Microsoft and Sony continue their retreat from smartphonesMicrosoft and Sony continue their retreat from smartphones

Q4 earnings season has revealed a global smartphone market approaching a plateau and a couple more of its major players seem to be positioning themselves for an exit.

January 29, 2016

Q4 earnings season has revealed a global smartphone market approaching a plateau and a couple more of its major players seem to be positioning themselves for an exit.

Microsoft has continued the policy it commenced last summer of pretty much ignoring smartphones. Its quarterly presentations barely touched on Windows Phone or Lumia, noting only that phone revenue halved “…reflecting our strategy change announced in July 2015.” Shipments seem to have declined even more dramatically, with the Verge reporting they fell from 10.5 million a year ago to 4.5 million. Not a single question was asked about the smartphone business in the ensuing analyst call.

Telecoms.com noted back in October 2014 that Microsoft was retreating from Windows Phone, an observation that seemed to antagonise some readers. However it was clear even back then that the smartphone platform market had formed a natural duopoly with Apple at the high-end and Android catering for the rest. The challenge for Windows Phone was to take share from Android, but the combination of a license fee and a lack of developer support made this highly unlikely.

Microsoft’s software licensing model was doomed in an industry dominated by a ‘free’ platform in Android. The company has belatedly realised that it’s best chance in mobile is to sell software and services such as Office and Skype to Android and iOS users, making Windows Phone redundant. It is likely to keep the Lumia programme alive primarily to showcase new mobile products and to help make the unified Windows 10 more mobile-friendly, but it no longer has any interest in making money out of the sale of smartphones.

Sony used its quarterlies to make almost exactly the same comment it did the previous quarter about declining revenues in its Mobile Communications segment. “This decrease was due to a significant decrease in smartphone unit sales resulting from a strategic decision not to pursue scale in order to improve profitability,” said Sony.

Essentially Sony has come to the same conclusion as Microsoft – that there’s no money in handset sales. There’s no point in Sony trying to take on the likes of Samsung and Huawei in the lower segments as they have superior economies of scale and margins are non-existent. While Apple owns the premium segment Sony seems to think it can still compete there to some extent, but this could also just be an orderly retreat, and it’s telling that the company has stopped announcing volumes.

Sometime in the not too distant future Sony will probably just merge the Mobile division into another one so that it won’t need to mention it at all in its quarterly announcements and will be able to just whistle nonchalantly whenever anyone brings it up.

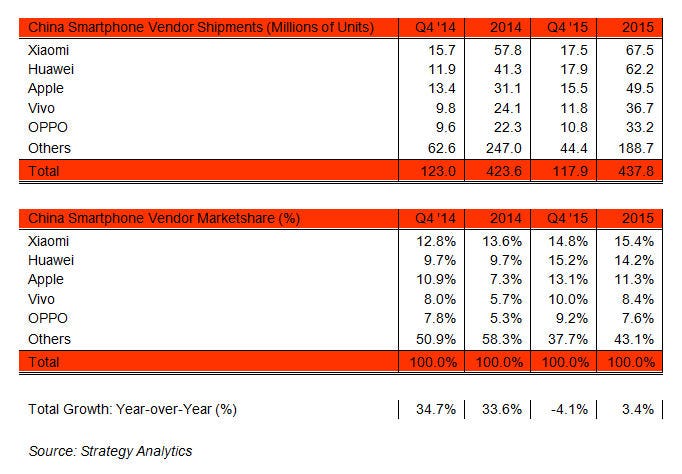

The global smartphone market remains very volatile and even the most established companies can suffer big swings in their fortunes. Lenovo is the latest top-5 vendor to see its shipments plummet and recently published China smartphone data from Strategy Analytics reveal it’s not even in the top five in China anymore, with newer low-priced players such as Vivo and Oppo overtaking it.

“The success of Vivo and Oppo lies in good hardware designs, robust product quality, strong retailer penetration, and rising brand awareness among mass-market consumers,” said Linda Sui of SA, indicating just how strong competition is in China.

The commoditized nature of the Android smartphone market means margins are minimal, and often negative. Currently vendors can either decide not to bother or treat the hardware as a loss-leader to create a captive market, which is the Xiaomi philosophy.

One company that isn’t going to give up trying to differentiate the devices themselves, however, is Samsung. The WSJ reports that it has now split mobile R&D into hardware and software forks as part of its ongoing efforts to create a distinctive, useful UI to place over standard Android. And lastly Samsung still hasn’t given up on foldable displays it seems, which it has been talking about for years. Apart from enabling a revival of the clamshell form factor it’s hard to see how much real value such an innovation would add.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)