Premium segment shines in otherwise gloomy smartphone marketPremium segment shines in otherwise gloomy smartphone market

Top-end handset sales reached new highs in 2023, despite a tumultuous year for the broader smartphone market.

January 3, 2024

Preliminary data from Counterpoint Research predicts that global sales in the premium segment – which it defines as devices that fetch a wholesale price of more than $600 – will achieve year-on-year growth of 6% for 2023, a new record.

This contrasts with the projected decline in the overall smartphone market, according to the analyst firm, which says that high-end handsets are expected to account for almost a quarter of overall smartphone shipments and 60% of revenues once all the full-year numbers are in.

Within this particular slice of the market, the ultra-premium segment is driving growth. Counterpoint said devices that cost $1,000 and above are expected to account for more than a third of premium handset sales in 2023.

"There has been a shift in consumer buying patterns in the smartphone market," said senior analyst Varun Mishra. "Considering the importance a smartphone holds, consumers are willing to spend more to get a high-quality device that they can use for a longer period."

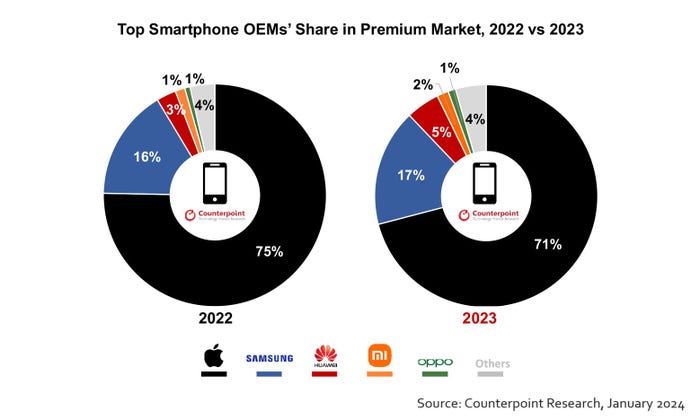

Unsurprisingly, Apple is by far the biggest player in the premium segment, although its grip has slipped slightly. In 2023, it captured 71% of sales, compared to 75% in 2022. Samsung and Huawei's respective market shares increased by one percentage point each over the same period, but they both have a lot of ground to make up (see chart below).

On a regional basis, China, Western Europe, India and the Middle East and Africa (MEA) are driving growth at the premium end. Counterpoint also highlighted that China, MEA, Latin America and India are likely to set new sales records, with India in particular becoming the fastest-growing premium handset market.

"Owning the latest and greatest flagships has also become a status symbol for many consumers, especially in emerging markets where they are jumping directly from the mid-price band to the premium band," said Varun. "Further, these devices are increasingly becoming more affordable due to promotion seasons and financing options."

Unfortunately, the strong performance at the high end won't be enough to offset weakness in the overall market.

Counterpoint predicted in November that in 2023, smartphone shipments will show a decline of 5% YoY, reaching 1.2 billion – the lowest level in almost a decade. Rival research firm IDC is even less optimistic, predicting back in June that shipments will fall to 1.17 billion.

The market is showing faint signs of recovery though.

Omdia stats published in November showed that smartphone shipments in Q3 came in at 301.6 million, a decline of just 0.7% compared to Q3 2022, suggesting that the market might have bottomed out.

Furthermore, Counterpoint also predicted back in November that Q4 shipments are expected to grow by 3% to 312 million units, and that 2024 will be a year of growth for the smartphone sector, driven by China, MEA and India.

With CES taking place in Las Vegas next week, smartphone makers will doubtless be doing their part to drum up excitement for the year ahead.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)