Google Pixel blossoms amidst Japan smartphone slumpGoogle Pixel blossoms amidst Japan smartphone slump

The Japanese mobile phone market continues to decline, new figures show, but for one company the picture is very positive: Google's Pixel smartphones are on the up in the land of the rising sun.

March 6, 2024

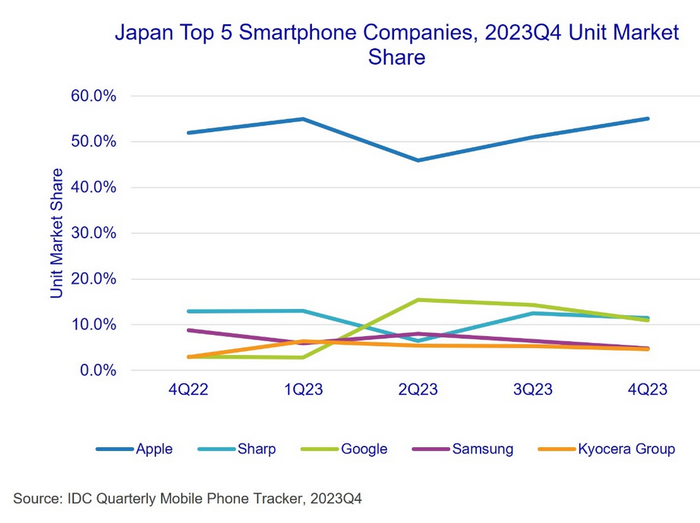

In a market historically dominated by local players – and in more recent times Apple – US-based Google is starting to make its mark. The firm's market share, generated by its range of Pixel smartphones, jumped above 10% in the fourth quarter of 2023 (see chart below), according to newly published data from IDC. It was the third-largest player in the market in Q4, beaten only narrowly by Sharp, recording a massive 527% shipments growth figure compared with the year-ago quarter.

There are a number of reasons for Google's growing popularity in Japan. In mid-2023 Counterpoint Research declared Google the largest Android vendor in the country and highlighted a number of technical improvements to its Pixel 7a devices – in the processor, camera and RAM – and noted that the Japanese market's preference for smaller screen sizes significantly influenced strong sales of the device.

IDC, meanwhile, notes that Google's partnership with the market's largest operator NTT DoCoMo, which came into being at the start of 2023, drove a rapid increase in market share over the course of the year.

Further, the US company was able to capitalise on issues faced by some of the domestic vendors; FCNT filed for civil rehabilitation – essentially bankruptcy protection – and was acquired by Lenovo, and electronics maker Kyocera announced plans to selectively pull back from the consumer segment, IDC pointed out.

Sharp made something of a comeback in Q4. Like Counterpoint, IDC's numbers show that Google was the leading Android vendor in Japan earlier in 2023, but by year-end Sharp was back on top, just: it claimed a 2023 market share of 10.9% to Google's 10.7%.

IDC puts Sharp's rebound down to its popularity among elderly people due to its affordable smartphones.

Market leader Apple, meanwhile, extended its market share by almost three percentage points over the 12 months, buoyed by strong demand for iPhone 15 devices. However, Apple's shipments slid by 6.1% year-on-year, in line with declines in the overall market.

Mobile phone shipments in Japan came in at 30.3 million units, down by 11.6% on the previous year. However, IDC notes that demand was stronger in the second half of the year, led by Apple, as the impact of inflation lessened and carriers moved to address inventory.

In Q4 shipments hit 8.3 million units – including 8.28 million smartphones – which represents a 3.5% decline on-year. However, Q4 was the only one of the year to record shipments north of 8 million, which is positive news for the market.

"Japan has been a market where local vendors have been exceptionally strong. However, amid intensifying competition in the smartphone market, local vendors in Japan are gradually finding it difficult to compete with global vendors in terms of product development and competitiveness, including foldable smartphones and AI smartphones," said Masafumi Inbe, Market Analyst at IDC Japan.

Inbe also gave a hint as to what we can expect to see in Japan this year.

"In 2024, apart from Google which experienced rapid growth, other global vendors such as Lenovo, which acquired FCNT, and Xiaomi, will strengthen their presence in the Japan market. Meanwhile, local vendors will be compelled to reassess their positions in the domestic market," he said.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)