Latin America smartphone shipments look steady next to global declineLatin America smartphone shipments look steady next to global decline

While shipments in the LatAm region are down 2.5% YoY, the global year-on-year decline is a more eye watering 9%, according to figures from Canalys.

September 1, 2022

While shipments in the LatAm region are down 2.5% YoY, the global year-on-year decline is a more eye watering 9%, according to figures from Canalys.

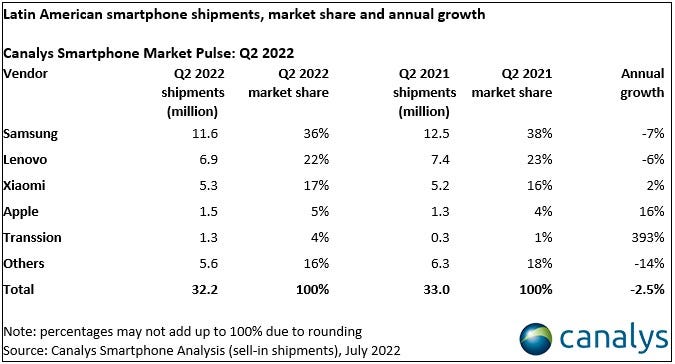

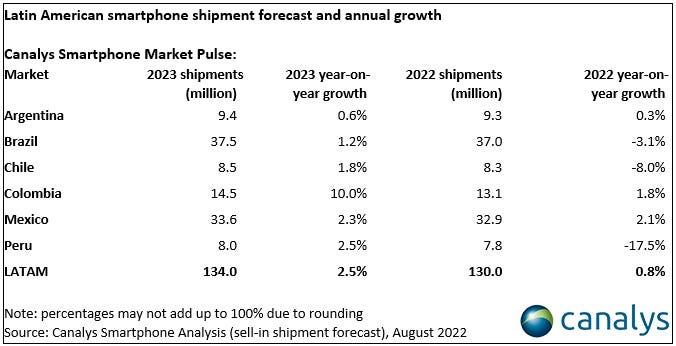

Canalys market watchers calculate that the Latin American smartphone shipments fell 2.5% year on year in Q2 2022 with 32.2 million units sold, which doesn’t seem too bad next to the overall global year-on-year decline of 9%. There were however outliers such as Peru and Chile, which clocked double-digit dives during the quarter.

Apparently there was an increase in the polarisation of the market, with the sub-$100 and $500-plus price bands both strengthening, which in particular has helped Apple as all its phones are at the upper end of the price spectrum.

“Apple coupled the successful launch of the iPhone 13 series with a conservative pricing approach, which, in a hyperinflationary environment, brought good results in the form of double-digit year-on-year shipment growth of 16%,” said Canalys Senior Analyst Damian Leyva-Cortes. “Lenovo and Samsung also benefited from this trend to elevate the value of their shipments, though shipment numbers were hurt by exposure to other price bands, with both companies seeing falls below the overall market decline.”

At the lower end of the market, competition is apparently intensifying due to an increasing number of incoming vendors, especially in Mexico and Colombia. Shipments in the $100-to-$500 price band represent over 70% of all shipments in the Latin American region, and in some markets, such as Chile and Colombia, that figure is rising.

Leyva-Cortes added: “While Latin American markets are hit by inflation, there are still many unmet demands. So, in the meantime, smartphone vendors must focus on end users and their different wants and needs. As, for now, channels, and especially operators, are treating all smartphone vendors and their products the same.

“It is expected that economic headwinds will affect shipments in the short term, meaning the overall Latin American region will see 0.8% growth in 2022 and 2.5% growth in 2023. This means that Latin America would be the world’s only region to grow in 2022, though it would also be the slowest region to recover in 2023. But, when looking at a country level, the picture varies greatly from market to market.”

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)