Global smartphone market Q3 2015 – Samsung strikes back

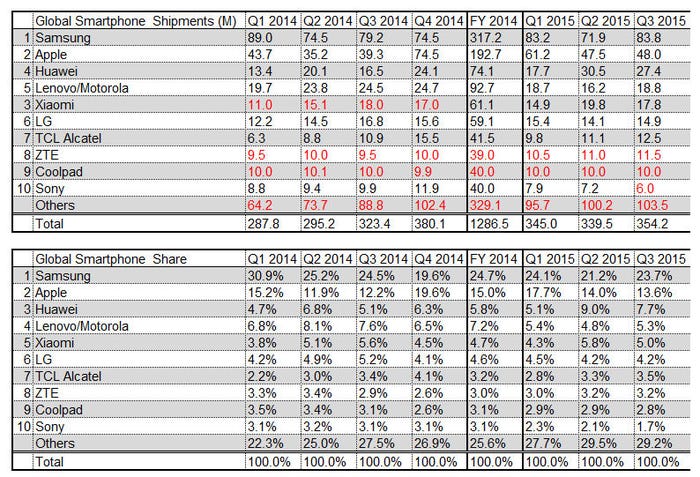

Korean tech giant Samsung managed to register smartphone unit growth for the first time in over a year, in spite of strong performances from Apple and Huawei.

October 29, 2015

Korean tech giant Samsung managed to register smartphone unit growth for the first time in over a year, in spite of strong performances from Apple and Huawei.

Maybe reports of Samsung’s smartphone demise were premature. Initial sales of the new Galaxy S6 phones were disappointing, thanks in part to an apparent supply chain miscalculation. This now appears to have been resolved and alongside a few other launches Samsung’s mighty marketing and distribution operations have started firing on all cylinders.

“Samsung has finally returned to positive smartphone growth for the first time in six quarters since Q1 2014,” said Neil Mawston of Strategy Analytics. “Its smartphone division is back on the road to recovery. Samsung’s smartphone growth is being driven by select price cuts and attractive new models like the Galaxy Note 5, A8 and J5.”

The Apple money making machine carried on regardless, trousering $11.1 billion in profit thanks mainly to selling 48 million iPhones, each of which yields hundreds of dollars of margin. This is in stark contrast to Android vendors, who consider themselves luck to break even on each phone they sell. Apple doubled its revenue from Greater China and seems to have totally cracked that massive market.

Incidentally Strategy Analytics has also released its Q3 smart watch numbers, with Apple driving rapid growth in the overall category. “We estimate Apple Watch shipped 4.5 million units and captured a dominant 74 percent smartwatch marketshare worldwide in Q3 2015,” said Mawston. “Apple Watch’s retail presence is expanding fast and the device is now available in over 30 countries worldwide, including the United States, South Korea and China. However, Apple Watch is still not widely available at most mobile operators, and this is one area of weakness that Apple must improve to maintain its shipment growth in the future.”

Back to smartphones, Huawei seems to have cemented its third place position, holding the likes of Lenovo and Xiaomi at bay in its home market and doing a decent job of its international expansion. “Huawei maintained third position with 8 percent global smartphone marketshare in Q3 2015, up from 5 percent a year ago,” said Woody Oh of SA. “Huawei is expanding rapidly across Asia, Europe and the United States, putting competitive pressure on key rivals such as Lenovo-Motorola and Xiaomi.”

The trading environment for Android smartphone vendors remains very tough. With hardware innovation currently almost non-existent, Apple’s advantages in brand and unique software ecosystem are probably even greater. In spite of a stronger than expected quarter Samsung’s global smartphone share still declined year-on-year and it has Apple’s strongest quarter up next.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)