As Indian smartphone market warms up, leaders Samsung and Micromax feel the heat

With India now viewed as the main source of global smartphone growth, the latest data from Counterpoint Research shows agile Indian and Chinese brands gaining ground on the leaders.

March 14, 2016

With India now viewed as the main source of global smartphone growth, the latest data from Counterpoint Research shows agile Indian and Chinese brands gaining ground on the leaders.

A recent Reuters report has brought further attention to the Indian market and specifically domestic giant Micromax, which seems to be going through a challenging time after a long period of strong growth.

The Indian smartphone market leader for some time was Samsung, which used the same scale, distribution and marketing advantages as it does elsewhere to establish a strong number one position. So Indian company Micromax did the pragmatic thing and poached Vineet Taneja, who had previously headed up Samsung’s mobile efforts in India, to become its new CEO.

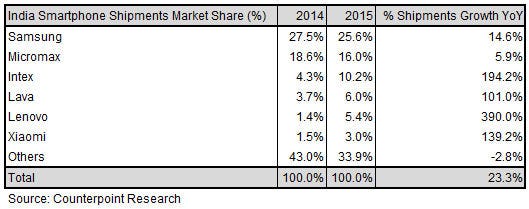

Under Taneja’s tenure, however, Micromax’s sales have stagnated and it has lost almost three percentage points of market share, according to Counterpoint. At the same time local rivals Intex and Lava have posted triple-digit growth, as have Chinese companies Lenovo and Xiaomi. Less than two years after his appointment Taneja resigned to pursue other interests and Micromax is still looking for an answer to its domestic challenges.

Telecoms.com spoke to Neil Shah of Counterpoint to get some further insight on the Micromax situation. “I believe the executive position at Micromax has seen some instability as the growth in the domestic market slowed down and has been under severe pressure from Chinese entrants like Lenovo, Xiaomi at one end and domestic rivals such as Intex, Lava growing at the other,” he said. “While Micromax has grown well in the overseas markets where it has entered (e.g. Russia), India still remains the major contributor to overall sales. Micromax’s smartphone shipments grew below the market average at a modest 6% annually in a market which grew 23%. Hence, Micromax lost some share to rivals.

“However, Micromax’s Cyanogen powered Yu branded devices grew well to put some brakes on Xiaomi. Yu also has integrated O2O services within their latest models to build an ecosystem and drive newer revenue opportunities but still not enough to offset the overall decline in the Micromax branded feature phone and smartphone business.

“Micromax needs a stable and visionary leader to take the number one domestic mobile phone brand in India further ahead of the rivals. Additionally, Micromax needs to streamline its portfolio to limited SKUs like Lenovo or Xiaomi to be more agile. Micromax will also look to expand further into more countries to boost the shipment growth in coming quarters.”

The Indian market is playing out in quite a similar way to how China’s did a couple of years ago, with the early front-runners being strongly challenged by agile challengers. One significant difference is that the average selling price of smartphones in India is significantly lower than in China, so there is even greater advantage to be had from lean and mean operations. So long as this remains the case things will be tough for the giant front-runners.

About the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)