Huawei destroys the competition in Chinese smartphone marketHuawei destroys the competition in Chinese smartphone market

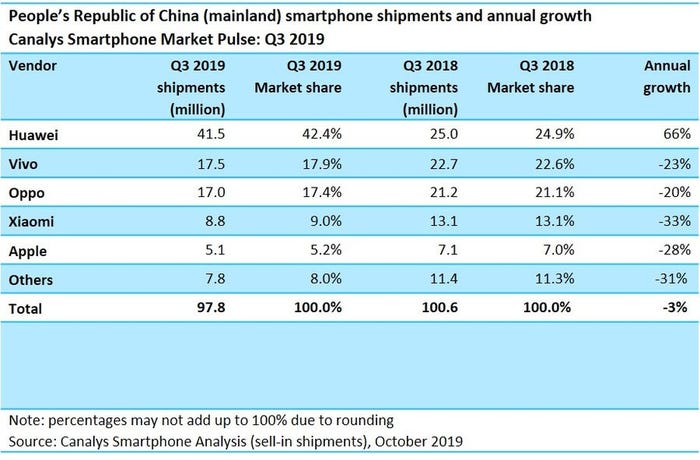

According to the latest numbers from research firm Canalys, Huawei’s Q3 smartphone shipments in China increased by 66% while all its competitors declined.

October 30, 2019

According to the latest numbers from research firm Canalys, Huawei’s Q3 smartphone shipments in China increased by 66% while all its competitors declined.

Huawei’s massive shipment numbers are all the more impressive when you consider the overall market is in decline, with total Chinese smartphone shipment numbers down 3% year-on-year. Somehow, in the space of a year, Huawei has managed to turn a competitive market into one it dominates, with more than double the market share of the second placed vendor.

“Huawei opened a huge gap between itself and other vendors. It has 25% more share than this quarter’s runner-up, Vivo,” said Nicole Peng of Canalys. “Its dominant position gives Huawei a lot of power to negotiate with the supply chain and to increase its wallet share within channel partners. Huawei is in a strong position to consolidate its dominance further amid 5G network rollout, given its tight operator relationships in 5G network deployment, and control over key components such as local network compatible 5G chipsets compared with local peers. This puts significant pressure on Oppo, Vivo and Xiaomi, which find it very hard to make any breakthrough.”

“Vivo, Oppo and Xiaomi’s shipments are in freefall, despite new products constantly being pushed to market,” said Louis Liu of Canalys. “Smaller vendors hope to leverage 5G to rapidly boost market share given that China major operators have aggressively pushed 5G pre-registration with plentiful discounts and free 5G data allowance, which has resulted in over 10 million subscribers registering an interest to move to 5G.

“In addition to Huawei, Vivo, ZTE, Xiaomi and Samsung have launched 5G-capable smartphones between US$500 and US$1000, with more products likely to follow in Q4. However, Canalys expects 5G tariffs and device prices to fall rapidly to attract mass market consumers, with similar intense competition to the 4G era among major vendors, causing first-mover advantage in 5G to diminish in next to no time.”

So apart from simply acknowledging Huawei’s overall size and strength, Canalys seems to think its advantages in 5G account for this violent swing in its favour. This may be a factor but it seems unlikely to be the main reason. More likely Huawei has been aggressively cutting prices and incentivising the channel to show preference to its products as it seeks to show the US its sanctions aren’t biting.

This enabled Huawei to be bullish over its last quarterly numbers, but it’s not a sustainable strategy. The overall market is in decline and smartphone replacement cycles are typically at least two years. Huawei may have one or two more quarters of domestic smartphone growth to come, but after that it may not find revenue growth so easy to come by.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)