Q3 2020 smartphone market does better than expected, except HuaweiQ3 2020 smartphone market does better than expected, except Huawei

Samsung had its best smartphone quarter for years as the overall market grew sequentially by 35%.

October 30, 2020

Samsung had its best smartphone quarter for years as the overall market grew sequentially by 35%.

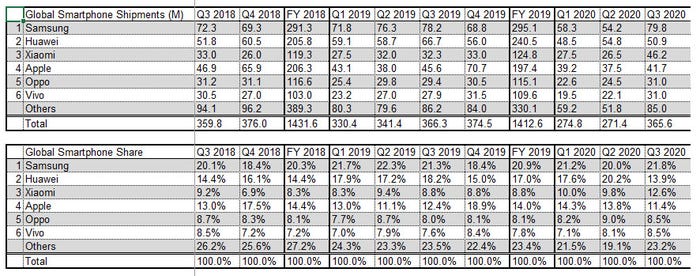

The global smartphone market hit 365.6 million units shipped in the third quarter of 2020, having only managed 271.4 million the previous quarter. It declined slightly year-on-year, but still represented an impressive rebound after the COVID-19 depression that dominated the first half of the year.

“Eased lockdown conditions in all key markets made way for exports and imports, thus streamlining the supply chain again,” said Tarun Pathak of Counterpoint, whose data we use in the table below. “Also, the pent-up demand due to lockdowns helped the smartphone market take a recovery trajectory.

“The supply issues are getting resolved as the manufacturing units in China and Vietnam have started operating at their normal levels, while in India, they are operating at 80% of the pre-COVID levels. In markets like the US and Europe, a modest ‘back to school’ bump in the quarter helped the market to recover.”

While Samsung was by far the biggest contributor to the total, its market share was nothing out of the ordinary. The big gainer was Xiaomi, which managed to grow its shipment volume by an amazing 43%. Huawei, meanwhile, declined by 24% as the combined effects of US constraints on its supply chain and its inability to offer full-fat Android kicked in.

“In China, Xiaomi’s struggle for growth ended and shipments were up 28% YoY and 35% QoQ,” said Abhilash Kumar of Counterpoint. “This impressive show by Xiaomi in China was driven by a series of campaigns and promotions during the brand’s decennial celebrations in August. Also, in new markets like LATAM, Europe and the MEA, Xiaomi’s share expanded rapidly at the expense of Huawei amid US-China trade sanctions. The brand is also performing well in Southeast Asian markets like Indonesia, Philippines and Vietnam.”

One final bit of insight reveals the 5G smartphone market is ramping nicely. “5G shipments continued to grow (82% QoQ),” said Aman Chaudhary of Counterpoint. “Interestingly, 5G shipments in Q3 exceeded the overall H1 2020 shipments. The growth was driven by 5G devices quickly proliferating into the sub-$300 price band, with offerings from Huawei, vivo, OPPO, Xiaomi and OnePlus.

“Affordable 5G devices will drive this segment, especially in China, in the coming quarters. Also, with the launch of the iPhone 12 series in Q4, Apple will be the key to driving 5G volumes in markets like the US, Canada and Western Europe.”

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)