Is the secondary mobile device market ready for a 4G device deluge?

There is a clear link between the success of the new smartphone market and the secondary device ecosystem.

July 22, 2019

Telecoms.com periodically invites third parties to share their views on the industry’s most pressing issues. In this article, Alan Bentley, President, Global Strategy at Blancco, looks at anticipated 5G device sales forecasts and considers the impact that they could have on the secondary device market.

The global device market has been under criticism in recent years. Many industry commentators have bemoaned slowing levels of innovation when it comes to new smartphone functionality. Global OEMs have been trying to maintain high prices for premium high-end devices, despite minor improvements in features and technology. While on one hand, device prices have sustained themselves, on the other, consumers are keeping their old devices for longer and global smartphone shipments and sales have started to decline.

Global OEMs and operators have been looking to accelerate their sales figures. Both have pointed towards 5G as the catalyst to build much healthier pipelines and grow revenues. 5G promises greater capacity, richer content and faster processing speeds. The hope is that it will excite mobile consumers in new ways and persuade them to part with more money for the privilege of consuming it.

5G device demand is looking strong

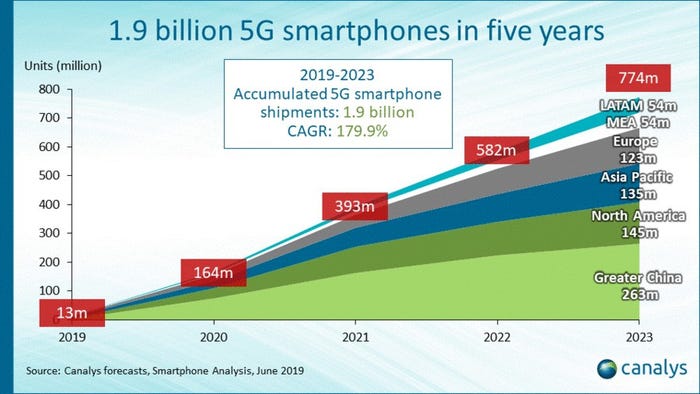

The good news is that industry predictions seem to support these hopes. Only last week, industry analyst Canalys predicted that 1.9 billion 5G smartphones will ship over the next five years. Global volumes will increase from an anticipated 13 million devices this year, to a daunting 774 million by 2023. This suggests that the current period of smartphone upgrade inertia we’re experiencing will end.

However, the success of the secondary mobile device market will be a significant contributing factor to the success of 5G devices and network service uptake. Over the past few years, it has helped improve consumer affordability for high-end devices, while helping OEMs sustain high prices. In other words, if OEMs and operators hope to sell high volumes of 5G devices, they must also be ready to collect almost the same number of used 4G smartphones.

Secondary strain from primary market pain

There is a clear link between the success of the new smartphone market and the secondary device ecosystem. If the primary market stalls, so will the secondary market. The affects of this link have been felt over the past year. According to Counterpoint Research, the secondary market grew just 1% in 2018, compared to around 13% the year before. The primary reason was the 11% drop in new smartphone sales in the same period. If consumers aren’t upgrading, old devices simply can’t be collected. However, the secondary market still grew. Consumer appetite for 5G is reflected by the 5G device shipment forecasts and there is also increasing comfort for engaging in the secondary market, assuming data security standards remain high. This will lead to a deluge of 4G devices hitting the secondary market in the next 12-18 months and the supporting ecosystem needs to be ready.

Is the secondary market ready?

The commitment from every stakeholder within the secondary market ecosystem is clear. OEMs, operators and the logistics providers that manage buyback and trade-in programmes on their behalf, are investing significant time and money to scale secure device collection. While Canalys predicts that 582 million 5G smartphones will ship in 2022, Counterpoint Research predicts that less than half, just 220 million devices will be collected in the same year.

This feels conservative. Operators and OEMs are marketing buyback ad trade-in programmes very hard. Earlier this year, Apple’s Tim Cook openly stated that its iPhone buyback programme was central to its strategy of stimulating device sales and maintaining premium pricing. Several of the world’s largest operators are known to be predicting or expecting significant revenue from used device collection and resale this year (and in future years).

Most now advertise their buyback programmes on their website homepages and include the ability to trade-in used handsets for all new device purchases. There is also strong consumer incentive to engage in the process. Recent statistics from HYLA Mobile suggest that the secondary market returned more than $2 billion to US consumers that traded in their devices in the US last year alone. All secondary market stakeholders have significant incentive for the entire ecosystem to deliver.

More devices, more speed, more risk

The significant increase in 4G devices hitting the secondary market will drive greater efficiency enhancements across an increasingly complex supply chain. Mobile device processors will be judged according to a variety of factors. Perhaps the main one is speed – of device diagnosis, repair and resale. Technology advancements, including the use of AI and automation continues to drive through mobile device processing efficiencies. Mobile devices can now be processed in seconds, rather than minutes. This is vital in retaining as much of the latent value held in used devices as possible.

However, with greater speed comes greater risk, especially given the importance of maintaining consumer trust in data management practices tied to the secondary market. If consumers lack the confidence in operators, OEMs and logistics companies to keep their data secure, they won’t trade-in their old devices. What’s more, upgrade inertia will continue.

The mobile industry is dependent on 5G to grow revenues. This requires a healthy device upgrade cycle. It’s time for all parties in the process to play their part in ensuring that the secondary device market is booming, for a strong and secure future.

Alan Bentley is President, Global Strategy at Blancco. An industry veteran, he joined the company in October 2016, and has worked closely with Blancco’s many customers and partners to implement data erasure solutions to mitigate security risks and ensure regulatory compliance. This gives him a unique insight into the market and business requirements driving the needs of today’s businesses.

Alan Bentley is President, Global Strategy at Blancco. An industry veteran, he joined the company in October 2016, and has worked closely with Blancco’s many customers and partners to implement data erasure solutions to mitigate security risks and ensure regulatory compliance. This gives him a unique insight into the market and business requirements driving the needs of today’s businesses.

Read more about:

DiscussionAbout the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)