Q2 smartphones: Samsung grows, Huawei slows and Apple flows

The latest global smartphone shipment numbers reveal a return to growth for Samsung, a major reduction in growth for Huawei and transition for Apple.

July 31, 2019

The latest global smartphone shipment numbers reveal a return to growth for Samsung, a major reduction in growth for Huawei and transition for Apple.

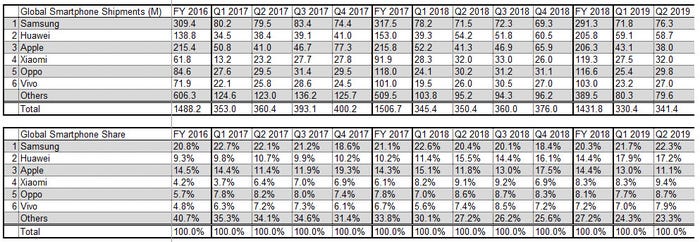

As you can see from the table below, Q2 2019 marked the first quarter in which Samsung registered year-on-year smartphone shipment growth for the first time in almost two years, in an overall market that continues to contract. One of the reasons for this could be the Galaxy S10 being better received than its predecessor as well as it being the main early 5G phone.

“Samsung shipped 76.3 million smartphones worldwide in Q2 2019, jumping 7% annually from 71.5 million units in Q2 2018. Samsung has lifted its global smartphone marketshare from 20% to 22% in the past year,” said Neil Mawston of analyst firm Strategy Analytics. “Strong sales in midrange and entry segments increased Samsung’s shipments, but its profit margin declined due to fierce price competition.”

While Huawei’s smartphone shipments continued to grow, it was at a much slower rate than for the past couple of years, but that was still a considerable achievement all things considered. “Huawei captured a healthy 17 percent global smartphone marketshare in Q2 2019, up from 15 percent a year ago,” said Mawston. “Huawei surged at home in China during the quarter, as the firm sought to offset regulatory uncertainty in other major regions such as North America and Western Europe.”

Apple iPhone shipments declined for the third quarter in a row, as Apple continues to diversify in favour of services such that iPhones accounted for less than half of total Apple revenues for the first quarter ever. “Apple iPhone shipments fell 8 percent annually, making it the worst performer among the world’s big-five smartphone players,” said Woody Oh of SA. “Apple is stabilizing in China due to price adjustments and buoyant trade-ins, but other major markets such as India and Europe remain challenging for the expensive iPhone.”

The rest of the table is all about the Chinese vendors, all of whom saw flat year-on-year growth. “Oppo took fifth position with 9 percent global smartphone marketshare during the quarter, holding steady from 9 percent share a year ago,” said SA’s Lindi Sui. “Oppois expanding hard into Western Europe, with new models like the Reno 5G, but it is coming under pressure at home in China from a resurgent Huawei.” Lucky Western Europe.

Talking of Chinese vendors, Counterpoint Research has identified massive growth from a new brand called Realme, which managed to ship almost five million units, having only started a year ago. Realme seems to specialize in the sub-premium category, in common with OnePlus, which is also owned by Shenzhen-based BBK Electronics, along with Oppo, but the focus of Realme’s hard expansion seems to be India.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)