IDC confirms bleak picture for global smartphone marketIDC confirms bleak picture for global smartphone market

Analyst firm IDC has released its Q4 2022 smartphone market numbers and they confirm major declines for the quarter and the full year.

January 27, 2023

Analyst firm IDC has released its Q4 2022 smartphone market numbers and they confirm major declines for the quarter and the full year.

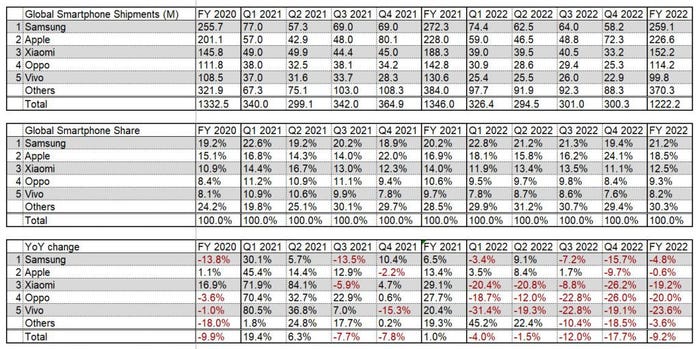

IDC reckons global smartphone shipments declined by 18.3% in Q4 2022 and by 11.3% for the full year. The year-on-year change numbers in our table below don’t tally exactly with that as we use whichever analyst firm’s numbers that come out first, which recently has often been Counterpoint. All of them are educated guesses, so there will always be variations depending on their sources and methodology.

When you consider that the total smartphone market size was over 1.5 billion units shipped in 2017, that would seam to represent an absolute peak, with the 2022 numbers 20% lower than that. Chinese vendors have been especially heavily hit, part of the reason for which could be the country’s absurd zero-covid policy. Conversely Apple deserves special mention for keeping its shipments more of less flat in such a bear market.

“We have never seen shipments in the holiday quarter come in lower than the previous quarter,” said IDC’s Nabila Popal. “However, weakened demand and high inventory caused vendors to cut back drastically on shipments. Heavy sales and promotions during the quarter helped deplete existing inventory rather than drive shipment growth.

Vendors are increasingly cautious in their shipments and planning while realigning their focus on profitability. Even Apple, which thus far was seemingly immune, suffered a setback in its supply chain with unforeseen lockdowns at its key factories in China. What this holiday quarter tells us is that rising inflation and growing macro concerns continue to stunt consumer spending even more than expected and push out any possible recovery to the very end of 2023.”

“We continue to witness consumer demand dwindle as refresh rates climb past 40 months in most major markets,” said Anthony Scarsella of IDC. “With 2022 declining more than 11% for the year, 2023 is set up to be a year of caution as vendors will rethink their portfolio of devices while channels will think twice before taking on excess inventory. However, on a positive note, consumers may find even more generous trade-in offers and promotions continuing well into 2023 as the market will think of new methods to drive upgrades and sell more devices, specifically high-end models.”

While we haven’t seen and global numbers from Counterpoint yet, the firm has published some for two of the biggest country markets – China and India. China’s smartphone shipment numbers were down 15% for the quarter and 14% for the year, with Apple and Huawei taking share from the rest. Shipments were only down 9% for the year in India but the mix there continues to trend upwards in terms of average price.

“Despite declining shipments, the premium smartphone market’s share kept rising in 2022 and reached 11%, the highest ever,” said Shilpi Jain of Counterpoint. “This paradoxical trend implies that India’s smartphone market is moving from being volume-driven to value-driven. While entry-tier and budget segments were most affected, the premium segment remained immune and showed double-digit growth.

“OEMs’ increased focus, consumers upgrading for premium features and, most importantly, availability of various financing schemes like ‘No-cost EMI’, ‘Buy Now, Pay Later (BNPL)’ and ‘Samsung finance+’ boosted this premiumization trend. We believe the momentum for the premium segment will continue in 2023 as well owing to OEMs’ focus and faster consumer upgrades.”

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)