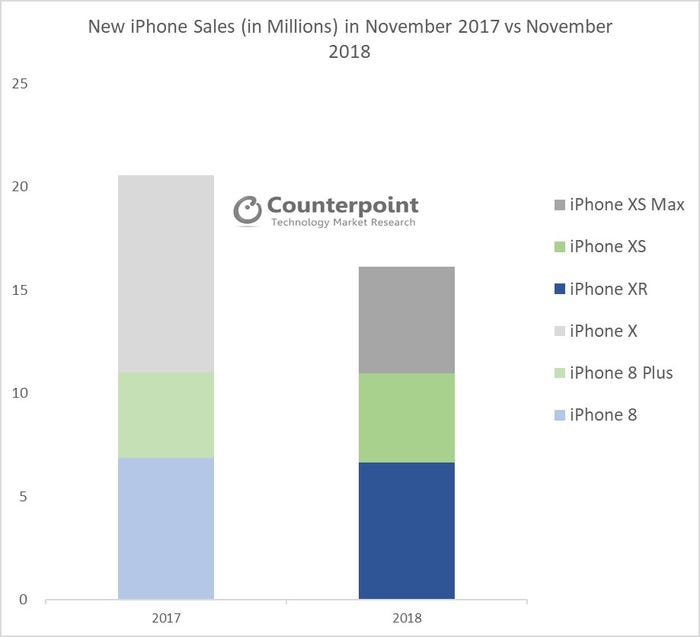

Facing more affordable competition from the Chinese brands, the iPhone’s total sales suffered a 20% decline in November, with the cheaper XR model outselling the more expensive models, according to an update from Counterpoint.

January 10, 2019

Facing more affordable competition from the Chinese brands, the iPhone’s total sales suffered a 20% decline in November, with the cheaper XR model outselling the more expensive models, according to an update from Counterpoint.

The research firm published its monthly update on iPhone sales for November, estimating that the decline was across the board. In Europe and North America, replacement cycles are getting longer while operators are reducing their subsidies, both trends playing to the decline of iPhone sales.

One exception was China, where the sales held largely thanks to the 11.11 (“Single’s Day”) sale, where all online channels would hand out discounts. However, the China market is expected to go down in December. On one hand the Single Day sales already satisfied much of the demand; on the other hand, the ongoing trade war with the US has pumped anti-American sentiment into some consumers, which Tim Cook also employed to explain away the weakness in its phone business.

When it comes to the model breakdown, Counterpoint said the best-selling model was XR, the cheapest among the three new models recently launched. More specifically, the 64GB version, the one with the smallest memory, was selling the best. This is in stark contrast to a year ago, when the best-selling model was the then newly launched iPhone X, the most expensive one in the new line-up. The research firm also concluded that when looking at the performances of the two most expensive models of the two years, the “iPhone XS Max, when compared to iPhone X during the same month last year, shows a 46% decline in sales.”

The decline should not come as a surprise though. In all markets the Chinese brands are gaining momentum, not the least in emerging markets like India, where smartphone market is still expanding. “iPhone has never achieved a significant share of the Indian market because it’s just too expensive. It rarely makes it above 1% of the overall market or 2% of the smartphone market. Recent changes to import taxes made the cost even more prohibitive. Apple has now decided to start assembling in India through Foxconn. This should help offset the import taxes it currently has to pay. This move may also be a hedge against potential damage from the ongoing China/US trade war.” Peter Richardson, research director and partner at Counterpoint told Telecoms.com. “However, while Apple’s brand is certainly well-regarded, Indian consumers have become accustomed to the quality of Chinese Android products, from players such as Xiaomi, Vivo and Oppo. It is questionable whether they will see the value in iOS relative to these Chinese players that are innovating much faster. Huawei (and Honor) has also been a marginal presence so far, but is expected to grow relatively quickly, adding to the market’s competitive landscape,” Richardson added.

Even in the more advanced markets Apple has shown weakness for a while. Earlier we reported that Apple was compensating the Japanese operators to offer discount and considering reviving iPhone X in Japan to boost sales.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)