Apple on the rebound in China according to CanalysApple on the rebound in China according to Canalys

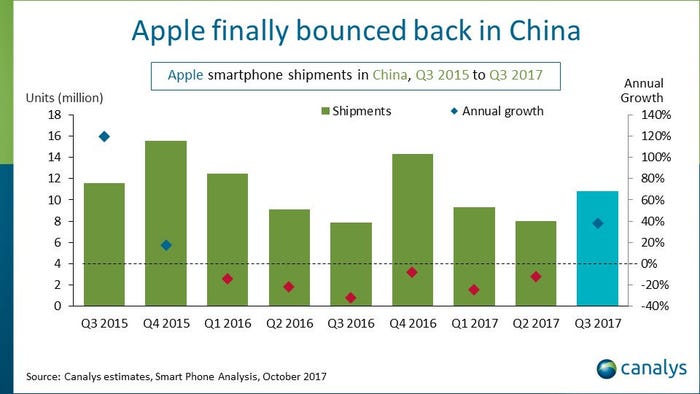

Analyst firm Canalys reckons Apple’s smartphone fortunes in China are improving after six consecutive quarters of decline.

October 30, 2017

Analyst firm Canalys reckons Apple’s smartphone fortunes in China are improving after six consecutive quarters of decline.

Chinese iPhone shipments apparently increased by 40% year-on-year, hitting 11 million in Q3 2017, although it should be noted that Apple has yet to formally announce its shipment and revenue numbers for the quarter. Canalys warns, however, that this upturn in Apple’s Chinese fortunes could be fleeting.

“Apple’s growth this quarter is only temporary,” said Mo Jia of Canalys. “The high sell-in caters to the pent-up demand of iPhone upgraders in the absence of the iPhone X. Price cuts on earlier models after announcing the iPhone 8 have also helped. However, Apple is unlikely to sustain this growth in Q4.

“While the iPhone X launches this week, its pricing structure and supply are inhibiting. The iPhone X will enjoy a healthy grey market status, but its popularity is unlikely to help Apple in the short term.”

The Canalys Apple China numbers are below, followed by the year-on-year comparison for the top five Chinese smartphone vendors. As you can see the company reckons overall shipments declined by 5% in the country, but at the same time four of the top five vendors experienced substantial increases.

Here’s what Canalys had to say on the matter: “Huawei grew shipments by 23%, shipping over 22 million units to take the lead, while Oppo declined slightly (compared to the stellar performance a year ago) shipping 21 million units. Vivo, with a 26% growth was the most impressive performer in the top 3, shipping over 20 million units. Xiaomi and Apple round up the top 5 this quarter.”

Xiaomi looks like it shipped around 16 million for the quarter, taking the total for the top five to 91 million – 76% of the total. Canalys says total shipments fell by around 6 million, but the top five increased theirs by around 14 million, meaning the long tail must have dropped a whopping 20 million shipments annually – around half its likely previous total.

To sanity-check these numbers we asked Neil Mawston at Strategy Analytics for a second opinion. He hasn’t come up with his Q3 numbers yet – quite sensible since the vendors haven’t either – but he did say this: “We provisionally model China at 0% YoY growth (zero) for 121 million smartphone shipments in Q3 2017.” So opinion is divided, but that long-tail drop-off still seems odd.

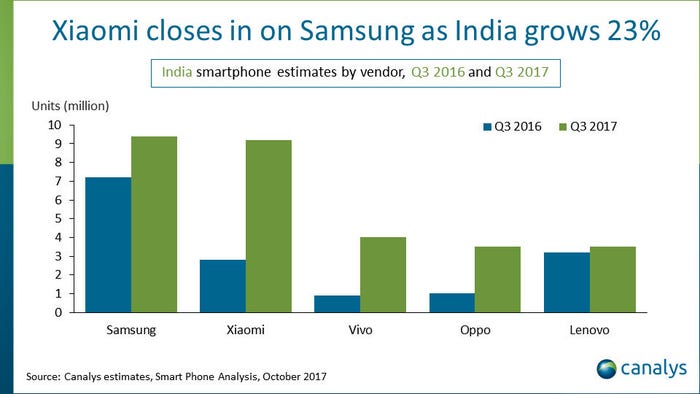

Canalys thought it might as well have a crack at India while it was at it, which seems to be the engine room of global smartphone growth these days, following the sudden decline of the Chinese long tail. There we’re seeing healthy growth of 23%, driven largely by Chinese vendors, although Samsung is clinging onto top spot.

“Xiaomi’s growth is a clear example of how a successful online brand can effectively enter the offline market while maintaining low overheads,” said Rushabh Doshi of Canalys. “But Xiaomi focuses on the low end. It struggles in the mid-range (devices priced between INR15,000 and INR20,000 [US$230 and US$310]), where Samsung, Oppo and Vivo are particularly strong. Nevertheless, we predict Xiaomi’s continued go-to-market innovations will allow it to overtake Samsung within a couple of quarters.”

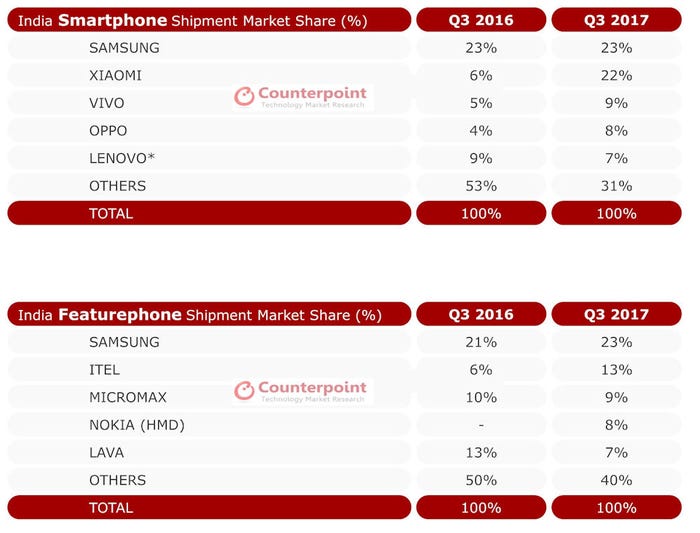

There seems to be more consensus on India than there was on China, with analyst firm Counterpoint publishing a pretty equivalent set of numbers, although they’re also still keeping an eye on its featurephone market. Both firms also agreed that India overtook the US to become the second biggest smartphone market in Q3.

“India continues to be an attractive destination for handset OEMs,” said Karn Chauhan of Counterpoint. “With strong smartphone growth and a sizeable featurephone market for at least three to four years, OEMs in India can target a diverse set of audiences. This has allowed a number of OEM’s to still realize double digit growth in the featurephone segment in spite of being absent in the smartphone segment.”

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)