Ofcom triples UK mobile license feesOfcom triples UK mobile license fees

Ofcom has set its annual mobile spectrum license fees 13 per lower than it mooted in February, but analysts say the new level is still likely to be met with protests from the operators.

September 24, 2015

Ofcom has set its annual mobile spectrum license fees 13 per lower than it mooted in February, but analysts say the new level is still likely to be met with protests from the operators.

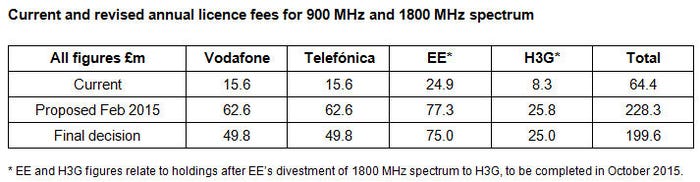

The UK regulator has announced that operators should pay a combined annual total of £80.3m for the 900 MHz band and £119.3m for the 1800 MHz band with the operators’ joint annual fees totalling £199.6m. The previous grand total was less than a third of that, at $64.4m.

The fees paid by Vodafone and Telefonica will rise from their current levels of £15.6 million each to £49.8 million each. However, in February their individual annual license fees were provisionally outlined at £62.6 million each. EE will be the biggest contributor to Ofcom, with a license fee of £75 million, while H3G will pay £25 million. The figures for the latter two are subject to adjustment as EE’s divestment of 1800 MHz spectrum to H3G is completed in October 2015.

Ofcom also announced that operators have lost the option to pay at different points in the year and will observe a single common payment date set by the regulator. The new fees come into effect in two phases: one half of the fees increase, from the current to the new rates, will come into effect on 31 October 2015. The second half will come into effect on 31 October 2016, with full fees payable annually from that point.

The fee assessment was influenced by ‘stakeholder feedback’ and the outcome of the spectrum auction in Germany in June, said Philip Marnick, Ofcom’s Group Director of Spectrum.

“The mobile industry has not previously had to pay market value for access to this spectrum, which is a valuable and finite resource, and the new fees reflect that value,” said Marnick.

Expect protests from the operators, warned Kester Mann, Principal Analyst of Operators at CCS Insight. “Operators are likely to warn that investment in networks and services will be impacted as a result,” said Mann. “This is a pill the providers are going to have to swallow. In one of Europe’s most competitive markets, they have no choice but to continue to make improvements to coverage and capacity and have little margin to adjust pricing to compensate.”

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)