Global smartphone shipments plunge to lowest level since 2014

The decline of the global smartphone market continues but nobody sent Huawei the memo as it raced past Apple into second place.

May 1, 2019

The decline of the global smartphone market continues but nobody sent Huawei the memo as it raced past Apple into second place.

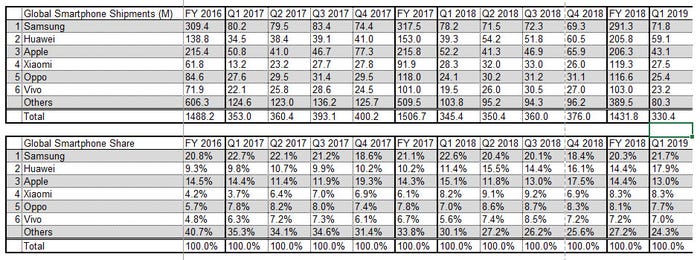

According to Strategy Analytics, from which we derive the majority of our smartphone numbers below, 330.4 million smartphone units were shipped in Q1 2019. This represented a year-on-year decline of 4% and marked the lowest quarterly total since Q3 2014. Among the vendors Apple was the biggest loser and was easily overtaken for second place by Huawei thanks to remarkable 50% year-on-year shipment growth.

“The global smartphone market has declined again on an annual basis, but the fall is less severe than before, and this was the industry’s best performance for three quarters,” said SA’s Linda Sui. “Global smartphone shipments are finally showing signs of stabilizing, due to relatively improved demand in major markets like China. The outlook for later this year is improving.”

“Huawei surged 50% annually and outgrew all major rivals to ship 59.1 million smartphones worldwide during Q1 2019, up from 39.3 million in Q1 2018,” said Neil Mawston of SA. “Huawei captured a record 18 percent global smartphone marketshare in Q1 2019. Huawei is closing in on Samsung and streaking ahead of Apple, due to its strong presence across China, Western Europe and Africa.”

“Apple iPhone shipped 43.1 million units to capture 13 percent global smartphone marketshare in Q1 2019, dipping from 15 percent a year ago,” said Woody Oh of SA. “Apple lost ground in China during the quarter and is struggling to make headway in price-sensitive India. However, decent price cuts in China and India during recent weeks indicate the iPhone will bounce back slightly in those two countries in the next quarter.”

While shipments might be going down the toilet, the total value of those shipments seems to be stable thanks to increasing average selling prices. “By revenue, the situation is healthier, due to higher average prices (like expensive iPhones),” said Mawston. “Global revenue today is broadly around the same level as the average quarter last year.”

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)