Rise of cheaper 5G phones lifts MediaTek above QualcommRise of cheaper 5G phones lifts MediaTek above Qualcomm

Taiwanese chip maker MediaTek overtook US rival Qualcomm in the 5G chipset market in the first quarter.

July 9, 2024

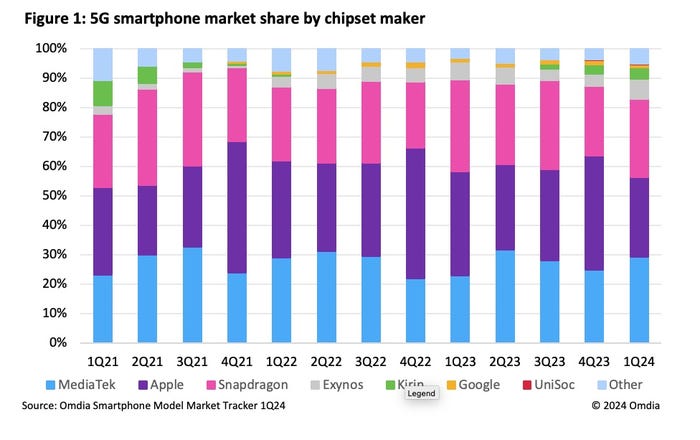

According to new figures from Omdia, shipments of 5G smartphones powered by MediaTek reached 53 million in the first three months of the year, representing an impressive 53% uptick on Q1 2023.

Shipments of smartphones equipped with Qualcomm's Snapdragon were comparatively flat, inching up to 48.3 million from 47.2 million.

As a result, MediaTek's market share in the 5G smartphone chipset market increased to 29.2% from 22.8%, while Qualcomm's fell to 26.5% from 31.2%. Apple sits third, while a motley crew comprised of Samsung Exynos, Huawei-owned HiSilicon's Kirin, Google Tensor and Shanghai-based Unisoc make up the rest (see chart below).

It's not entirely clear from the release whether Omdia has lumped in the 5G modem market with these stats. While Apple uses in-house processors for its iPhones, it still relies on Qualcomm for the modem. Ergo, if these figures encompass both processors and modems, then every iPhone shipped will count in both Apple and Qualcomm's favour.

[UPDATE: Omdia subsequently clarified that this data refers only to the processing unit.]

Given how Omdia has split out the market shares, we're going to assume that this is about processors rather than modems. But just to be sure, Telecoms.com has reached out to Omdia for clarification, and will update this story if necessary.

Meanwhile, MediaTek's rise is good news, because it means affordable 5G phones are becoming more widely available.

"The smartphone chipset industry is primarily shaped by two major trends: the widespread adoption of 5G and the expanding low-end segment. As 5G technology becomes more affordable and is integrated into smartphones priced below $250, MediaTek stands to benefit the most," explained Aaron West, senior analyst in Omdia's smartphone group.

Indeed, according to Omdia, Q1 shipments of 5G smartphones below $250 surged by 62% year-on-year to 62.8 million. This favours MediaTek as the preferred choice for this segment. Furthermore, in June, Omdia also reported in booming demand for sub-$150 phones, with shipments in this category growing to 120 million in the first quarter, up from 90 million a year earlier.

However, the premium end of the market, where prices start at $600, is also growing – albeit not as rapidly. According to Omdia, shipments increased to 73 million from 70 million, driven by the launch of Samsung's Galaxy S24 series, and the iPhone 15 Pro Max.

The popularity of premium devices should help Qualcomm come roaring back – it has spent much of this year promoting the on-device AI capabilities of its latest Snapdragon chipset, features that will be incorporated first and foremost into pricier handsets.

"On-device AI capabilities are becoming increasingly important to smartphone OEMs, with Snapdragon emerging as a key innovator and preferred choice for premium devices," West said.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)