Europe stings Apple for €13 billion plus interest in Irish back taxesEurope stings Apple for €13 billion plus interest in Irish back taxes

The European Commission has ruled a reduced corporation tax deal between Ireland and devices giant Apple was illegal and is looking for retrospective repayments that could top €13 billion.

August 30, 2016

The European Commission has ruled a reduced corporation tax deal between Ireland and devices giant Apple was illegal and is looking for retrospective repayments that could top €13 billion.

This cosy deal has apparently been in place since 1991, which is one of the reasons the sums are so large, the other being the silly amounts of profit Apple has made since it launched the iPhone. This investigation kicked-off back in June 2014 alongside similar inquiries into Starbucks in the Netherlands and Fiat Finance in Luxembourg.

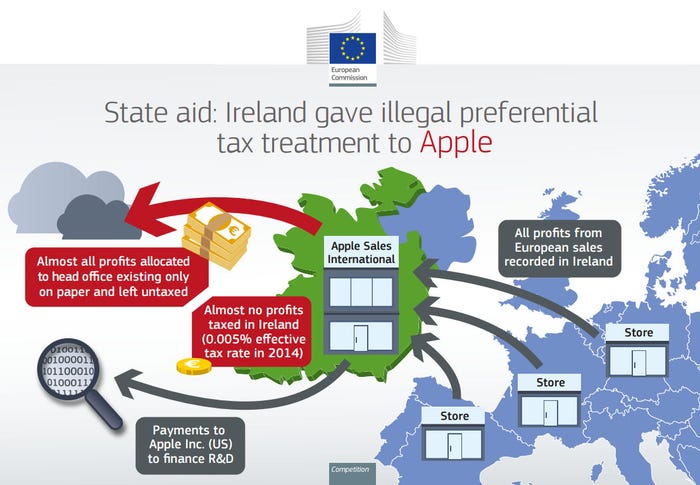

Apple is essentially being accused of aggressive tax avoidance. As you would hope, in the two-and-a-bit years of peering under the Apple rock the EC found quite a few creepy crawlies. Apple created an Irish company called Apple Sales International back in ’91, which acted as the hub for all its European sales, such that it effectively sold every individual product itself. This enabled Apple to cut out middle men such as retailers and regional offices.

However nearly all profits generated by ASI were channelled to its ‘head office’ which ironically had no actual office and wasn’t actually based anywhere, which meant it didn’t owe anyone any tax. Handy.

In 2011 ASI recorded profits in the region of €22 billion but claimed only €50 million of that was considered taxable in Ireland, which amounted to an effective corporation tax rate of 0.05%, with that rate shrinking further to 0.005% by 2014. The standard corporation tax rate in Ireland is at least 12.5%.

The underlying pseudo-legal justification for a ruling such as this is that it is an abuse of the EU state aid system, which doesn’t allow for preferential treatment of individual companies. It’s safe to assume that in the period concerned plenty of companies in Ireland did pay the full corporation tax rate and the EC doesn’t see why Apple should have been any different.

“Member States cannot give tax benefits to selected companies – this is illegal under EU state aid rules,” said European Commissioner Margrethe Vestager. “The Commission’s investigation concluded that Ireland granted illegal tax benefits to Apple, which enabled it to pay substantially less tax than other businesses over many years. In fact, this selective treatment allowed Apple to pay an effective corporate tax rate of 1 per cent on its European profits in 2003 down to 0.005 per cent in 2014.”

Irish Finance Minister Michael Noonan thinks the EC is wrong and is presumably worried about the impact this ruling is likely to have on direct foreign investment as well as the Irish jobs created by Apple itself.

“I disagree profoundly with the Commission’s decision,” he said. “Our tax system is founded on the strict application of the law, as enacted by the Oireachtas, without exception.

“The decision leaves me with no choice but to seek Cabinet approval to appeal the decision before the European Courts. This is necessary to defend the integrity of our tax system; to provide tax certainty to business; and to challenge the encroachment of EU state aid rules into the sovereign Member State competence of taxation.

“It is important that we send a strong message that Ireland remains an attractive and stable location of choice for long-term substantive investment. Apple has been in Ireland since the 1980s and employs thousands of people in Cork. The company has continued to expand its operations in Ireland in recent times.”

Noonan’s tone is especially intriguing in the current strained European political climate brought about by the UK’s vote to leave the EU. He is taking a strong stance in favour of national sovereignty over EU ‘encroachment’ at a time when the bloc is trying to re-establish its post-Brexit integrity. On the flip side it is possibly only mega-bureaucracies such as the EU that have the will and the power to take on corporate giants such as Apple, as Microsoft, Intel and Google could attest to.

The result is that the EC wants Apple to pay the illegally avoided taxes back to Ireland. It’s only allowed to back-date for a decade prior to the first request for information which takes us back to 2003 and amounts to the aforementioned sum. Apple is apparently no longer using this tax technique in Ireland and it’s possible that some of those repayments could go to other European countries.

While it has yet to offer comment on the ruling Apple will, of course, throw lawyers at this such that even if it doesn’t get the ruling overturned it will at least defer the repayment indefinitely. But the EU is nothing if not patient and is unlikely to let even direct intervention by the US government stand in its way.

€13 billion is still pocket change to Apple, which is well over $200 billion in the black and adds tens of billions to that pile every quarter. But in spite of that Apple’s shares were down around 2% in pre-market trading at time of writing, so this development is far from insignificant.

Here’s a handy graphic from the EC summarising what it’s saying Apple and Ireland have done wrong.

UPDATE 14:00 30 August 2016 – Apple CEO has issued the following response to the ruling:

A Message to the Apple Community in Europe

Thirty-six years ago, long before introducing iPhone, iPod or even the Mac, Steve Jobs established Apple’s first operations in Europe. At the time, the company knew that in order to serve customers in Europe, it would need a base there. So, in October 1980, Apple opened a factory in Cork, Ireland with 60 employees.

At the time, Cork was suffering from high unemployment and extremely low economic investment. But Apple’s leaders saw a community rich with talent, and one they believed could accommodate growth if the company was fortunate enough to succeed.

We have operated continuously in Cork ever since, even through periods of uncertainty about our own business, and today we employ nearly 6,000 people across Ireland. The vast majority are still in Cork — including some of the very first employees — now performing a wide variety of functions as part of Apple’s global footprint. Countless multinational companies followed Apple by investing in Cork, and today the local economy is stronger than ever.

The success which has propelled Apple’s growth in Cork comes from innovative products that delight our customers. It has helped create and sustain more than 1.5 million jobs across Europe — jobs at Apple, jobs for hundreds of thousands of creative app developers who thrive on the App Store, and jobs with manufacturers and other suppliers. Countless small and medium-size companies depend on Apple, and we are proud to support them.

As responsible corporate citizens, we are also proud of our contributions to local economies across Europe, and to communities everywhere. As our business has grown over the years, we have become the largest taxpayer in Ireland, the largest taxpayer in the United States, and the largest taxpayer in the world.

Over the years, we received guidance from Irish tax authorities on how to comply correctly with Irish tax law — the same kind of guidance available to any company doing business there. In Ireland and in every country where we operate, Apple follows the law and we pay all the taxes we owe.

The European Commission has launched an effort to rewrite Apple’s history in Europe, ignore Ireland’s tax laws and upend the international tax system in the process. The opinion issued on August 30th alleges that Ireland gave Apple a special deal on our taxes. This claim has no basis in fact or in law. We never asked for, nor did we receive, any special deals. We now find ourselves in the unusual position of being ordered to retroactively pay additional taxes to a government that says we don’t owe them any more than we’ve already paid.

The Commission’s move is unprecedented and it has serious, wide-reaching implications. It is effectively proposing to replace Irish tax laws with a view of what the Commission thinks the law should have been. This would strike a devastating blow to the sovereignty of EU member states over their own tax matters, and to the principle of certainty of law in Europe. Ireland has said they plan to appeal the Commission’s ruling and Apple will do the same. We are confident that the Commission’s order will be reversed.

At its root, the Commission’s case is not about how much Apple pays in taxes. It is about which government collects the money.

Taxes for multinational companies are complex, yet a fundamental principle is recognized around the world: A company’s profits should be taxed in the country where the value is created. Apple, Ireland and the United States all agree on this principle.

In Apple’s case, nearly all of our research and development takes place in California, so the vast majority of our profits are taxed in the United States. European companies doing business in the U.S. are taxed according to the same principle. But the Commission is now calling to retroactively change those rules.

Beyond the obvious targeting of Apple, the most profound and harmful effect of this ruling will be on investment and job creation in Europe. Using the Commission’s theory, every company in Ireland and across Europe is suddenly at risk of being subjected to taxes under laws that never existed.

Apple has long supported international tax reform with the objectives of simplicity and clarity. We believe these changes should come about through the proper legislative process, in which proposals are discussed among the leaders and citizens of the affected countries. And as with any new laws, they should be applied going forward — not retroactively.

We are committed to Ireland and we plan to continue investing there, growing and serving our customers with the same level of passion and commitment. We firmly believe that the facts and the established legal principles upon which the EU was founded will ultimately prevail.

Tim Cook

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)