Global smartphone shipments down for fourth quarter in a row

Smartphone shipments around the world have declined for the fourth consecutive quarter with China representing the biggest dent in volume, according to preliminary data from IDC, a telecoms market research firm.

July 29, 2022

Smartphone shipments around the world have declined for the fourth consecutive quarter with China representing the biggest dent in volume, according to preliminary data from IDC, a telecoms market research firm.

At 286 million units in Q2 2022, shipments declined 8.7% YoY and were around 3.5% lower than the research firm’s Forecasts. As was expected, Central and Eastern Europe (CEE) saw the biggest drop of 36.5% YoY with the ongoing invasion of Ukraine by Russia. However, IDC points out that the CEE only accounts for 6% of global shipments, meaning a moderate drop overall. China’s shipment decline, however, stood at 14.3% YoY making the biggest depletion on global volumes.

“What started out as a supply-constrained industry earlier this year has turned into a demand-constrained market,” said Nabila Popal of IDC. “While supply improved as capacity and production was ramped up, roaring inflation and economic uncertainty has seriously dampened consumer spending and increased inventory across all regions. OEMs have cut back orders for the rest of the year with Chinese vendors making the biggest cuts as their largest market continues to struggle.”

Excluding Japan and China, APAC accounts for nearly half of all global shipments and also declined 2.2% in 2Q22. All other regions, except Canada, saw moderate single digit declines.

Despite IDC’s expectation for improved demand by the end of the year in some regions, the research firm plans to revise down its forecast for the remainder of 2022. The positive spin on the increasingly negative outlook though, according to IDC, is to view the current decline as “demand that is [not] lost, but simply pushed forward”.

Last month Telcoms.com reported on the European smartphone supply constrains caused by a perfect storm of Covid-19 related challenges, major conflict in eastern Europe and the ongoing component shortage. To that end, it comes as no surprise that global shipments are also down and expected to remain so for the remainder of the year, especially as China continues to be impacted by Covid-related lockdowns.

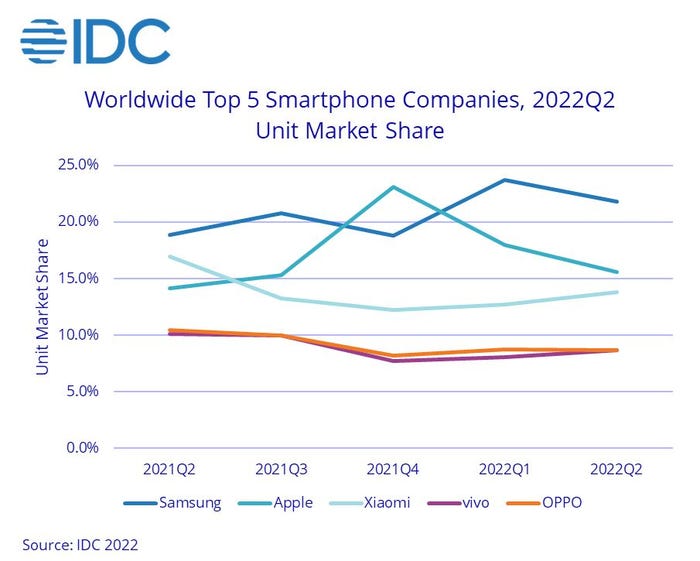

From a vendor perspective, little was changed in the market share and positioning of the top players. Here is the chart provided by IDC:

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)