Q4 2016 smartphone market – Apple rubs salt in Samsung’s woundsQ4 2016 smartphone market – Apple rubs salt in Samsung’s wounds

The Q4 2016 global smartphone shipment numbers are in and it comes as no surprise to see that Samsung’s loss was Apple’s gain.

February 1, 2017

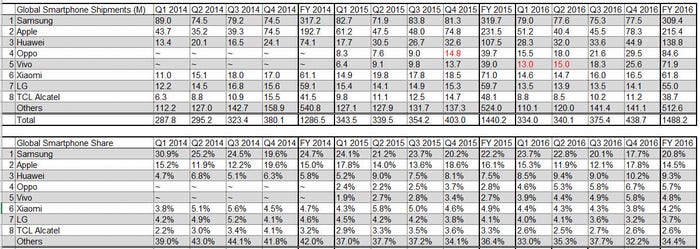

The Q4 2016 global smartphone shipment numbers are in and it comes as no surprise to see that Samsung’s loss was Apple’s gain.

The fruity gadget giant managed to shift 78.3 million iPhones over the holiday season, a new record for its quarterly shipments and the first time it has shipped more than Samsung for years (see table). The overall market also experienced relatively healthy growth, thanks in part to renewed vigour from China.

Apple was typically modest and understated about its achievements, which included lobbing another $18 billion onto its mountain of cash. “We’re thrilled to report that our holiday quarter results generated Apple’s highest quarterly revenue ever, and broke multiple records along the way,” said Apple CEO Tim Cook. “We sold more iPhones than ever before and set all-time revenue records for iPhone, Services, Mac and Apple Watch. Revenue from Services grew strongly over last year, led by record customer activity on the App Store, and we are very excited about the products in our pipeline.”

To be fair to Samsung it did well to even stay close to Apple considering what a world-class balls-up its Q4 was thanks to the Note7 recall. The rest of the list is dominated by Chinese vendors, some of which we don’t have data on. Oppo and Vivo keep doubling their shipments, thus increasing the probability of reaching a Xiaomi moment of truth. Meanwhile Huawei keeps growing well ahead of the market, taking its market share into double figures for the first time in Q4.

“This was the iPhone’s best performance for over a year, as Apple capitalized on Samsung’s recent missteps,” said Neil Mawston of analyst firm Stratgegy Analytics. “Samsung lost momentum in the quarter as a result of its Note 7 battery fiasco. Samsung captured 18 percent share for the quarter and 21 percent share for the full year, its lowest level since 2011. Samsung will be banking on the rumoured Galaxy S8 model in a few weeks’ time to reignite growth and return to the top spot in quarterly smartphone shipments.”

“Huawei maintained third position with a record 10 percent global smartphone marketshare in Q4 2016, the first time the company has ever reached double figures – it was an impressive performance,” said Woody Oh of SA. “Huawei is struggling at home in China against rivals like Oppo, but its overseas performance in markets like Western Europe is accelerating due to improved smartphone designs, more sophisticated marketing, and deeper retail distribution.”

“Oppo held on to fourth position and grew a robust 99 percent annually,” said Linda Sui of SA. “Oppo has grown swiftly in China with popular Android models such as the R9. Oppo’s next challenge in 2017 is to expand beyond China and continue its momentum in emerging regions like India and Nigeria. Vivo maintained fifth place with a record 6 percent marketshare in Q4 2016. Like Oppo, Vivo is very popular in China and it continues to strengthen its portfolio with upgraded smartphone models like the X9 and upcoming V5 Plus with 20MP dual-camera functionality.”

These numbers will have further enraged Samsung execs still licking their wounds from the end of last year. The amount of commercial and emotional investment in this year’s Samsung launches can’t be overstated and conversely Apple would like nothing more than keep its great smartphone rival down. Cook referred repeatedly to its services division in the analyst call and is expected to invest heavily in unique content in a bid to double the size of that division over the next four years.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)